What an incredible - and shorter - week in the world of high finance.

Doomsday news appeared EVERYWHERE, yet did not impact the market per se. Gold however, like our recycled, solid gold art installation, held its ground. Only the metal looks like it is about to go into orbit. Yields rose, the dollar remained flat, grains caught a boost and, of course, the NASDAQ 100 soared to yet another new all-time high.

The start of stagflation (also recycled from the 1970's) might finally be upon us. Regardless of the latest COVID flare up, many stocks ran to new 52-week highs. Nevertheless, millions remain unemployed and the new surge threatens the full reopening of the economy. But also recycled is the human amazing superpower - hope!

The Economic Modern Family already owns gold, but also hopes to soar away with NASDAQ in the recycled gold capsule. Can they?

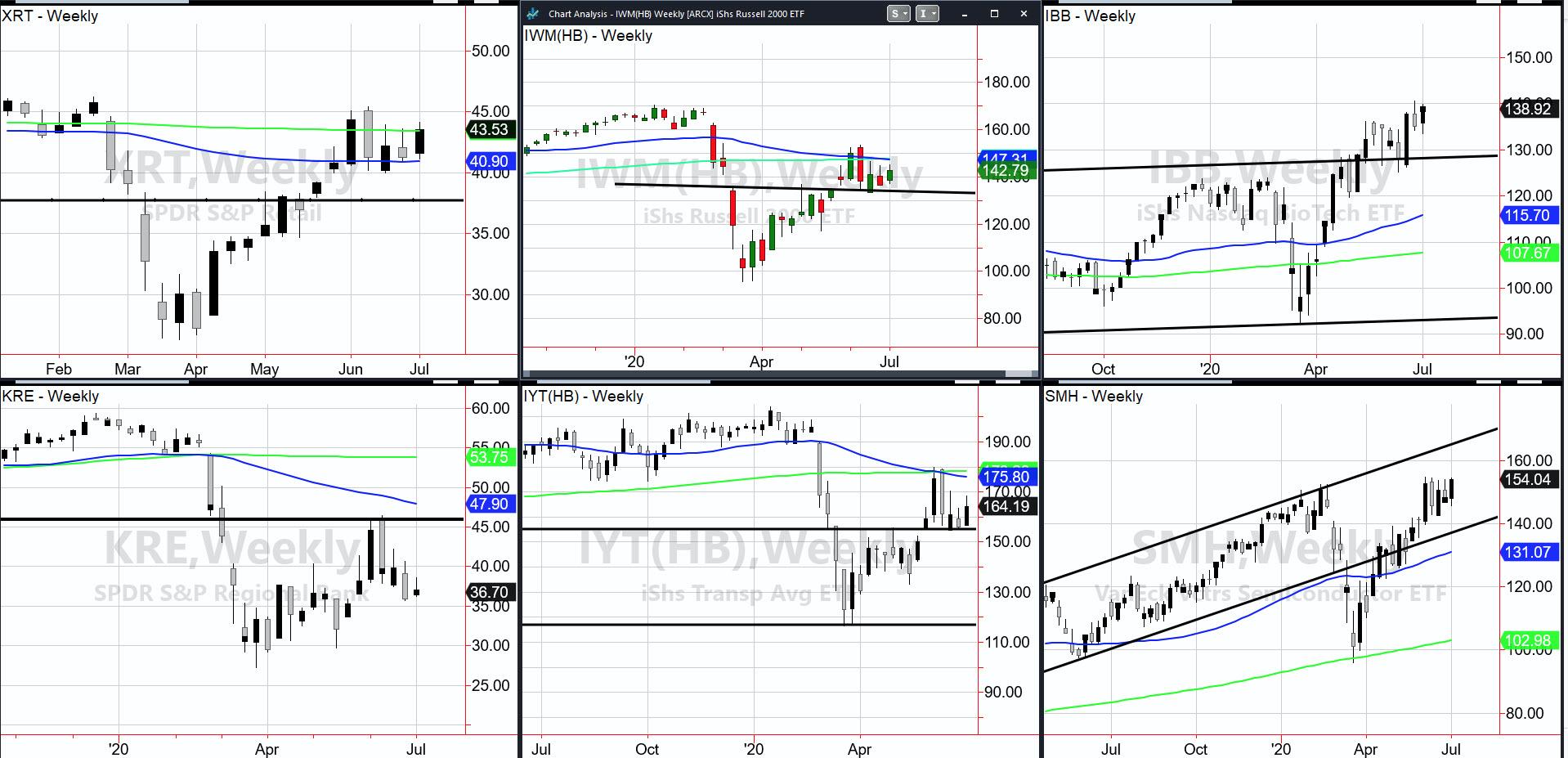

If you are looking at these weekly charts and thinking to yourself man, that is where all of them were trading weeks ago, you would be right.

The trading ranges are wide, given the volatility, but persistent. Retail (XRT), for example, sits between the 50- and 200-week moving averages. I am particularly interested in whether Granny can enter the gold capsule and do something she has not done for years - LEAD! As a consumer-based economy, that would be compelling. Even more compelling, to me, than strong FAANG stocks as far as the hope for the economy in the future.

Granddad Russell 2000 (IWM) is below both the weekly moving averages and in a bear phase. Concerning? Yes. However, should his wife get wings, he will follow, as a happy consumer is a happy manufacturer.

Biotechnology (IBB) over 140, unless we have a full-blown crash, also gives us hope for the whole Family.

Regional Banks (KRE) is an issue for sure as it is still lagging. Still bearish. Still, though, showing a positive divergence on momentum. Plus, we had an inside week, so all is not lost yet.

If Granny is not enough, it will be partly because Transportation (IYT) is another one in a bearish phase. IYT is like rocket fuel for the gold space capsule. And, speaking of trading ranges, Sister Semiconductors (SMH) has pushed against the 155 area for weeks. It is also the same area SMH was just before the crash in February.

We would all love to hear some good news over the long weekend, such as that the number of new cases are falling, the death rate remains very low and the US government continues to want to help its people. Nonetheless, the Economic Modern Family looks poised to go either way - take out the top of the ranges for a wonderful start to next week...

Or...

Abandon hope of entering a golden space capsule and, instead, just be grateful that they own gold instead.

Happy 4th!

- S&P 500 (SPY): Rangebound 316-300

- Russell 2000 (IWM): 141 support, 146.50 resistance

- Dow (DIA): 250 support, 258.50 pivotal, 262.90 resistance

- Nasdaq (QQQ): You might want to make a bearish case, but not seeing it yet

- KRE (Regional Banks): Confirmed bear phase, but inside week

- SMH (Semiconductors): 155 resistance, 150 support

- IYT (Transportation): Inside day. 160.60 pivotal support, 170 resistance

- IBB (Biotechnology): 136-140 range now

- XRT (Retail): Could not close over 43.50, so watch carefully

- Volatility Index (VXX): 31.00 support and over 32.70 troubling

- Junk Bonds (JNK): 100 big support

- LQD (iShs iBoxx High-Yield Bonds): New highs - watch 134.90

Mish Schneider

MarketGauge.com

Director of Trading Research and Education