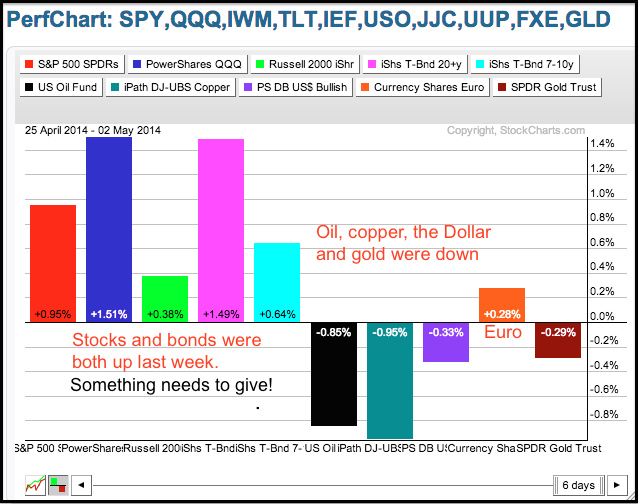

Nothing much changed last week. SPY broke flag resistance and continued to lead the major index ETFs. IWM remains in a downtrend and formed a rising wedge, which could be a bearish continuation pattern. The markets shrugged off good economic news and closed weak on Friday. Perhaps Ukraine fears kept buyers on the sidelines. Buyers are clearly not on the sidelines in the Treasury market as the 20+ YR T-Bond ETF (TLT) surged to a new high for the year. Relative strength in Treasuries is not good for stocks and suggests a certain risk aversion in the market right now. Gold worked its way lower the first four days of the week and then surged to resistance on Friday. A follow through breakout would be bullish for bullion.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

*************************************************************

SPY surged from 181 to 188.5 in mid April, corrected with a falling flag and then broke flag resistance last week. The breakout is holding and broken resistance in the 187-187.5 turns first support to watch for a failed breakout. The flag lows mark key support in the 185-186 area. The indicator window shows the SPY:TLT ratio falling over the last two weeks as SPY underperforms TLT, which hit a new high last week. Relative weakness in SPY is negative, but a flag/wedge breakout in this ratio would be bullish for stocks.

**************************************************************

QQQ is trying for a breakout, but continues to have trouble with resistance in the 88 area. Overall, an inverse head-and-shoulders of sorts is taking shape and the ETF broke flag resistance last week. A small pennant formed on Thursday-Friday and a breakout here would provide another bullish indication. The indicator window shows the QQQ:SPY ratio turning flat as QQQ performs inline with SPY over the last four weeks.

**************************************************************

IWM remains in a downtrend and the weakest of the major index ETFs. The ETF did manage to hold above the mid April low and bounce with a rising wedge the last two weeks. Rising wedges, however, are potentially bearish continuation patterns. The bulls have a slight edge as long as the wedge rises. A break below 110.9 would reverse the wedge and signal a continuation of the downtrend. For the overall downtrend, I am leaving key resistance at 114 for IWM.

**************************************************************

Despite some positive economic reports last week, the 20+ YR T-Bond ETF (TLT) continued higher and finished at a new high for the move. This puts the ETF just above the upper trend line of the rising channel and makes it overbought. The lower trend line and mid April lows combine to mark key support in the 109-109.5 area.

**************************************************************

The US Dollar ETF (UUP) surged on the open Friday, but fell back to support and closed near support. The bigger trend for the Dollar is down and a break would signal a continuation lower. The late April highs mark resistance at 21.40. The Euro Index ($XEU) opened weak and closed strong. The move was enough to break the mid March trend line zone and the Euro is acting like it wants to move higher. The European Central Bank (ECB) meets on Thursday and there are no signs that Draghi is ready to embark on QE for the EU.

**************************************************************

The USO Oil Fund (USO) fell sharply and has now retraced 62% of the advance from mid March to mid April. The bigger trend for oil is up and this is still considered a correction within that uptrend. The falling channel defines this correction and I will mark resistance at 37. A break above this level would end the correction and signal a resumption of the bigger uptrend.

**************************************************************

The news out of Ukraine is certainly not positive and the situation remains very fluid. This fear may have sparked a rally in gold on Friday as GLD surged to its resistance zone. A follow thru breakout at 126.2 would be short-term bullish and could have medium-term implications as well.

***************************************************************

Key Reports and Events (all times Eastern):

Mon - May 05 - 10:00 - ISM Services Index

Wed - May 07 - 07:00 - MBA Mortgage Index

Wed - May 07 - 10:30 - Crude Oil Inventories

Thu - May 08 - 08:30 - Initial Jobless Claims

Thu - May 08 - 08:30 - European Central Bank (ECB) Policy Statement

Thu - May 08 - 10:30 - Natural Gas Inventories

Fri - May 09 - 10:00 - JOLTS - Job Openings

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.