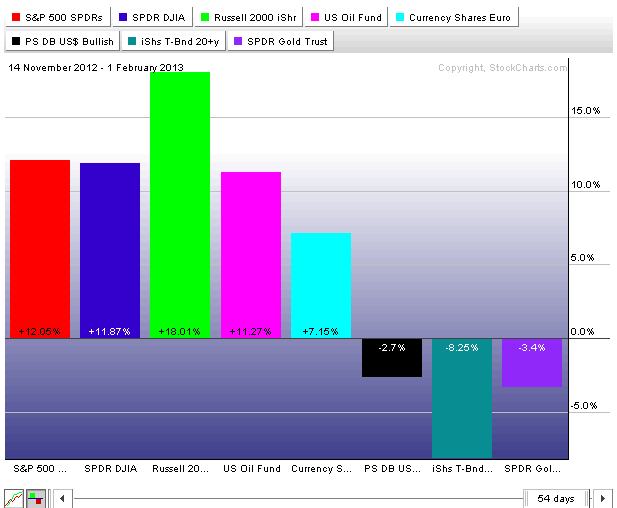

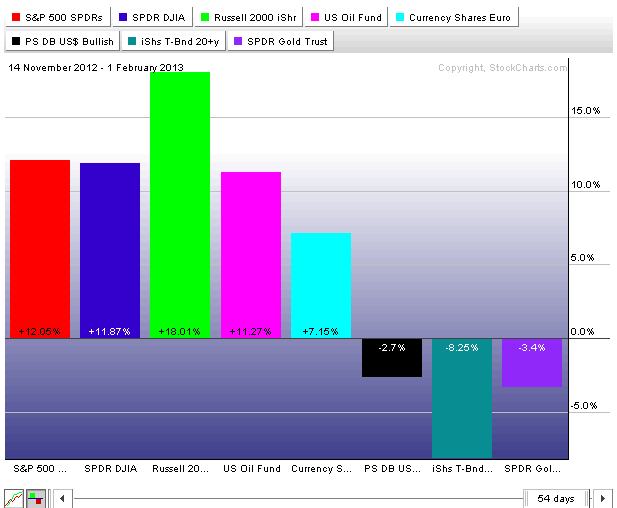

Stocks finished the week on a high note with the Dow Industrials closing above 14000 for the first time since 2007. The trend since mid November is pretty much straight up with the major index ETFs up double digits since these lows. The S&P 500 is up around 12 and the Russell 2000 is up around 18%. Even the lowly Nasdaq is up over 11%. There is no denying the direction of the underlying trend, but this rally is certainly getting long in tooth. The chances of a corrective period are increasing with each new high. It is also possible that we see a stealth correction where the market simply grinds higher at a slower pace. Elsewhere, Treasuries are as oversold as stocks are overbought. Weakness in Treasuries is feeding the equity bulls as money rotates from safe-havens to riskier assets. Oil is on the risk-on bandwagon, but is also getting overbought. The Dollar broke support on Friday, but managed to rebound after Friday's initial plunge. Perhaps a bear trap is in the works here.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Mon - Feb 04 - 10:00 - Factory Orders

Tue - Feb 05 - 10:00 - ISM Services

Wed - Feb 06 - 07:00 - MBA Mortgage Index

Wed - Feb 06 - 10:30 - Oil Inventories

Thu - Feb 07 - 08:30 - Jobless Claims

Thu - Feb 07 - 10:30 - Natural Gas Inventories

Fri – Mar 01 - 23:59 – Sequester Takes Effect

Wed – Mar 27 - 23:59 – Government Shut Down Deadline

Wed – May 15 - 23:59 – New Debt Ceiling Deadline

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More