The markets got a taste for risk as the Senate debated the fiscal cliff on Friday. A bill did indeed pass by a wide margin and the House subsequently passed the bill as well. The bill does provide some relief from the fiscal slope, but does little to fix the long-term problems. Basically, the fiscal slope has been kicked down the road and the markets have been given a breather. Risk-assets, such as stocks, oil and gold, warmed to the idea on Friday. Safe-havens, such as Treasuries, were not impressed. The 20+ YR T-bond ETF (TLT) failed at resistance from broken support and broke flag support with a sharp decline on Monday. This decline fueled a rally in stocks, which are negatively correlated with Treasuries. Money was moving from safety to risk, which is what the Fed wants. Anyone want to fight the Fed this year?

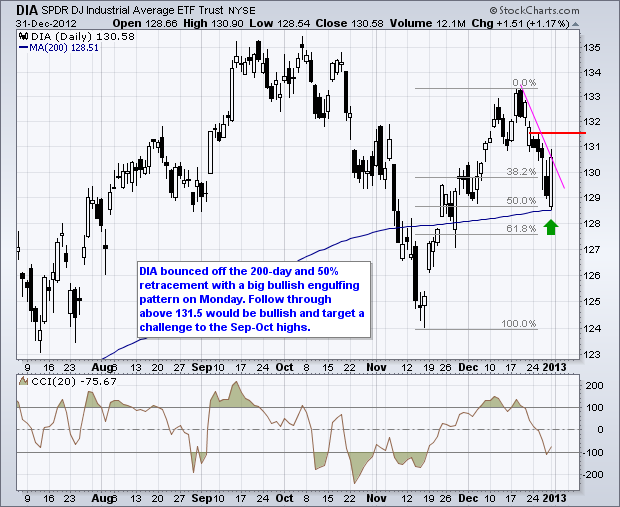

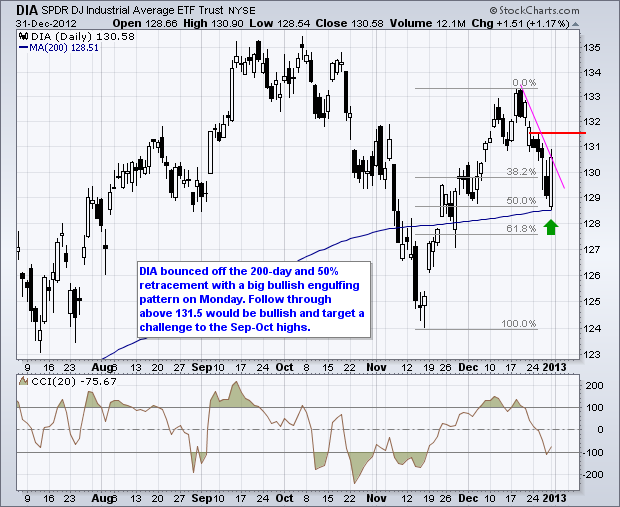

In any case, DIA, SPY and QQQ formed large bullish engulfing patterns on Monday. Exchange volume, however, was below average and this detracts from the robustness of the bullish engulfing patterns. IWM led Friday's charge with a move above last week's high. Small-caps are leading and this is bullish overall. Elsewhere, oil remains in an uptrend and the USO is holding the break above the November highs. The Dollar formed a bearish wedge and is trading near resistance. GLD surged along with stocks, but remains in a downtrend since late November and a rising flag could be taking shape the last few weeks.

Even though the trading week is short, the economic calendar is quite packed and volatility could continue. The New Year starts with Auto-Truck Sales, Chicago PMI, ISM Manufacturing Index and Construction Spending on Wednesday. Thursday we get employment appetizers with the Challenger and ADP Report. The first Friday of the month, as always, features the US employment report and non-farm payrolls. Traders can also look forward to factory orders and the ISM services index. Whew, there is never a dull moment!

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Wed - Jan 02 - 07:00 - MBA Mortgage Index

Wed – Jan 02 - 09:00 - Chicago PMI

Wed – Jan 02 – 10:00 - ISM Manufacturing Index

Wed – Jan 02 – 10:00 – Construction Spending

Wed – Jan 02 - 14:00 – FOMC Minutes

Thu – Jan 03 – 07:30 - Challenger Job Report

Thu – Jan 03 - 08:15 - ADP Employment Report

Thu – Jan 03 - 08:30 - Jobless Claims

Thu – Jan 03 – 11:00 – Oil Inventories

Fri – Jan 04 - 08:30 - Employment Report

Fri – Jan 04 - 10:00 - Factory Orders

Fri – Jan 04 - 10:00 – ISM Services Index

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More