Stocks rallied with a broad advance that lifted most boats. The sectors and industry groups that were hit the hardest over the last few months got the biggest bounces. These include energy, materials, mining, gold and steel. Elsewhere, the EW Consumer Discretionary ETF (RCD) surged 1.5% and held support. The Home Construction iShares (ITB) kept its uptrend alive with a 1.75% gain. Semis got an oversold bounce as the Semiconductor SPDR (XSD) gained 2%. Bonds pulled back as the market turned to riskier assets, such as stocks and commodities. Weakness in bonds weighed on utilities as this sector lost ground.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Short-term Overview (Tuesday, 11-August-2015):

- Short-term breadth is bearish overall.

- Four of the five EW sector ETFs are in uptrends (RYT, RYH, RYF, RGI).

- SPY formed a lower high with a gap-surge, but remains below resistance.

- QQQ gapped up, but remains within a falling wedge.

- IWM got an oversold bounce, but remains within a downtrend and shows relative weakness.

- TLT remains in an uptrend.

- UUP fell back, but remains in an uptrend overall.

- USO got an oversold bounce within a bigger downtrend.

- GLD firmed for a few weeks and broke first resistance.

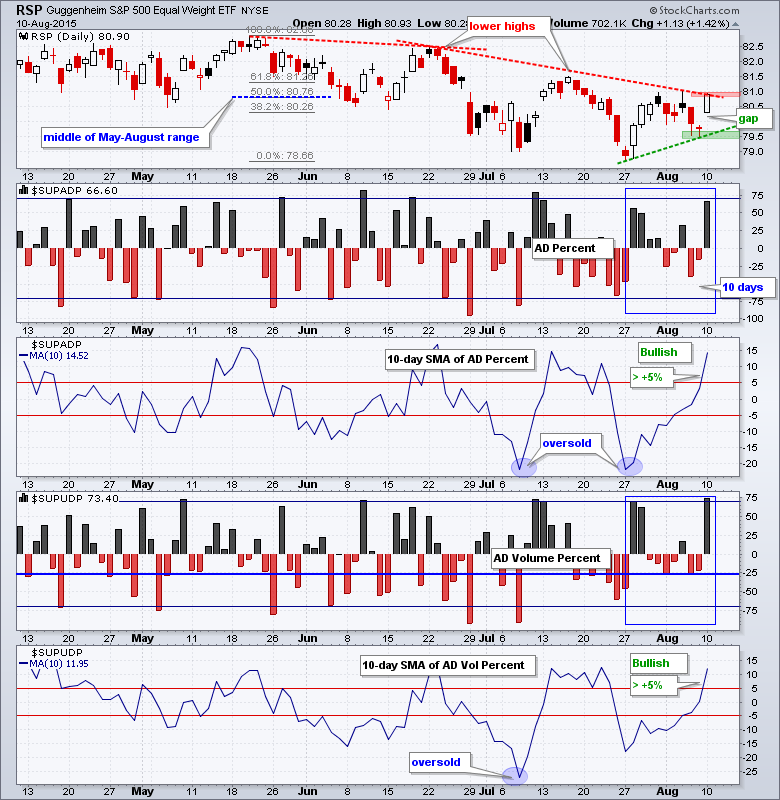

RSP held above the late July low, gapped up and closed strong. The gap held and prices moved higher after the gap. This is short-term bullish. A strong gap should hold so I will mark support at 79.40. A move below this level would fill the gap and reverse the short-term upswing. Note that RSP is still in a medium-term downtrend with lower lows and lower highs since late May.

AD Percent surged to +66% and AD Volume Percent surged above +73%. Once again, AD Volume Percent was stronger than AD Percent and this points to strength in large-caps. The surge in AD Percent, however, was the strongest since mid July and it does represent the third up thrust in 10 days. The 10-day SMAs for AD Percent and AD Volume Percent both moved above +5% to turn bullish.

The sector balance is net bullish with four in uptrends and one flat. Consumer discretionary got a nice surge off support to keep the big trading range alive. Industrials broke out to finally reverse its short-term downtrend. Technology is still the strongest overall because it forged higher highs last week and this week.

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Aug 12 - 07:00 - MBA Mortgage Index

Wed - Aug 12 - 10:00 - JOLTS Jobs Report

Wed - Aug 12 - 10:30 - Crude Oil Inventories

Wed - Aug 12 - 14:00 - Treasury Budget

Thu - Aug 13 - 08:30 - Initial Jobless Claims

Thu - Aug 13 - 08:30 - Retail Sales

Thu - Aug 13 - 10:00 - Business Inventories

Thu - Aug 13 - 10:30 - Natural Gas Inventories

Fri - Aug 14 - 08:30 - Producer Price Index (PPI)

Fri - Aug 14 - 09:15 - Industrial Production

Fri - Aug 14 - 10:00 - Michigan Sentiment

Mon - Aug 17 - 08:30 - Empire Manufacturing

Mon - Aug 17 - 10:00 - NAHB Housing Market Index

Tue - Aug 18 - 08:30 - Housing Starts/Building Permits

Wed - Aug 19 - 07:00 - MBA Mortgage Index

Wed - Aug 19 - 08:30 - Consumer Price Index (CPI)

Wed - Aug 19 - 10:30 - Crude Oil Inventories

Wed - Aug 19 - 14:00 - FOMC Minutes

Thu - Aug 20 - 08:30 - Initial Jobless Claims

Thu - Aug 20 - 10:00 - Existing Home Sales

Thu - Aug 20 - 10:00 - Philadelphia Fed

Thu - Aug 20 - 10:00 - Leading Indicators

Thu - Aug 20 - 10:30 - Natural Gas Inventories

Tue - Aug 25 - 09:00 - Case-Shiller Housing Index

Tue - Aug 25 - 09:00 - FHFA Housing Price Index

Tue - Aug 25 - 10:00 - New Home Sales

Tue - Aug 25 - 10:00 - Consumer Confidence

Wed - Aug 26 - 07:00 - MBA Mortgage Index

Wed - Aug 26 - 08:30 - Durable Goods Orders

Wed - Aug 26 - 10:30 - Crude Oil Inventories

Thu - Aug 27 - 08:30 - Initial Jobless Claims

Thu - Aug 27 - 08:30 - GDP

Thu - Aug 27 - 10:00 - Pending Home Sales

Thu - Aug 27 - 10:30 - Natural Gas Inventories

Fri - Aug 28 - 08:30 - Personal Income & Spending

Fri - Aug 28 - 08:30 - PCE Prices

Fri - Aug 28 - 10:00 - Michigan Sentiment

Mon - Aug 31 - 09:45 - Chicago PMI

Tue - Sep 01 - 10:00 - Construction Spending

Tue - Sep 01 - 10:00 - ISM Manufacturing Index

Tue - Sep 01 - 17:00 - Auto/Truck Sales

Wed - Sep 02 - 07:00 - MBA Mortgage Purchase Index

Wed - Sep 02 - 08:15 - ADP Employment Report

Wed - Sep 02 - 10:00 - Factory Orders

Wed - Sep 02 - 10:30 - Crude Oil Inventories

Wed - Sep 02 - 14:00 - Fed's Beige Book

Thu - Sep 03 - 07:30 - Challenger Job Report

Thu - Sep 03 - 08:30 - Initial Jobless Claims

Thu - Sep 03 - 10:00 - ISM Services

Thu - Sep 03 - 10:30 - Natural Gas Inventories

Fri - Sep 04 - 08:30 - Employment Report

This commentary is designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.