With Monday's market surge, some lagging ETFs joined the bulls with consolidation breakouts. The next four charts show sector ETFs that were lagging SPY because they remained below resistance from the March-April highs. These sector ETFs are still lagging, but they are now trying to play some catch-up with breakouts over the last few days. The notable exception is the Healthcare SPDR (XLV), which has yet to break resistance.

****************************************************************

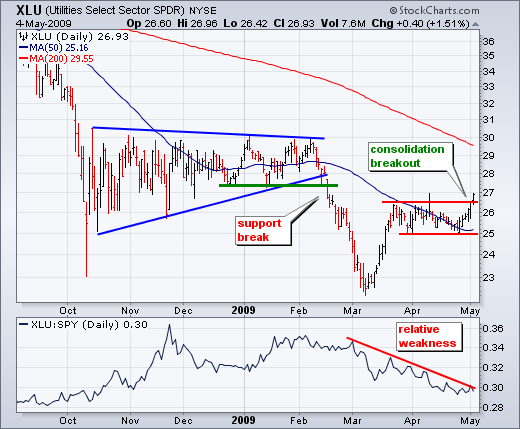

The Utilities SPDR (XLU) broke consolidation resistance with a surge over the last six days. In fact, XLU closed higher for six consecutive days. Overall, the pattern looks like a sharp advance with a flat consolidation (flag). The breakout signals a continuation higher with the next resistance level around 30 from the October-February highs. The bottom indicator shows the price relative trending lower over the last two months. XLU still shows relative weakness, but the flag breakout is a good start for the bulls.

*****************************************************************

The Consumer Staples SPDR (XLP) chart shows similar characteristics with a surge in March, flat consolidation in April and breakout yesterday. Despite this breakout, the price relative is still trending lower as XLP shows relative weakness overall. XLP is simply not as strong as the broader market (SPY)

*****************************************************************

The Energy SPDR (XLE) broke back above triangle resistance with a surge over the last two days. In contrast to XLP, the price relative for XLE turned up over the last two weeks. While on the subject of energy, it is also worth noting that the United States Oil Fund ETF (USO) broke flag resistance over the last two days. A weak Dollar and strong stock market contributed to strength in oil on Monday.

*****************************************************************

With the breakouts shown above, the Healthcare SPDR (XLV) remains the big laggard right now. XLV got a modest bounce over the last six days, but remains below resistance at 25. This resistance level stems from broken support and the April highs. In addition, the price relative remains in a clear downtrend as it hit a new low for the year yesterday.

*****************************************************************