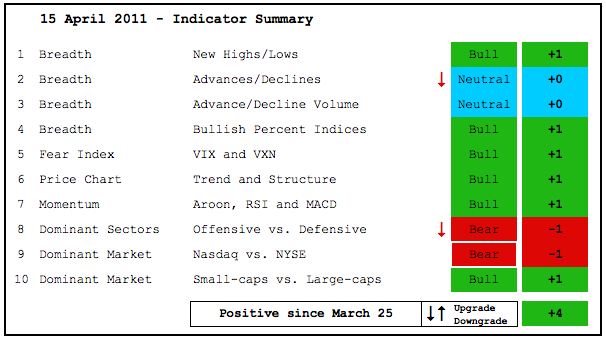

The indicator summary is weighed down by relative weakness in the Nasdaq and some key sectors. First, the Nasdaq has been underperforming the NY Composite since early January. Second, the Nasdaq AD Line and AD Volume Line are weaker than the NYSE AD Line and AD Volume Line. Third, the Finance SPDR took a hit this week and turned relatively weak. The Technology ETF (XLK) and the Consumer Discretionary SPDR (XLY) have also been lagging recently. Despite these negatives, there are enough positives to keep the indicator summary positive for the moment. You can review past positive/negative turns on the chart at the end of this commentary. Keep in mind that this is NOT A SYSTEM for buy and sell signals. It is simply a tally of 10 key indicator groups designed to assess current market conditions. Positive readings +3 and above give a bullish bias, negative readings -3 and below give a bearish bias, readings between +2 and -2 indicate indecision. There are more details on the about page.

- AD Lines: Neutral. The Nasdaq AD Line formed a lower high and moved sharply lower the last six days. The NYSE AD Line hit a new 52-week high in early April.

- AD Volume Lines: Neutral. The NYSE AD Volume Line surged back to its February high, but the Nasdaq AD Volume Line fell well short of its February high.

- Net New Highs: Bullish. The Nasdaq and NYSE Cumulative Net New Highs Lines remain in clear uptrends, but Net New Highs were hit pretty hard this week. Nasdaq Net New Highs dipped into negative territory and NYSE Net New Highs hit the zero line.

- Bullish Percent Indices: Bullish. All BPIs remain above 50%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) both moved back below 20. The fear factor is low and this is positive for stocks.

- Trend Structure: Bullish. DIA, IWM and MDY moved above their February highs to record fresh 52-week highs in early April. Even though QQQ and SPY have yet to confirm, three of the five have and this is bullish.

- SPY Momentum: Bullish. Momentum on the March-April surge was not as strong as momentum during the January-February surge. Lower highs formed in MACD(5,35,5), RSI and Aroon from mid February to early April, but these indicators have yet actually break down.

- Offensive Sector Performance: Bearish. The Industrials SPDR (XLI) was the only offensive sector to break its February high. The Finance SPDR (XLF) and the Technology ETF (XLK) did not come close to their February highs, while the Consumer Discretionary SPDR (XLY) is lagging.

- Nasdaq Performance: Bearish. The Nasdaq has been underperforming the NY Composite ($NYA) since early January.

- Small-cap Performance: Bullish. Small-caps have been outperforming since 24-January and the Price Relative ($RUT:$OEX) hit a fresh 52-week high this week.

- Breadth Charts (here) and Inter-market charts (here) have been updated

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure. With 10 indicator groups, the medium-term evidence is unlikely to change drastically overnight.

Previous turns include:

Positive on 11-Sept-09

Negative on 5-Feb-10

Positive on 5-March-10

Negative on 11-Jun-10

Positive on 18-Jun-10

Negative on 24-Jun-10

Positive on 6-Aug-10

Negative on 13-Aug-10

Positive on 3-Sep-10

Negative on 18-Mar-11

Positive on 25-Mar-11