A number of stocks, ETFs and indices gapped down on Friday and then firmed on Monday. Friday's gap and decline endorsed the bearish case, but firmness on Monday shows indecision. The ability to fill Friday's gap would be considered bullish. Keep this in mind when reviewing the charts. The next group of charts feature bullish setups for CAKE, CHK, CSCO, DELL, INTC, NVDA and OMC.

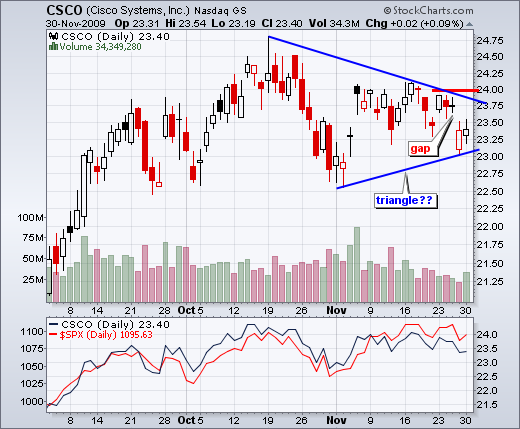

After Friday's gap, Cisco (CSCO) is trying to firm around 23. The stock formed a white candlestick on Friday and an indecisive spinning top on Monday. Look for a move above 24 to break resistance. A reaction low at 23 would call for a triangle. A triangle breakout would project further strength above the October high.

Intel (INTC) gapped down twice in the last seven days, but the stock is trying to firm around the 62% retracement mark. In addition, a falling wedge is taking shape. Look for a break above 19.5 to fill Friday's gap and revive the bulls.

Dell (DELL) got slammed with a gap below 15 six days ago, but the stock is trying to firm near support around 14. Support stems from broken resistance and the early November low. The stock formed a doji on Monday to signal indecision. Look for a break above 14.4 to signal an oversold bounce off support.

After a big gap and resistance breakout in early November, Nvidia (NVDA) pulled back with a small falling wedge. The stock already filled Friday's gap with a bounce on pretty good volume yesterday. Look for follow through above 13.4 to trigger a breakout.

Cheesecake Factory (CAKE) tests support. At first glance, this pattern looks like a bearish head-and-shoulders with neckline support around 17.5-18. That may indeed be the case, but the stock is holding support and carries a bullish bias as long as support holds. That said, the decline over the last two weeks formed a falling wedge that retraced around 62% of the prior advance. The stock bounced on good volume yesterday and a follow through breakout would be bullish.

After getting whacked in October, Omnicare (OMC) rebounded with a bounce back above 37 in mid November. The stock pulled back over the last two weeks and formed a small falling wedge. Despite this decline, upside volume continues to outpace downside volume, which is positive. Also notice that OMC held up quite well on Friday and filled the gap on Monday. A follow through breakout at 37 would be bullish.

Natural Gas ($NATGAS) had a big move in September-October with a resistance breakout around 4.50. There is actually a big resistance zone around 4.10-4.50 and this area turns into a support zone. Notice how $NATGAS bounced off support last week. The blue line shows the iPath Natural Gas ETF ($GAZ) seriously lagging the underlying commodity. I doubt it will catch up, but GAZ did hold above its September low and surged last week.

Chesapeake Energy (CHK) is an oil and gas exploration and production company. The stock broke resistance with a big surge from July to October and then corrected in October-November. This decline retraced 50-62% of the prior advance and the stock is trying to firm around 23. There was a high volume surge last Thursday, but a pull back on Friday-Monday. Look for follow through above 25 to trigger a breakout.

Chesapeake Energy (CHK) is an oil and gas exploration and production company. The stock broke resistance with a big surge from July to October and then corrected in October-November. This decline retraced 50-62% of the prior advance and the stock is trying to firm around 23. There was a high volume surge last Thursday, but a pull back on Friday-Monday. Look for follow through above 25 to trigger a breakout.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More