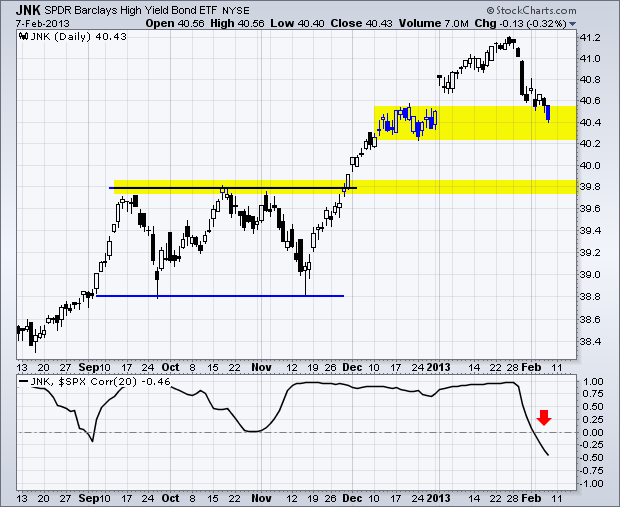

The stock market is holding up, but some external indicators are not. First, the US Dollar Fund (UUP) surged over the last few days and broke short-term resistance. Also note that bear trap from last Friday-Monday. Second, the Euro is falling has tensions heat up in Italy and Spain. Berlusconi, who controls some 80% of Italian media, is polling quite well and talking populist. These parliamentary elections are schedeuled for February 24th and a strong showing by Berlusconi's party would likely hit the Euro. Third, the Treasuries firmed over the last two weeks. A breakout in TLT would be negative for stocks. Fourth, junk bonds, which are positively correlated with stocks, plunged over the last two weeks. The chart below shows the High-Yield Bond SPDR (JNK) plunging last week and continuing lower this week. The Correlation Coefficient (JNK,SPY) has been largely positive since October 2008, but moved to its lowest, and most negative, level since September 2008. Also keep in mind that stocks are still overbought and ripe for a pullback. And finally, historical data shows that February is the second weakest month of the year.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Tue - Feb 12 - 10:00 – Tim Cook Speaks at Goldman Sachs Tech Conference

Sun - Feb 24 - 10:00 – Italian Parliamentary Elections

Fri – Mar 01 - 23:59 – Sequester Takes Effect (unless...)

Wed – Mar 27 - 23:59 – Government Shut Down Deadline

Wed – May 15 - 23:59 – New Debt Ceiling Deadline

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.