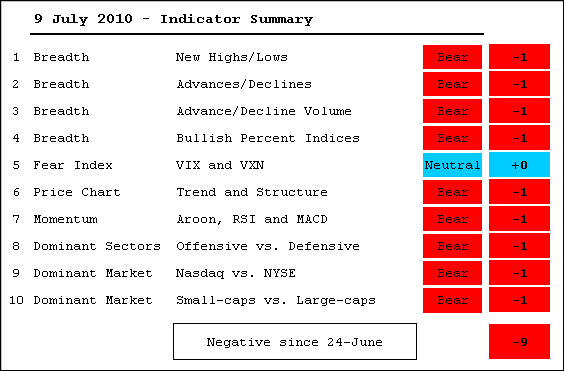

Even with this week's bounce, the indicator summary remains decidedly negative. The AD Lines and AD Volume Lines remain in clear downtrends and bullish divergences have yet to appear. NYSE Net New Highs have yet to break down, but have yet to surge higher. The S&P 500 Volatility Index ($VIX) is interesting because it remains below its May high. Conversely, the S&P 500 broke its May low. Fear is not as rampant as May.

- AD Lines: Bearish. The Nasdaq and NYSE AD Lines remain in downtrends with resistance from the mid June highs.

- AD Volume Lines: Bearish. The Nasdaq and NYSE AD Volume Line remain in downtrends with resistance from the mid June highs.

- Net New Highs: Bearish. Nasdaq Net New Highs remain weak overall, but NYSE Net New Highs remain flat. The bears have the edge until there is a positive surge in Net New Highs.

- Bullish Percent Indices: Bearish. Except for the consumer staples and utilities sectors, BPIs remain below 50% and bearish overall.

- Sentiment: Neutral. The S&P 500 Volatility Index ($VIX) and Nasdaq 100 Volatility Index ($VXN) formed lower highs in mid June and have been trending lower the last seven weeks. However, they have yet to move back below their June lows.

- Trend Structure: Bearish. The major index ETFs formed lower highs in mid June and broke below their prior reaction lows (late May and early June). Downtrends are now clear and present.

- SPY Momentum: Bearish. The Aroon Oscillator and MACD are in negative territory and RSI has yet to break its 50-60 resistance zone.

- Offensive Sector Performance: Bearish. Defensive sectors are holding up much better than offensive sectors. Consumer staples are outperforming consumer discretionary. Utilities are outperforming technology.

- Nasdaq Performance: Bearish. The $COMPQ:$NYA ratio broke below its May-June lows.

- Small-cap Performance: Bearish. The $RUT:$OEX ratio has been moving lower since April.

- Breadth Charts have been updated (click here)

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More