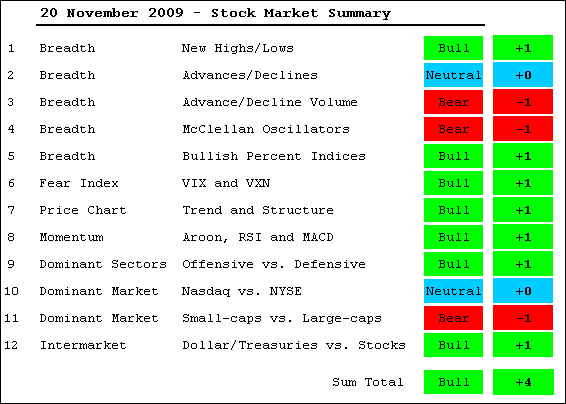

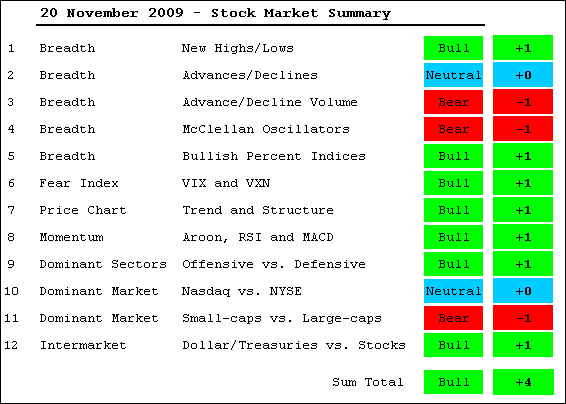

The warnings signs continue, but the bulk of the medium-term evidence remains bullish. On the negative side, breadth has been deteriorating the last few weeks. Small-caps and the finance sector have been relatively week since October. Bonds surged this week in what could be a flight to quality as we head into yearend. The Bullish Percent Index for the consumer discretionary sector is the weakest of the nine sectors. And finally, the volatility indices formed higher lows and have inverse head-and-shoulders patterns working. These negatives are, however, outweighed by the positives right now. New 52-week highs continue to outpace new 52-week lows. All Bullish Percent Indices are above 50%. The volatility indices have yet to break neckline resistance. Momentum and overall trend favor the bulls. Three of the four offensive sectors show strength and the Dollar remains in a downtrend. Again, this table is not designed to foreshadow a top. Instead, it is designed to weigh the bulk of the evidence and follow until proven otherwise. Even though the major index ETFs are short-term overbought and looking vulnerable to a pullback, it is still considered a pullback within a bigger uptrend.

*****************************************************************

Indicator Run Down

*****************************************************************

AD Volume Lines: Bearish. After breaking below the October low, the AD Volume Lines rebounded with the November advance. However, both remain well below their October highs. With the Nasdaq and NY Composite moving to new reaction highs in November, bearish divergences are taking shape in the AD Volume Lines.

*****************************************************************

AD Lines: Neutral. The NYSE AD Line remains in an uptrend, but the Nasdaq AD Line shows relative weakness with a breakdown and downtrend. Also notice that broken support from the October low is turning into resistance and the Nasdaq AD Line formed a rising flag, which is a bearish pattern.

*****************************************************************

McClellan Oscillators: Bearish. Despite the sharp November advance in stocks, both McClellan Oscillators failed to make it back above 40. This also occurred during the October rally. It appears that breadth is weakening on each rally.

*****************************************************************

Bullish Percent Indices: Bullish. This table can be divided into two parts: the major indices and the sectors. The Nasdaq is the weakest of the major indices, while the Dow and the S&P 100 are the strongest. Large-caps are relatively strong and techs are relatively weak. At 62.69%, the consumer discretionary is still bullish overall, but it is the weakest of the nine sectors. Relative weakness in this key sector is a concern. The technology and industrials sectors are by far the strongest with bullish percents above 80%.

*****************************************************************

Fear Index: Bullish. A divergence and head-and-shoulders pattern formed in the S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) over the last few weeks. Both the S&P 500 and Nasdaq 100 moved above their October highs, but their respective volatility indices held above their October lows. Normally, these volatility indices should move below their October lows for confirmation. In addition, both are forming inverse head-and-shoulders patterns over the last three months. A break above the Sep-Oct highs would be bullish for volatility and bearish for stocks.

*****************************************************************

Trend/Structure: Bullish. The Dow Diamonds (DIA), S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQQ) all recorded new reaction highs again this week, but the Russell 2000 ETF (IWM) remains well below its October high. Three of the four are in clear uptrends with higher highs and higher lows. I am, however, quite concerned with relative weakness in small-caps. IWM broke support in late October and rallied back above 60 early this week. A rising flag formed and the ETF is testing flag support after Thursday's decline. A break below 58 would signal a continuation lower and target a move to around 52-53.

*****************************************************************

Momentum: Bullish. Upside momentum is not as strong as it was in July-August, but there is still more upside momentum than downside momentum. RSI, MACD(5,35,5) and Aroon(20) all peaked in mid September and formed bearish divergences with lower highs in October and now November. These lower highs show less upside momentum, but upside momentum all the same. Medium-term, all three need to break their respective support zones to turn bearish: RSI below 40, MACD below zero and Aroon below -50.

*****************************************************************

Offensive Sectors: Bullish. The Consumer Discretionary SPDR (XLY), Industrials SPDR (XLI) and Technology SPDR (XLK) all recorded higher highs again this week. The Financials SPDR (XLF) remains below its October high and is the laggard. As with small-caps, I will adhere to majority rule here. Three of the four offensive sectors are strong and this is bullish overall. On the price chart below, XLI is both overbought and bullish as the Stochastic Oscillator remains above 80. Look for a move below 80 and a support break at 27 to start a downswing within the medium-term uptrend.

XLF hit the 62% retracement mark around 15 and stalled the last eight days. The ETF is still above support, but a break below 14.5 would be bearish for this key sector. MACD(5,35,5) is hovering in positive territory just above its signal line. A move into negative territory would be bearish for momentum.

*****************************************************************

Nasdaq vs. NYSE: Neutral. Both the Nasdaq and the NY Composite moved above their October highs this week. They are pretty much moving in lock-step since August. Notice that the price relative has been flat since August.

*****************************************************************

Small-caps vs. Large-caps: Bearish. The Russell 2000 (small-caps) continues to seriously lag the S&P 100 (large-caps). This shows a flight to safety because large-caps represent lower beta stocks with less risk than small-caps.

*****************************************************************

Intermarket: Bullish. Short-term rates plunged to new lows again this week and the Dollar also hit a new low. Low and falling short-term rates are bearish for the Dollar. While a falling Dollar is not necessarily bullish for stocks, the Dollar and stocks have been moving opposite each other since March. Therefore, I would consider the current Dollar downtrend bullish for stocks - until proven otherwise.

In other bond developments, the recent breakout in the 20+ Year Treasury ETF (TLT) could be negative for stocks. TLT declined to the support zone around 93-94, firmed in early November and broke resistance with a gap up on Monday. This gap and breakout are bullish - and they are holding. Money moving into bonds is money that is not available for stocks. It could also represent a flight to safety of sorts.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More