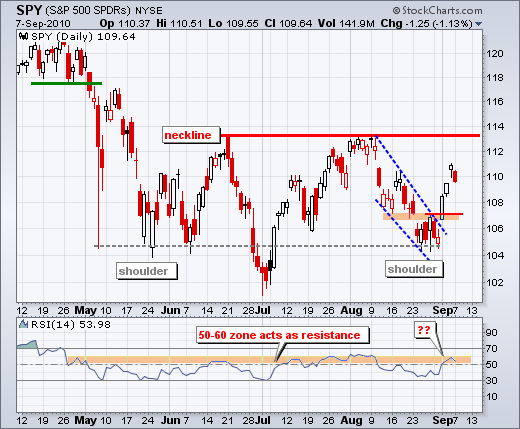

On the daily chart, the S&P 500 ETF (SPY) is currently on an upswing within a larger consolidation. This larger consolidation is, of course, the inverse head-and-shoulders pattern. Unconfirmed, this pattern is just one big consolidation or trading range. Confirmed, with a break above the June-August highs, it is a bullish reversal pattern. There is one problem with this inverse head-and-shoulders. It seems too big relative to the prior decline (April to July). The prior decline was from 121 to 102 and this pattern extends from 102 to 113. The mid point of the decline is 111.5 and the pattern extends beyond this mid point. It seems that an inverse head-and-shoulders reversal pattern should not take up over half the prior decline. Regardless of the pattern at work, SPY remains in an upswing within a larger trading range. As long as SPY remains below resistance, there is still a chance for choppy trading or even another swing lower.

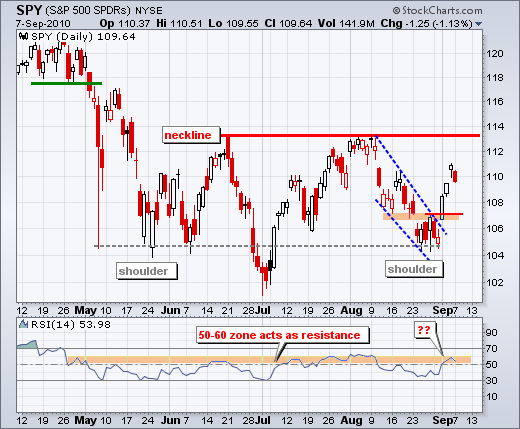

The 60-minute chart is littered with annotations because there is a lot happening. First, SPY met resistance around 110-111 and pulled back with a modest decline on Tuesday. Resistance here stems from broken support, the gap and the mid August highs. There is also momentum resistance as RSI on the daily chart trades in the 50-60 zone. If you are going to pick a top, then this is the place to do it. As far as a pullback, the yellow area marks a 38-50% retracement of last week's advance. The 62% retracement extends to broken resistance around 107. A healthy pullback should be relatively short (38-50%). RSI on the 60-minute chart also has potential support in the 40-50 zone.

The economic docket is rather light this week. Bonds may be in focus with the 10-year and 30-year auctions on Wednesday and Thursday, respectively.

Key Economic Reports:

Wed - Sep 08 - 10:00 - 10 Year Note Auction

Wed - Sep 08 - 10:30 - Crude Inventories

Wed - Sep 08 - 14:00 - Fed's Beige Book

Wed - Sep 08 - 15:00 - Consumer Credit

Thu - Sep 09 - 08:30 - Initial Claims

Thu - Sep 09 - 10:00 - 30 Year Bond Auction

Charts of Interest: Tuesday and Thursday.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More