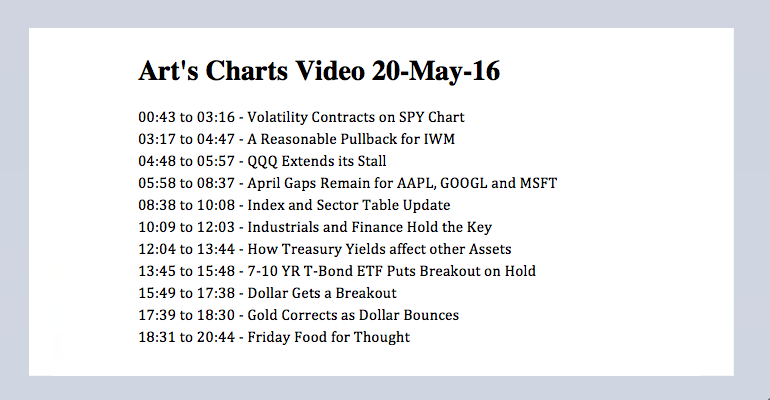

Volatility Contracts on SPY Chart // QQQ Extends its Stall // April Gaps Remain for AAPL, GOOGL and MSFT // A Reasonable Pullback for IWM // Index and Sector Table Update // Industrials and Finance Hold the Key // How Treasury Yields affect other Assets // 7-10 YR T-Bond ETF Puts Breakout on Hold // Dollar Gets a Breakout // Gold Corrects as Dollar Bounces // Friday Food for Thought //// ...........

Volatility Contracts on SPY Chart

The S&P 500 SPDR (SPY) is currently in the midst of a rather mild pullback the last four weeks. Overall, the ETF remains in a large trading range and the swing within this range is up. The green Raff Regression Channel and April-May lows mark support in the 200-203 area. A smaller Raff Regression Channel (red) defines the four week decline with resistance around 208. Notice that SPY was down around 4% from high to low and the four candlesticks show indecision with long upper and lower shadows. These shadows represent the weekly highs and lows. I still view a ~4% pullback as a correction within a bigger uptrend and would watch 208 for an upside breakout to end this pullback.

Chartists looking to quantify this four week range can use the Bollinger BandWidth indicator. The default parameters are (20,2) so I changed them to (4,2). This means we are using a 4-week moving average and the bands are set 2 standard deviations from this moving average. BandWidth is simply the upper band less the lower band divided by the moving average. Note that BandWidth dipped below 2.5% and to its lowest level since June. BandWidth does not really give us any directional clues. It simply provides a picture of volatility and we have clearly seen a volatility contraction on the SPY chart (narrowing 4 week range). John Bollinger theorized that volatility expansions follow volatility contractions so we can expect a significant move in the coming weeks.

QQQ Extends its Stall

There is no change on the QQQ chart because the ETF extended its consolidation in the 105-106 area. QQQ fell sharply in late April and this stalled with three indecisive candlesticks. This is like a consolidation (pennant) and a breakdown from here would suggest that the second shoe is dropping. Such a move would also reverse the upswing that began in February. An upside breakout is also possible as long as support in the 105 holds.

April Gaps Remain for AAPL, GOOGL and MSFT

The CandleGlance chart shows the top holdings for QQQ. Apple (10.5%), Alphabet (9.12%), Microsoft (8.05%), Amazon (6.58%), Facebook (5.41%) and the Nasdaq Biotech iShares (~12%) account for over 50% of the ETF. I am fudging a little with IBB because it is technically not a holding. However, healthcare accounts for 12.68% of QQQ and the vast majority of these stocks are biotechs.

There are basically three groups. First, AMZN and FB remain in clear uptrends. Second, APPL and IBB are in clear downtrends. Third, GOOGL and MSFT are in large trading ranges. Of note, AAPL, MSFT and GOOGLE gapped down in April and these gaps remain. However, AAPL, IBB, GOOGL and MSFT are all near support zones. GOOGL and MSFT are testing their rising 200-day moving averages and these two could tilt the balance for QQQ. A close below 700 in GOOGL and 49 in MSFT would be quite negative.

A Reasonable Pullback for IWM

On the IWM chart, I remain focused on price action since the February reversal. I do see lower lows and lower highs extending back to the June peak, but I think the February-April surge (+18%) remains the dominant chart feature. As with SPY, IWM is in the midst of a reasonable pullback the last four weeks as the ETF fell 6.3% from high to low, which is around 1/3 of the prior surge. A pullback is normal after a big advance and I am using the red Raff Regression Channel to define this pullback. A break above 112 would reverse the slide and signal a continuation of the prior advance.

Index and Sector Table Update

There is no change in the index table and only one change in the sector table. The bulk of the evidence remains bullish for the market. Small-caps continue to lag overall as the Small-Cap %Above 200-day EMA (!GT200SML) dipped below 50%. Note that Mid-Cap %Above 200-day EMA (!GT200MID) and S&P 500 %Above 200-day EMA (!GT200SPX) are both above 60%. Small-caps may be weighing, but the weight of mid-caps plus large-caps is more than that of small-caps.

The consumer discretionary sector got a downgrade because the Consumer Discretionary HiLo Line ($XLYHLP) moved below its 20-day EMA and XLY broke below its April low. This means the indicators are net bearish for XLY and it remains the weakest sector. Amazon is the big dog in XLY, but there appear to be too many dog dogs in the sector right now (blame retailers). Despite weakness in technology and consumer discretionary, the other seven sectors remain bullish and this is net bullish for the broader market. At worst, pockets of weakness may impede the bulls and result in a grinding advance for the broad market indexes.

Not much has changed on the sector-index breadth charts so I will just post links to the charts with breadth indicators. The 10-day EMA of High-Low Percent is bullish when it exceeds +30% and remains bullish until it exceeds -30%, which is bearish. The High-Low Line is bullish when rising and above the 20-day EMA.

Chart Links

| SPY | XLY | XLK |

| MDY | XLF | XLI |

| IJR | XLV | XLP |

| QQQ | XLU | XLE |

| XLB |

Industrials and Finance Hold the Key

There are four offensive sectors in the S&P 500: consumer discretionary (12.5%), technology (22%), finance (16.3%) and industrials (10%). Together, these four account for around 60% of the S&P 500. We have already seen weakness in the consumer discretionary and technology sectors so I am watching the Finance SPDR (XLF) and the Industrials SPDR (XLI) closely. Breakdowns in these two would likely tilt the market balance to the bears.

On the price chart, XLI surged over 20% and then fell back over the last four weeks. The green Raff Regression Channel and April low mark support in the 54 area. The four week decline is viewed as a correction as long as support holds. Look for a break above 56 to end this pullback.

XLF also pulled back, but has managed a gain this week and the sector is showing some relative strength. A falling wedge formed and a breakout here would signal a continuation of the bigger uptrend. Notice that XLF firmed near broken resistance and 22.6 is the first support level to watch for signs of a breakdown.

XLF also pulled back, but has managed a gain this week and the sector is showing some relative strength. A falling wedge formed and a breakout here would signal a continuation of the bigger uptrend. Notice that XLF firmed near broken resistance and 22.6 is the first support level to watch for signs of a breakdown.

How Treasury Yields Might Effect other Assets

Treasury bonds were hit hard this week and the 10-YR Treasury Yield ($TNX) surged. Even though correlations and intermarket relationship are not as important as price action of the underlying, continued weakness in Treasury bonds could affect several groups. A decline in Treasury bonds implies a rise in Treasury yields (interest rates). A rise in Treasury rates would be negative for consumer staples, utilities, REITs and gold. It would be positive for banks, brokers and the Dollar. The chart below confirms some of these relationships.

7-10 YR T-Bond ETF Puts Breakout on Hold

On the price chart, IEF broke above the triangle trend line last week and then fell back hard this week. The ETF remains range bounce since February. Watch support from the April low because a break below this level would be bearish. The indicator window shows the IEF:SPY ratio flattening the last two months. IEF is still underperforming SPY and this shows a preference for stocks (since February). A break above the red resistance line would show relative strength in IEF and this would be negative for stocks.

Dollar Gets a Breakout

The US Dollar ETF (UUP) surged the last three weeks and June Dollar Futures (^DXM16) broke above its April high. I prefer to use the futures contract for analysis because it represents the purest play on the Dollar index. I view the breakout as bullish and am impressived to see the greenback surge three consecutive weeks. There is an argument to be made for a bigger downtrend since March 2015, but we have to make a stand somewhere and I choose to turn bullish with this breakout.

Gold Corrects as Dollar Bounces

Rising Treasury yields and strength in the Dollar is negative for gold. Even so, I will focus on the actual gold chart before turning bearish. The Gold SPDR (GLD) fell over the last three weeks. This decline coincides with a bounce in the Dollar (weakness in the Euro and Yen). On the price chart, GLD broke flag resistance and this signal has yet to be negated. The mid April lows mark first support and define the flag breakout. A close below this support level would negate the flag breakout and be negative for bullion.

Friday Food for Thought

The “Soros Put” Story (PriceActionLab)

The “Soros put” story is repeated in the financial media every year in the last four years. Investors and traders should not pay attention to these stories. Soros does his homework well and investors and traders should do theirs.

The Greatest Obstacle To Making Money In Financial Markets (Brett Steenbarger, Forbes)

As a psychologist who works with investors and traders in financial markets, I’m often asked to help money managers with their performance. The common assumption is that people fail to reach their investment potential because of the intrusion of cognitive and emotional factors that bias their decision-making. If only they could learn to tame their emotions and stay mindful and focused, they could harvest the returns from their ideas.

New SEC Rule Proposals Aimed at ETFs May Chase Investors Into ETNs (Bloomberg)

New proposals from the U.S. securities watchdog aimed at reducing risks in exchange-traded funds (ETFs) may end up being the best thing that ever happened to rival exchange-traded notes (ETNs).

Goldman Picked a Good Time to Like Tesla's Stock (Bloomberg)

Just after 4 p.m. yesterday, Tesla Motors Inc. announced a $2 billion stock offering, of which about $1.4 billion will fund a production expansion, and the rest will pay taxes on an option exercise by Chief Executive Officer Elon Musk. The deal will be led by Morgan Stanley and Goldman Sachs. Awkwardly, another thing that happened yesterday -- in the wee hours of the morning, some 16 hours before the deal launched -- is that the equity research analysts at Goldman Sachs raised their rating on Tesla from "Neutral" to "Buy."

A Simple Breakout Trading Rule (Investment Idiocy)

Breakout. Not the classic home arcade game, seen here in Atari 2600 version, but what happens when a market price breaks out of a trading range. In this post I'll discuss a trading rule I use to look at breakouts. This will be an opportunity to understand in more general terms how I go about designing and testing trading rules. It will be fascinating for those who are interested in this, and full of mind numbing detail it you're not.

******************************************************

Measuring Risk On-Risk Off - Using charts to quantify stock, economic and credit risk.

PPO Trading Strategy - How to use 3 PPOs to develop a trend-reversion trading strategy.

Long-term Trend Indicators - Using the PPO, EMA Slope and CCI to determine the trend.

ETF Master ChartPack - 300+ ETFs organized in a Master ChartList and in individual groups.

Follow me on Twitter @arthurhill - Keep up with my 140 character commentaries.

****************************************

Thanks for tuning in and have a good day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************