|

|

Dow Theory is based on the writings of Charles Dow, creator of the Dow Jones Industrial Average. As editor of the Wall Street Journal in the late 19th century, Dow wrote many articles detailing his thoughts on market analysis. He never wrote a book, but William Hamilton and Robert Rhea assembled and refined Dow’s work into current Dow Theory.

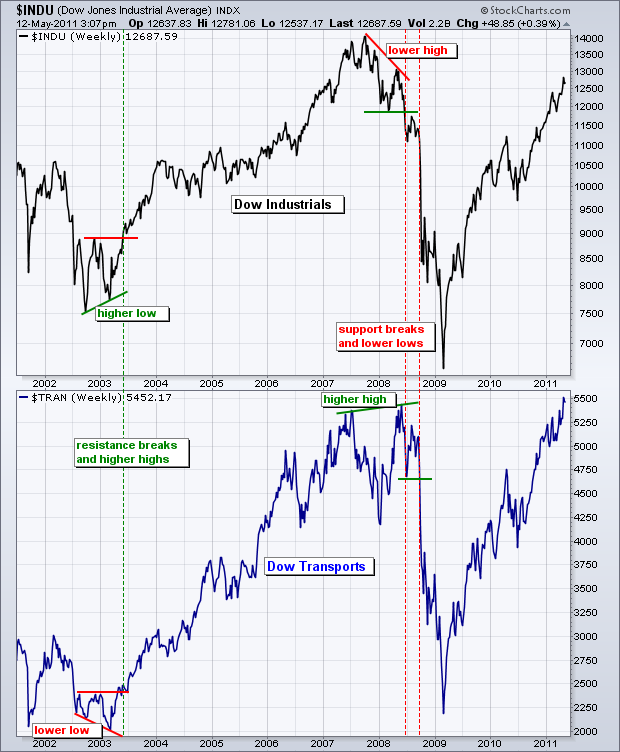

Confirmation is at the core of Dow Theory. This means the Averages, Dow Industrials and Dow Transports, must confirm one another. Lower lows in both Averages produce a sell signal, while higher highs produce a buy signal. A non-confirmation is present when one Average fails to confirm a higher high or a higher low in the other.

The chart below shows a couple of big signals and the current bullish confirmation. In 2002-2003, the Dow Industrials formed a higher low as the Dow Transports formed a lower low. This non-confirmation from the Dow Industrials suggested that conditions were improving. Both broke above their prior reaction highs to trigger bullish signals in June 2003.

Click this image for a live chart.

A large non-confirmation formed when the Dow Transports formed a higher high in 2007-2008 and the Dow Industrials formed a lower high in early 2008. The lower high in the Dow Industrials amounted to a non-confirmation. Even though the Dow Transports forged a higher high at the time, the lower high in the Dow Industrials suggested something was amiss. Both forged lower lows a few months later for a full sell signal.

The theory of confirmation is currently on a buy signal. Both the Dow Industrials and Dow Transports formed “V” reversals and higher highs in the second half of 2009. Both recorded new 52-week highs in late April to keep the bull signal firmly in place. You can read much more about Dow Theory in our ChartSchool.