Mish's Market Minute October 29, 2021 at 07:21 PM

Next week, investors are expecting the Fed to announce a reduction in the monthly bond-buying program. Jerome Powell, the Fed chair, has previously stated that he's looking to keep the original tapering schedule... Read More

Mish's Market Minute October 27, 2021 at 07:34 PM

Both the tech-heavy Nasdaq 100 (QQQ) and the S&P 500 (SPY) sit near their recent breakout levels. This is a pivotal place for large-cap companies, as the small-cap Russell 2000 (IWM) has already given up almost two weeks of progress... Read More

Mish's Market Minute October 26, 2021 at 06:56 PM

Tuesday's market shows mixed price action amid positive earnings reports and a 14% increase in home sales for September. Focusing on the residential sector, many are looking for a top of the market, as home sales have skyrocketed since the pandemic began... Read More

Mish's Market Minute October 25, 2021 at 08:23 PM

The Consumer Staples ETF (XLP) is known to be an area of focus through market downturns, as it offers exposure to companies that are historically safety plays. Some of XLP's biggest holdings include companies such as Walmart, Pepsi, Colgate and more... Read More

Mish's Market Minute October 22, 2021 at 10:16 PM

Friday, the chair of the Federal Reserve –Jerome Powell spooked the market when he announced that the Fed would keep rates near zero and continue with its tapering schedule... Read More

Mish's Market Minute October 20, 2021 at 07:01 PM

Both the S&P 500 (SPY) and the Dow Jones (DIA) are poised to hit new highs, while the Nasdaq 100 (QQQ) and the small-cap index Russell 2000 (IWM) have a bit more territory to clear. The above chart shows pivotal areas to clear in each index (Black Line)... Read More

Mish's Market Minute October 19, 2021 at 06:24 PM

Netflix (NFLX) will report earnings after Tuesday's market close. Although previous earnings for the company have been dreary at best, with an average earnings surprise of less than half a percent for the past three quarters, investors are now looking for a major improvement... Read More

Mish's Market Minute October 18, 2021 at 07:46 PM

Earnings season has taken the stage for the next couple of weeks as the market steadies itself for another move higher. Of course, another push higher means that companies will need to outperform or show signs of continued growth into the fourth quarter... Read More

Mish's Market Minute October 15, 2021 at 06:50 PM

As seen on the above chart, two of the major indices, including the S&P 500 (SPY) and the Dow Jones (DIA) cleared prior resistance from their 50-day moving averages (DMA)... Read More

Mish's Market Minute October 13, 2021 at 06:29 PM

For the past year, the Fed has stuck to its guns on the idea that supply-chain disruptions are causing a short-term increase in inflation and that, in 2022, inflation will decrease towards their 2% target... Read More

Mish's Market Minute October 12, 2021 at 06:07 PM

On Monday, we talked about specific sectors weakening as they teetered on the edge of support from their major moving averages. The main three were Transportation (IYT), Retail (XRT) and Semiconductors (SMH)... Read More

Mish's Market Minute October 11, 2021 at 06:42 PM

On Monday, the major indices attempted a reversal of Friday's price action but failed. This created another late-day selloff... Read More

Mish's Market Minute October 08, 2021 at 07:02 PM

The recent jobs report came in less than expected, with analysts' estimates running anywhere from 250,000 to 500,000 new jobs created. Disappointingly, employers added only 194,000 jobs in September... Read More

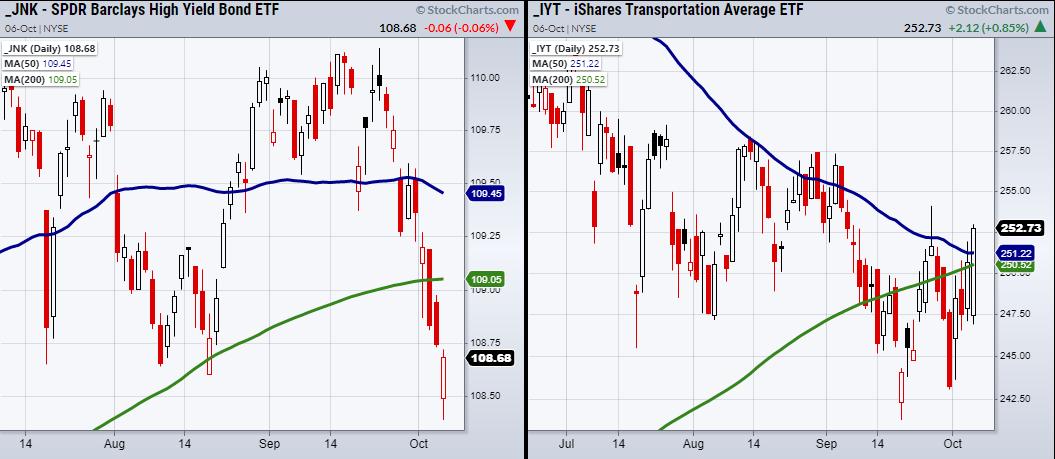

Mish's Market Minute October 06, 2021 at 05:43 PM

On Tuesday, we talked about the 6-month calendar range as a support level to hold in both the S&P 500 (SPY) and the Nasdaq 100 (QQQ). On Wednesday, both indices were able to hold support from their calendar range lows around $427 (for the SPY) and $352 (for the QQQ)... Read More

Mish's Market Minute October 05, 2021 at 06:11 PM

Calendar ranges have been used for a long time in charting as important levels to clear or break down from. Investors can view price as bullish when over the range and bearish when trading under... Read More

Mish's Market Minute October 04, 2021 at 08:53 PM

While the major indices continue to weaken, U.S factories have seen a 1.2% increase in orders in August. This shows that although equities are struggling, the demand for goods is steady... Read More

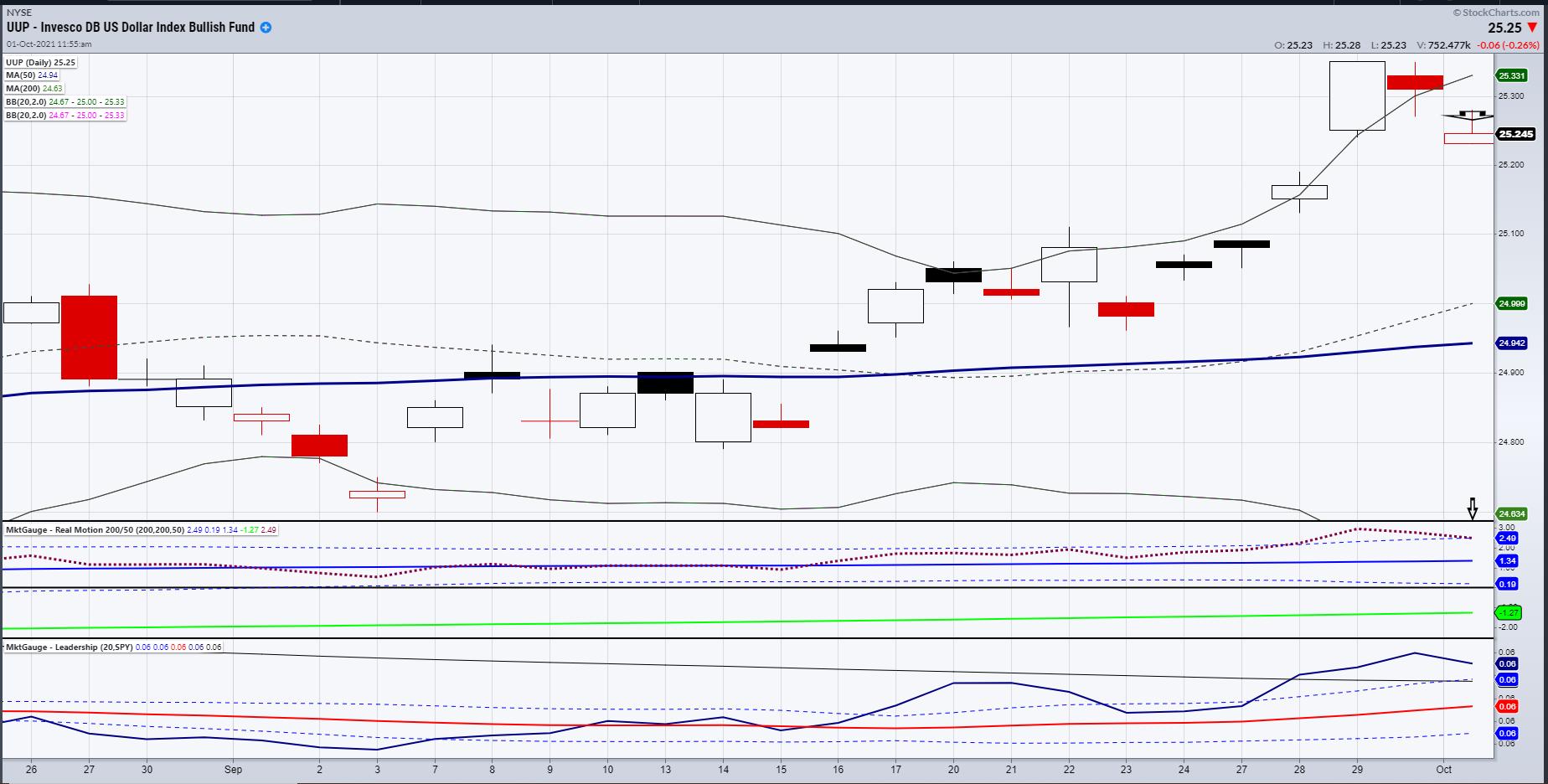

Mish's Market Minute October 01, 2021 at 06:30 PM

The U.S. Dollar chart, as represented by the Invesco DB US Dollar ETF (UUP), shows some classic signs of a top. Before I delve deeper into the technicals though, let's look at the fundamental reasons for the dollar rally last week... Read More