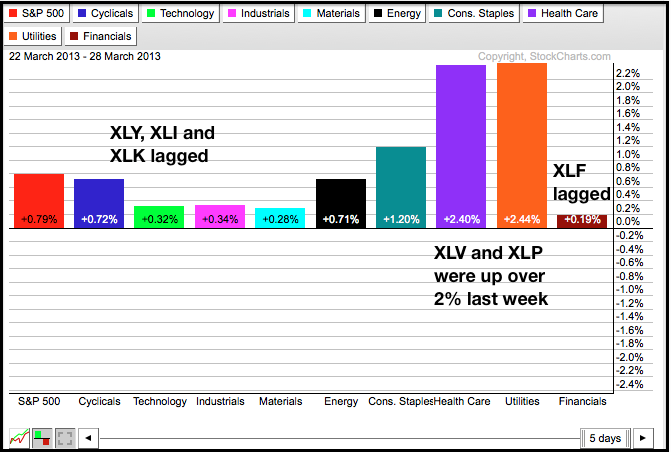

Another week and another new high for the S&P 500. Even though the weekly gain was small, MDY, QQQ and SPY ended the month at their highs for 2013. IWM lagged a little and finished just below its mid March high. The big trend remains up, but we have seen some slowing the last three weeks. The defensive sectors are not slowing though. The S&P 500 was up .79% for the week, but the Healthcare SPDR (XLV), Consumer Staples SPDR (XLP) and Utilities SPDR (XLU) were all up more than the S&P 500 – way more. In fact, these three sectors were the top performers last week. The Consumer Discretionary SPDR (XLY) came in fourth and lagged the S&P 500, which benefitted from relative strength in the defensive sectors. In addition to runaway relative strength in the defensive sectors, I am a little concerned with strength in Treasury bonds and the decline in the 10-year Treasury Yield ($TNX). Stocks and treasuries have a strong negative correlation, which means something needs to give pretty soon. Either the 20+ Year T-Bond ETF (TLT) gives up its gains or stocks embark on a corrective period. It will be a big week for Treasuries because the employment report is Friday. We can also look forward to the ISM Manufacturing Index on Monday and ISM Services on Friday.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Mon - Apr 01 - 10:00 - ISM Manufacturing Index

Mon - Apr 01 - 10:00 - Construction Spending

Tue - Apr 02 - 10:00 - Factory Orders

Tue - Apr 02 - 14:00 - Auto/Truck Sales

Wed - Apr 03 - 07:00 - MBA Mortgage Index

Wed - Apr 03 - 08:15 - ADP Employment Change

Wed - Apr 03 - 10:00 - ISM Services

Wed - Apr 03 - 10:30 - Oil Inventories

Thu - Apr 04 - 07:30 - Challenger Job Cuts

Thu - Apr 04 - 08:30 - Jobless Claims

Thu - Apr 04 - 10:30 - Natural Gas Inventories

Fri - Apr 05 - 08:30 - Employment Report

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.