Stocks moved higher on Thursday with the major index ETFs scoring modest gains, very modest gains.

The S&P 100 ETF (OEF) led the way with a whopping .80% advance. The Finance SPDR (XLF) led the

sectors with a 1.27% gain on renewed confidence in US banks. Semiconductors led the tech sector

with the broad-based Semiconductor SPDR (XSD) advancing over 1% on the day. The biggest moves came

in the intermarket area. The European Central Bank (ECB) sounded an optimistic tone in its policy

statement and this sent the Euro sharply higher. The Dollar plunged and gold surged on the news as

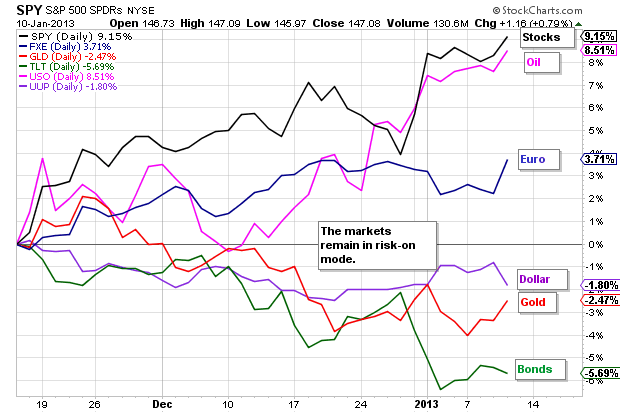

well. UUP failed to hold its breakout and GLD failed to hold its most recent breakdown. The chart

elow shows that the markets have been in risk-on mode since mid November. Gold may have perked up

yesterday, but it is down over the last eight weeks. The Dollar and Treasuries are also down, but

stocks and oil are up.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Fri - Jan 11 - 10:30 - TGIF

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.