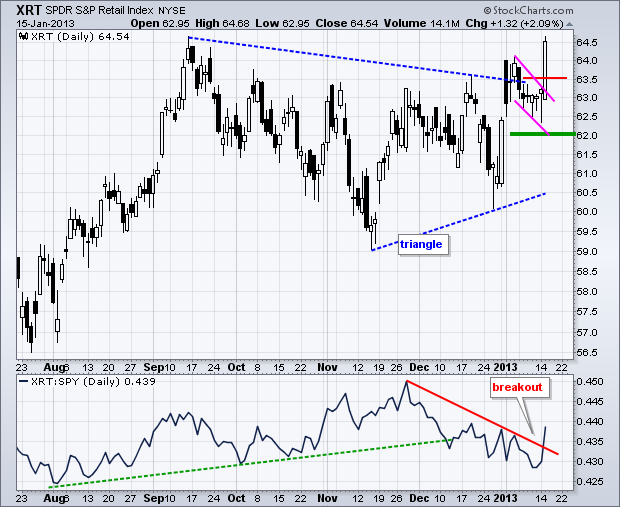

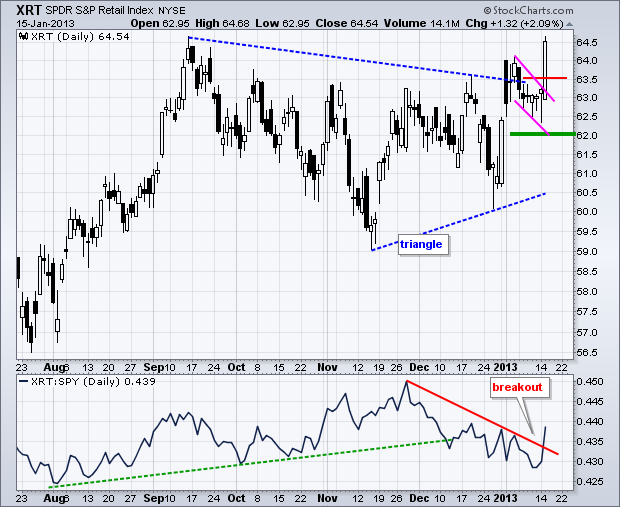

It is getting to be a familiar story. Stocks in general edged higher, but the Nasdaq 100 ETF (QQQ) edged lower because of weakness in Apple. AAPL broke support at 500 with a sharp decline on Tuesday. The company reports next Wednesday after the close. This is definitely one of the most anticipated reports in years, but don't forget that over 100 companies will also report earnings on Wednesday. Even though Apple weighs heavily in a number of market-capitalization weighted indices, I think the issues are company specific and the media coverage is excessive. Turning to matters that really matter, the Retail SPDR (XRT) broke wedge resistance with a huge move on Tuesday. This was in response to a better-than-expected retail sales report. Also note that the Consumer Discretionary SPDR (XLY) surges to a new 52-week highs. These are positive developments for the stock market overall.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Wed - Jan 16 - 07:00 - MBA Mortgage Index

Wed - Jan 16 - 08:30 – Consumer Price Index (CPI)

Wed - Jan 16 - 09:15 - Industrial Production

Wed - Jan 16 - 10:00 - NAHB Housing Market Index

Wed - Jan 16 - 10:30 - Oil Inventories

Wed - Jan 16 - 14:00 - Fed Beige Book

Thu - Jan 17 - 08:30 - Jobless Claims

Thu - Jan 17 - 08:30 - Housing Starts/Building Permits

Thu - Jan 17 - 10:00 - Philadelphia Fed

Thu - Jan 17 - 10:30 - Natural Gas Inventories

Fri - Jan 18 - 09:55 - Michigan Sentiment

Wed - Jan 23 – 16:30 – Apple Earnings

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More