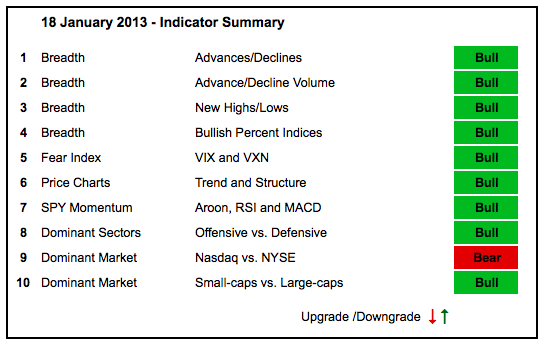

The only thing the bulls have to fear is bullishness itself. In other words, the bulk of the evidence is bullish, but stocks are getting overbought because the S&P 500 is up 10% since mid November (two months). The Russell 2000 ($RUT) is up over 15%. Except for relative weakness in QQQ, XLK and the Nasdaq, there are no signs of weakness out there. The NYSE AD Line and AD Volume Line hit new highs. Net New Highs surged on both the Nasdaq and the NYSE. The Consumer Discretionary SPDR (XLY) hit a fresh 52-week high as the Retail SPDR (XRT) broke out this week. Volatility is low and this means the fear factor is not a factor.

- AD Lines: Bullish. The Nasdaq AD Line broke the mid December high and March trend line to turn bullish in early January. The NYSE AD Line hit a new high and remains in a strong uptrend.

- AD Volume Lines: Bullish. The Nasdaq AD Volume Line broke above its September high in early January and the late December low marks key support. The NYSE AD Volume Line moved to a new high again this week and remains in a strong uptrend.

- Net New Highs: Bullish. Nasdaq Net New Highs have been strong all month and the cumulative line surged to new highs. NYSE Net New Highs are even stronger and the cumulative line has been rising since mid November.

- Bullish Percent Indices: Bullish. All nine sector Bullish Percent Indices are above 50%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) moved to its lowest level since 2007. The Nasdaq 100 Volatility Index ($VXN) is trading around 15, which is equivalent to the lows of 2007. It may be excessive, but low volatility is positive for the stock market.

- Trend-Structure: Bullish. IWM, SPY, MDY and DIA hit new 52-week highs this week. QQQ remains the laggard, but is holding its 2-Jan gap and has yet to break down.

- SPY Momentum: Bullish. RSI held the 40-50 support zone in late December and surged. MACD(5,35,5) remains in an uptrend and positive. Aroon surged above +50 in early December and remains positive.

- Offensive Sector Performance: Bullish. The Consumer Discretionary SPDR (XLY), Industrials SPDR (XLI) and Finance SPDR (XLF) hit 52-week highs again this week. Enough said.

- Nasdaq Performance: Bearish. The $COMPQ:$NYA ratio turned down again this month and remains in a downtrend since early September.

- Small-cap Performance: Bullish. The $RUT:$OEX ratio hit a ten month high as small-caps continue to outperform large-caps.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More