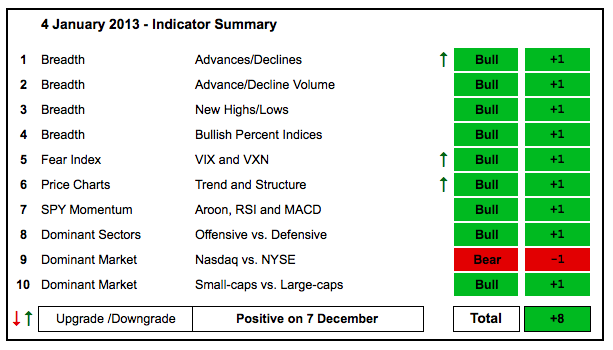

Strength over the past week triggered three upgrades for the indicator summary. The Nasdaq AD Line turned bullish with a break above its December high. The $VIX and $VXN plunged towards support to turn bullish. Fresh 52-week highs in the S&P MidCap 400 SPDR (MDY) and Russell 2000 ETF (IWM) affirm the overall uptrends and relative strength in small-caps and mid-caps. Relative performance of the Nasdaq is the only pocket of weakness as it continues to underperforming the NY Composite. The only negative is that stocks are short-term overbought and ripe for some sort of pullback or consolidation.

- AD Lines: Bullish. The Nasdaq AD Line surged over the last few days and edged above its late December high. A new uptrend could be emerging here with the December low marking support. The NYSE AD Line hit a new high and remains strong.

- AD Volume Lines: Bullish. The Nasdaq AD Volume Line broke the March trend line, fell back and surged back above this week. The trend break is largely holding and a break above the September high would be very bullish. The NYSE AD Volume Line is challenging its December high and remains in an uptrend since the early December breakout.

- Net New Highs: Bullish. Nasdaq Net New Highs surged to their highest level since mid September and the cumulative line is near its October high. NYSE Net New Highs surged to 25% of total issues and the cumulative line hit a new high.

- Bullish Percent Indices: Bullish. All nine Bullish Percent Indices are above 50%.

- VIX/VXN: Bullish. The Nasdaq 100 Volatility Index ($VXN) and S&P 500 Volatility Index ($VIX) broke out at the end of December, but plunged the last few days and are now trading closer to long-term support. The fear factor is low with these two trading near support.

- Trend-Structure: Bullish. IWM and MDY moved above their 2011 highs to record 52-week highs. DIA and SPY surged above their December highs. QQQ also broke its December high, but remains well below its September high.

- SPY Momentum: Bullish. RSI held the 40-50 support zone in late December and surged. MACD(5,35,5) remains positive. Aroon surged above +50 in early December and remains above +50.

- Offensive Sector Performance: Bullish. The Consumer Discretionary SPDR (XLY), Industrials SPDR (XLI) and Finance SPDR (XLF) recorded 52-week highs this week and the Technology SPDR (XLK) broke above its December high.

- Nasdaq Performance: Bearish. The $COMPQ:$NYA ratio bounced, but remains in a downtrend as the Nasdaq continues to underperform the NY Composite ($NYA).

- Small-cap Performance: Bullish. The $RUT:$OEX ratio turned up in mid November, broke the September high in December and continued above its July high. Small-caps are showing relative strength as the January effect takes hold.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

Previous turns include:

Positive on 7-December-12

Negative on 9-November-12

Neutral on 26-October-12

Positive on 6-July-12

Negative on 18-May-12

Positive on 30-December-11

Negative on 16-December-11

Positive on 3-December-11

Negative on 23-November-11

Positive on 28-October-11

Negative on 5-August-11

Neutral on 29-Jul-11

Positive on 30-Jun-11

Negative on 17-Jun-11

Positive on 25-Mar-11

Negative on 18-Mar-11

Positive on 3-Sep-10

Negative on 13-Aug-10

Positive on 6-Aug-10

Negative on 24-Jun-10

Positive on 18-Jun-10

Negative on 11-Jun-10

Positive on 5-March-10

Negative on 5-Feb-10

Positive on 11-Sept-09

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More