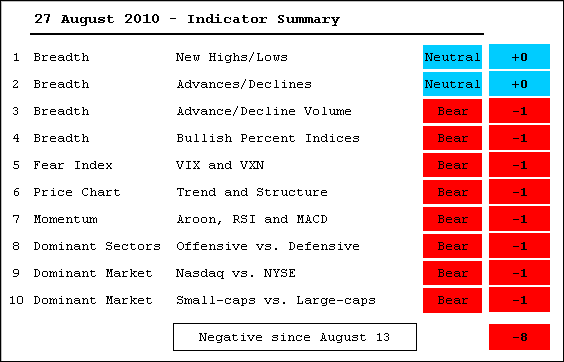

The indicator summary moved further into the red as the Bullish Percent Indices turned bearish and the S&P 500 Volatility Index ($VIX) broke above its mid July high. The NYSE AD Line and NYSE Net New Highs are the only two indicators keeping this summary from total negativity. We have seen a number of whipsaws since mid June because of choppy trading the last 2-3 months. However, it looks like selling pressure is expanding as the major indices tests their July lows and we head into September.

- AD Lines: Neutral. The NYSE AD Line moved lower in August, but remains well above its early July low (bullish). The Nasdaq AD Line moved below its July low (bearish).

- AD Volume Lines: Bearish. The Nasdaq AD Volume Line formed a lower high in late July (bearish) and the NYSE AD Volume Line is approaching its July low (bearish).

- Net New Highs: Neutral. Nasdaq Net New Highs dipped below -200 and the cumulative Net New Highs line is trending lower (bearish). NYSE Net New Highs remain barely positive (bullish).

- Bullish Percent Indices: Bearish. The major index BPIs are all below 50%. Six of the nine sectors BPIs are below 50%. Energy, consumer staples and utilities are above 50%.

- VIX/VXN: Bearish. The S&P 500 Volatility Index ($VIX) and Nasdaq 100 Volatility Index ($VXN) both broke above their mid July highs.

- Trend Structure: Bearish. QQQQ, SPY and IWM failed at or below their June highs. IWM is already testing its July lows.

- SPY Momentum: Bearish. MACD(5,35,5) and Aroon (20) are in negative territory and RSI is below 40.

- Offensive Sector Performance: Bearish. Finance continues to lead lower. Industrials fell apart this week. Consumer discretionary and technology bounced, but are not outperforming or showing upside leadership.

- Nasdaq Performance: Bearish. The $COMPQ:$NYA ratio has been moving lower since early June.

- Small-cap Performance: Bearish. The $RUT:$OEX ratio has been moving lower since April.

- Breadth Charts have been updated (click here)

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More