On Monday, the tech sector (SMH) and biotechnology sector (IBB) held as the other sectors of the Economic Modern Family failed to hold their gaps. Similarly to SMH, the only major index to close green today was the Nasdaq 100 (QQQ), which tends to have a high concentration of tech stocks.

In order for the market to ultimately reflect an economic rebound, tech stocks running helps, but we also need to see a continuation of what we saw earlier, a rise in the buying from the retail sector (XRT).

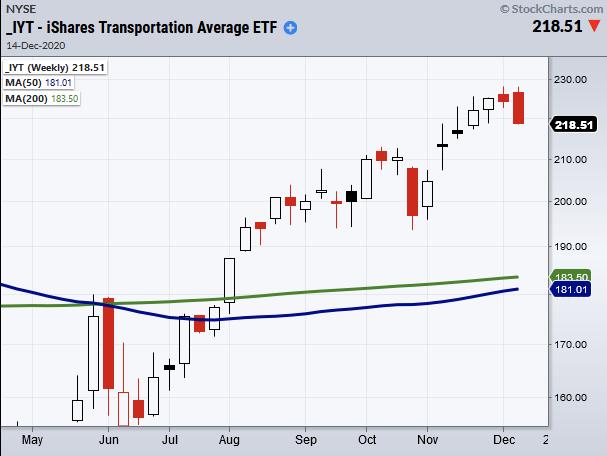

With that said, Transportation (IYT) closed down 2.5%. In fact, Monday's activity took out the last 2 weeks of price action.

Transportation's direct correlation to the retail space poses a problem for the retail sector if transportation continues lower. Transportation needs to hold up as it represents the "demand" side of the economy. This is especially important during the holiday season. Particularly noteworthy is the fact that many freight and truck carriers have said they are overloaded and deliveries could be delayed this season. Consumer sentiment is also lower this holiday season, as many families will spend much less than in recent years.

Furthermore, IYT has support from the highs of October and from the 50 day moving average at 212.45. This could end up being a pivotal level for transportation to hold or break.

This leads the market with two possibilities as we head to the end of this month. One is that the market throws a fit waiting for more money, as stimulus aid is set to expire for millions by the end of this year. The other is that we could see the market push higher as the hope for normalcy is fueled by vaccine shipments and emergency FDA approvals, as more companies release their version of the vaccine.

Of course the third possibility is that as we end the year with so many unknowns that the market consolidates, basically trading sideways. This would create a chopfest and a message that patience is required.

Watch the latest episode of StockCharts TV's Mish's Market Minute, where Mish dives into her favorite Oil and Energy stocks. Some of these stocks have made a run, but be sure to put them on your watch list!

- S&P 500 (SPY): 364 pivotal

- Russell 2000 (IWM): Watch 10-DMA to hold at 187.80; next support 180

- Dow (DIA): Needs to clear and hold 300

- Nasdaq (QQQ): 300 key support. 308.60 resistance.

- KRE (Regional Banks): Resistance 200-week moving average 52.69 to clear. Support 48.48

- SMH (Semiconductors): Would like to see this close over the 10-DMA at 215.53

- IYT (Transportation): Support 212.45 the 50-DMA

- IBB (Biotechnology): Support 150

- XRT (Retail): 59.24 support

Mish Schneider

MarketGauge.com

Director of Trading Research and Education

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Trading Research and Education