|

|

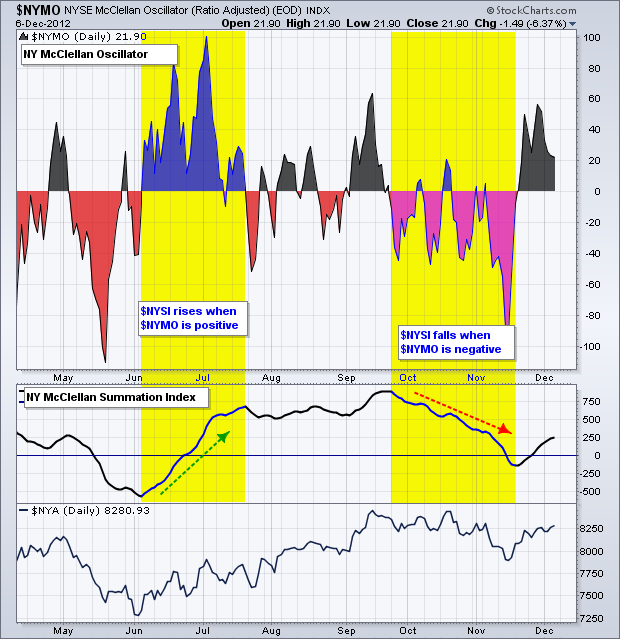

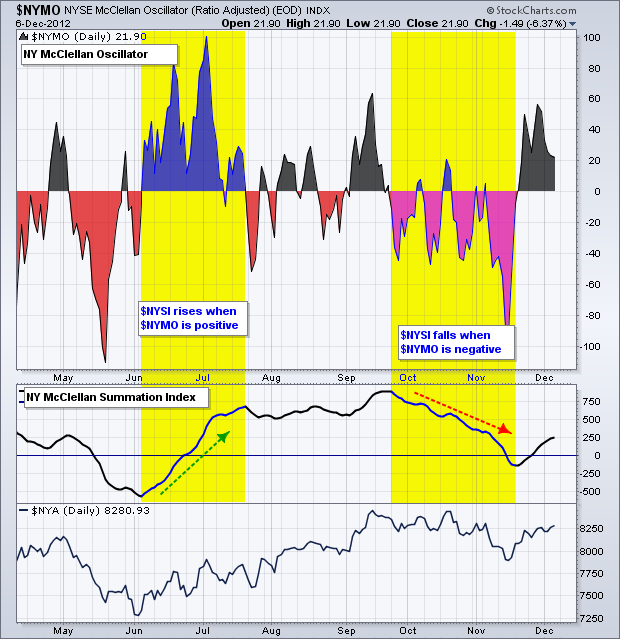

Let’s first start with the McClellan Oscillator. This is the 19-day EMA of Net Advances less the 39-day EMA of Net Advances. Net Advances equals advancing issues less declining issues. Some chartists use ratio-adjusted Net Advances by dividing Net Advances by Advances plus Declines. The McClellan Oscillator is similar to MACD because it is the difference between two moving averages. In this regard, the McClellan Oscillator measures the momentum of breadth (Ratio-Adjusted Net Advances). Notice how it oscillates above/below the zero line.

Click this image for a live chart.

Click this image for a live chart.

The McClellan Summation Index is a cumulative indicator based on the McClellan Oscillator values. The index rises when the McClellan Oscillator is positive and declines when the McClellan Oscillator is negative. The McClellan Summation Index is also an oscillator because it fluctuates above/below the zero line. The index trends higher when the McClellan Oscillator is positive for an extended period, and trends lower when the McClellan Oscillator is negative for an extended period. You can read more about the McClellan Oscillator and the McClellan Summation Index in our ChartSchool.