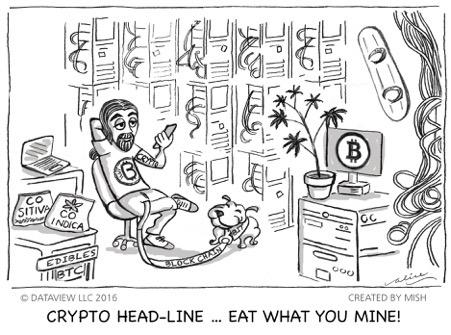

Today, Bitcoin (BTC) passed its record high as certain members of the Economic Moderns Family digest their recent gains.

Cryptocurrency as an alternative currency has pushed for widespread acceptance since the launch of the first Bitcoin in 2009. Even more so, it has become a movement for investors who see it as a place to park money long-term, with the idea that eventually it will become a highly used and accepted currency across the world. This idea has been reinforced by JPMorgan Chase (JPM), who is working to create a stable environment for crypto payments. Along with a growing number of supporting banks, institutional investors have also begun to buy crypto currency.

However, our newly adopted family member (BTC or GBTC), still hasn't lost its surprising amount of volatility, as he was trading briefly below 16,500 on Friday the 27th. High volatility has been a key reason institutional investors have stayed away from crypto, yet, as it becomes more accepted, it could also become more stable in its price movements, as today it made a quick recovery back to highs.

An article about the Winklevoss twins came out. You remember them - the ones that sued Zuckerberg for stealing their alleged IP. They predict $500,000 in Bitcoin.

Sometimes, you just got to go with it. But always - always - with a plan.

- S&P 500 (SPY): Needs to clear 364.38. 354.15 support

- Russell 2000 (IWM): Held support of the 10-DMA at 180.12

- Dow (DIA): Resistance 300; 289.19 key support

- Nasdaq (QQQ): 300 key to clear, with 293.81 support the 10-DMA

- KRE (Regional Banks): Next support 47.22.

- SMH (Semiconductors): Closed all-time high.

- IYT (Transportation): 225.49 resistance, with next support 215 if can't hold over the 10-DMA at 219.86

- IBB (Biotechnology): 146.53 high to clear

- XRT (Retail): Possible support from 10-DMA at 58.64. If can't hold, then watch for a move back to 56 area

Mish Schneider

MarketGauge.com

Director of Trading Research and Education

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Trading Research and Education