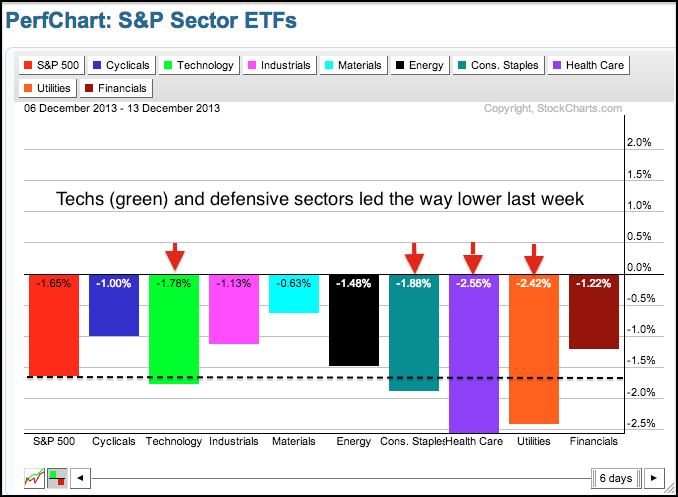

Stocks extended their correction as the S&P 500 ETF (SPY) saw its biggest weekly decline since August. The Russell 2000 ETF (IWM) led the major index ETFs lower with a 2% decline last week. In an interesting twist, the defensive sectors showed the biggest losses. The Healthcare SPDR (XLV) and the Utilities SPDR (XLU) both lost over 2%. The Gold Miners SPDR (GDX) and Silver Miners ETF (SIL) bucked the selling and gained for the week. It was a volatile week for gold as GLD surged above 122.4 early in the week, but finished below 120 and with a small gain. Even though GLD is firming near the June low with indecision the last two weeks, we have yet to see an upside catalyst that would suggest a double bottom is taking shape. Elsewhere, the Copper ETN (JJC) and the Base Metals ETF (DBB) managed respectable gains, while the Natural Gas ETF (UNG) surged over 6% to extend its big run. It is going to be a big week, especially the last three days. There are a slew of economic reports, the Fed makes its policy statement on Wednesday and the yearend is fast approaching.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Mon - Dec 16 - 08:30 - Empire Manufacturing

Mon - Dec 16 - 09:15 - Industrial Production

Tue - Dec 17 - 08:30 - Consumer Price Index (CPI)

Tue - Dec 17 - 10:00 - NAHB Housing Market Index

Wed - Dec 18 - 07:00 - MBA Mortgage Index

Wed - Dec 18 - 08:30 - Housing Starts-Sep&Oct

Wed - Dec 18 - 08:30 - Housing Starts/Building Permits-Nov

Wed - Dec 18 - 10:30 - Crude Oil Inventories

Wed - Dec 18 - 14:00 - FOMC Policy Statement

Thu - Dec 19 - 08:30 - Initial Jobless Claims

Thu - Dec 19 - 10:00 - Existing Home Sales-Nov

Thu - Dec 19 - 10:00 - Philadelphia Fed

Thu - Dec 19 - 10:00 - Leading Indicators

Thu - Dec 19 - 10:30 - Natural Gas Inventories

Fri - Dec 20 - 08:30 - GDP - Third Estimate

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.