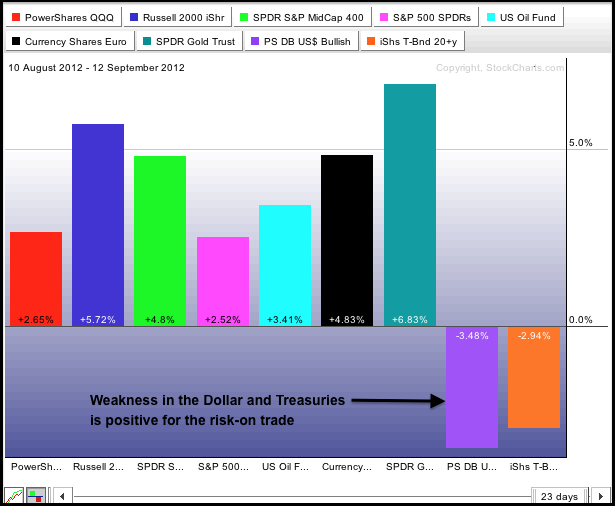

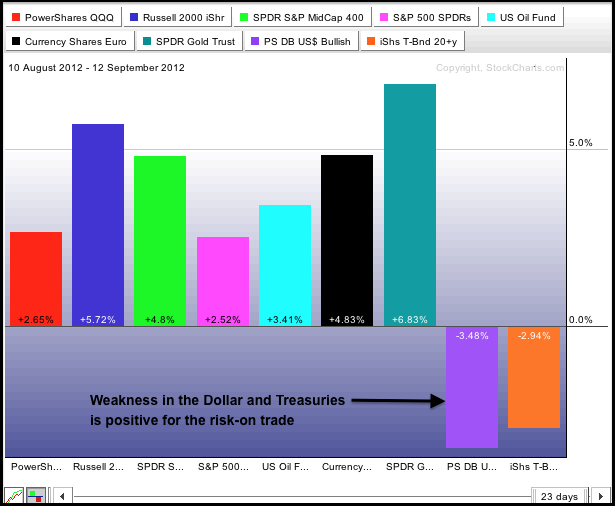

Stocks meandered again on Wednesday and then closed with small gains. All of the major index ETFs were up with the S&P MidCap 400 SPDR (MDY) leading the way (up a mere .52%). Six of the nine sectors were higher with the Energy SPDR (XLE) and Technology SPDR (XLK) leading the way. Both were up around .50% on the day. The Home Construction iShares (ITB) and the Retail SPDR (XRT) recorded new 52-week highs. Leadership from these two cyclical and domestic industries bodes well for the bulls. Also note that the Euro Currency Trust (FXE) continued its advance and the 20+ Year T-Bond ETF (TLT) fell ahead of today's Fed policy statement. In short, the tea leaves continue to favor the bulls.

No change. On the 60-minute chart, the S&P 500 ETF (SPY) broke wedge resistance with a gap-surge and this breakout is holding as the ETF consolidates in the 144 area. Even though there is a clear five wave count on the chart, I would put more weight on the uptrend and breakout. A move above the two-day high would break consolidation resistance and signal another continuation higher. Broken resistance turns into first support in the 142 area. Key support remains at 139.8 and RSI support at 40.

**************************************************************************

The Fed makes its policy statement today, but it appears that the 20+ Year T-Bond ETF (TLT) already made its move. TLT broke down last week and continued sharply lower this week. The decline in treasuries is actually positive for stocks and the economic outlook. I am marking short-term resistance at 124.5.

**************************************************************************

No change. The Dollar got squashed again on Friday as the US Dollar Fund (UUP) plunged below 22.10 and stayed down. The short-term downtrend extended and there is not much change on the chart, other than some severe oversold conditions. The late August consolidation marks the first resistance zone around 22.3-22.50. RSI resistance is set in the 50-60 zone.

**************************************************************************

No change. Oil is all mixed up with no place to go. Even though the Dollar fell sharply and stocks surged, the US Oil Fund (USO) is still bouncing around support in the 35 area. USO should be much higher considering the help it has had from the greenback and stock market. Despite dragging its feet, USO is holding support at 35 and RSI is holding support at 40. A break in both would be short-term bearish.

**************************************************************************

No change. Gold is certainly taking advantage of a weak Dollar and the prospects of more quantitative easing. The Gold SPDR (GLD) broke out in mid August, continued higher in late August and surged above 168 at the end of last week. GLD is as overbought as the Dollar is oversold, but shows no signs of weakness. First support is set in the 161-162 area. Key support remains in the 156-158 area.

**************************************************************************

Key Reports and Events:

Thu - Sep 13 - 08:30 - Jobless Claims

Thu - Sep 13 - 08:30 – Producer Price Index (PPI)

Thu - Sep 13 - 12:30 – FOMC Policy Statement

Fri - Sep 14 - 08:30 - Retail Sales

Fri - Sep 14 - 08:30 – Consumer Price Index (CPI)

Fri - Sep 14 - 09:15 - Industrial Production

Fri - Sep 14 - 09:55 - Michigan Sentiment

Sat – Oct 06 – 09:00 – EU Summit

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More