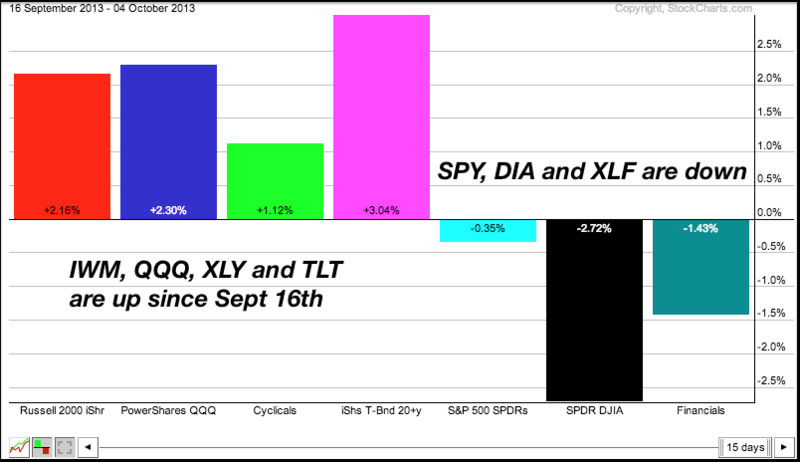

It remains a tale of two markets. The Dow Industrials SPDR and the S&P 500 ETF are weak and in short-term downtrends. The Russell 2000 ETF and Nasdaq 100 ETF are holding up and remain in consolidation patterns since September 18th. QQQ and IWM bounced off short-term support last week and these lows mark key support. Among the sectors, the Finance SPDR is in a downtrend since September 19th, but the Consumer Discretionary SPDR has been range bound with the late September lows marking support. Something needs to give to break this deadlock. Either SPY and DIA breakout to rally the stock market or IWM and QQQ break down. Similarly, either XLF breaks out to reverse its slide or XLY breaks support and weighs on the market. Chartists can also watch the 20+ Year T-Bond ETF (TLT) for clues as a falling flag formed last week. A flag breakout would be bullish for TLT and this would be negative for stocks. It is a light week for economic reports, especially with the absence of government reports during the shutdown. This lack of reporting means traders are flying in the dark and third quarter earnings could carry more weight.

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Key Reports and Events (all times Eastern):

No government reports during the shutdown

Tue - Oct 08 - 08:30 – Alcoa (AA) kicks off earnings season

Wed - Oct 09 - 07:00 - MBA Mortgage Index

Wed - Oct 09 - 10:30 - Crude Oil Inventories

Wed - Oct 09 - 14:00 - FOMC Minutes

Thu - Oct 10 - 08:30 - Initial Jobless Claims

Thu - Oct 10 - 10:30 - Natural Gas Inventories

Fri - Oct 11 - 08:30 - Retail Sales

Fri - Oct 11 - 08:30 - Producer Price Index (PPI)

Fri - Oct 11 - 09:55 - Michigan Sentiment

Fri - Oct 11 - 10:00 - Business Inventories

Thu - Oct 17 - 23:59 - Debt Ceiling Deadline

Thu - Oct 24 - 09:00 - Government Runs out of Money (estimate)

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.