While I don't like holding myself hostage to fundamental events, we need to be prepared for volatility when market-moving events hit the fan. Sometimes we can predict the news, such as the Fed policy statement remaining unchanged. Most of the time we cannot predict the news, such as an earnings surprise or the non-farm payrolls. In addition to predicting the news, we must also predict the market's reaction to said news. That makes for two predictions, which impacts the odds. One thing is certain.

Whatever the market's reaction, there will be some sliver of news to justify it. If the market rallies after the Fed, then the news would point to the prospect of lower interest rates continuing to stimulate the economy. If the market falls after the Fed, then the news would point to low interest rates stoking inflationary fires. Take your pick.

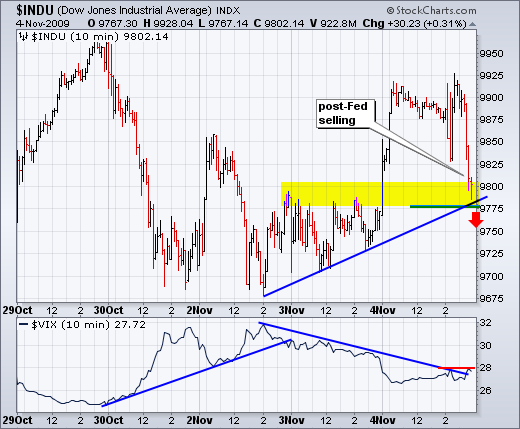

As we saw with yesterday's market action, stocks rallied ahead of the Fed policy statement, but sold off in the final hour. Selling pressure was not mild either. The Nasdaq was up around 1.5% in early trading, but finished the day with a negligible loss. The Dow was up over 130 points just before 3PM, but lost most of it to close with a 30 point gain. Incidentally, the stock market also sold off after the Fed policy statement on September 23rd. This occurred near the September high and signaled the start of a 7-day pullback into early October. On the Dow chart below, I am marking short-term support at 9775. Strong breakouts and surges hold. A move below 9775 would sow the seeds of doubt - as would a VIX breakout at 28.

On the 30-minute chart for SPY, the ETF broke above resistance at 105.5 and CCI surged above +100. Technically, this marks the start of an uptrend. However, this breakout occurred before the Fed announcement and did not hold after the Fed announcement. The inability to hold the breakout is not a good sign. Further weakness below 104.5 would fill yesterday's gap and argue for a continuation lower.

There are still two more reports ahead so don't expect volatility to dissipate until next week. Initial Claims comes out before Thursday's open (8:30AM). Wednesday's ADP report for non-farm private employment showed a decrease of 203,000. Should Initial Claims also disappoint, we could see another sizable decrease in non-farm payrolls on Friday. The consensus is for a loss of 175,000 jobs. While the employment report is not due until Friday morning, the market often prices the information in on Thursday.