In today's economy, investing in assets that will hold their value to or near the rate of inflation is more important than ever. These types of investments offer protection from inflation and can provide a hedge against other economic downturns.

You don't have to be a financial expert to know that stocks and bonds are down double digits this year, and inflation is at record highs not seen since November 1981. However, it would help if you had some expertise in investing in volatile commodities, in terms of timing, position sizing and risk management. In this article, I thought I would recap a few of the alternative assets highlighted in my daily over the last few weeks.

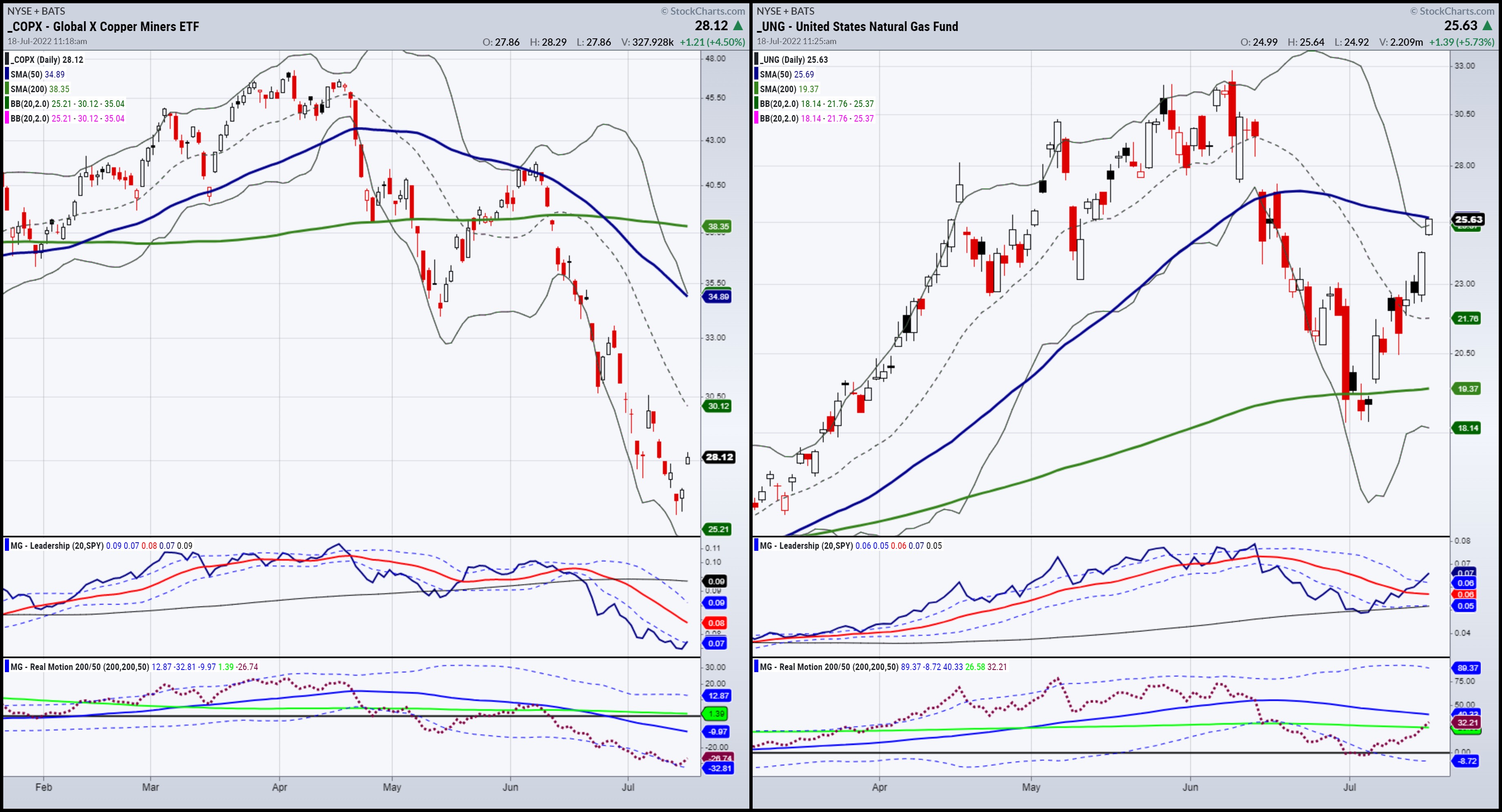

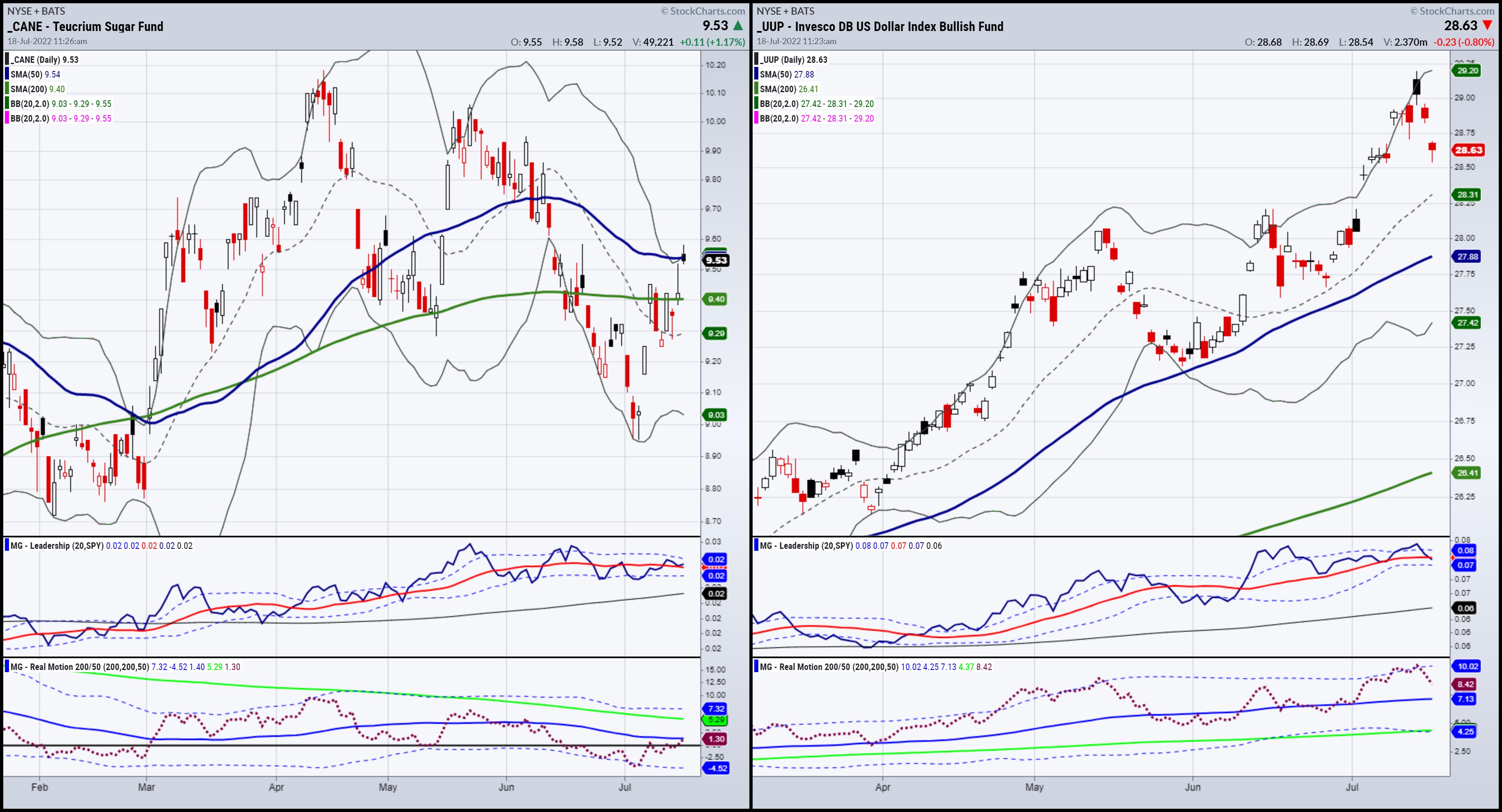

I previously wrote about higher natural gas prices, the upside in the sugar market, and the benefits of real assets in a stagflationary environment. I also wrote about the U.S. dollar's strength and potential decline.

Commodities have been volatile in recent months, but the overall trend has been higher. The euro, as a result of their energy crisis, has been under pressure recently. Investors are flocking to the dollar as Europe braces for a bigger energy crisis in the Fall. Natural gas prices are projected to rise much further. Given these clues about stagflation, it makes sense to overweight real assets relative to bonds in your portfolio.

There is no doubt that natural resources are in high demand around the globe. Prices for commodities like sugar, natural gas and copper have risen sharply and fallen back in recent weeks. We are bullish on copper long-term as we understand that the world is electrifying, and the tight market fundamentals support much higher copper prices. Furthermore, we will be paying close attention to the guidance given by companies in the energy, materials and industrial sectors.

Many pundits are calling for deflationary shocks and do not understand that commodities will skyrocket in stagflation and in war time. Commodity prices, on balance, should regain their uptrend shortly if we look at historical price volatility as a gauge.

Please follow my blog for more market insights and profitable trade ideas.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

In this special edition of StockCharts TV's Mish's Market Minute, Mish covers two price levels that may well illustrate what's to come during the second half of the year.

See Mish's most recent appearance on Neil Cavuto's Coast to Coast on Fox Business!

ETF Summary

- S&P 500 (SPY): 372-390 trading range; we are in one.

- Russell 2000 (IWM): 170 support must hold 176.50 resistance.

- Dow (DIA): 307 support and needs to clear 315.

- Nasdaq (QQQ): Looking heavy unless it clears 297.

- KRE (Regional Banks): 56 the 200-WMA; 60 resistance.

- SMH (Semiconductors): 200 support, 220 resistance.

- IYT (Transportation): 211.90 support with resistance at 220.

- IBB (Biotechnology): 129.50 resistance, 117 support

- XRT (Retail): 60.75, the 200-WMA, now support.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education