Mish's Market Minute September 30, 2022 at 07:29 PM

It is crucial to prepare for adjustments in Fed policy and the credit markets, and adjust your trading accordingly, given the persistence of high inflation. As seen above, The Fed-preferred inflation gauge (core PCE) remained elevated at 4... Read More

Mish's Market Minute September 28, 2022 at 07:08 PM

As we prepare to move into October, I wanted to take a moment to highlight some of my recent daily columns from September. On September 13, I wrote a Daily titled "Why Higher Inflation Matters and Transportation is Key"... Read More

Mish's Market Minute September 27, 2022 at 05:26 PM

As the selloff continues, our Big View service Risk Gauge has been bearish for weeks, signaling risk off. Most of our portfolio strategies hold more than 50% cash, some are short, and my discretionary service is looking to deploy capital soon... Read More

Mish's Market Minute September 26, 2022 at 07:06 PM

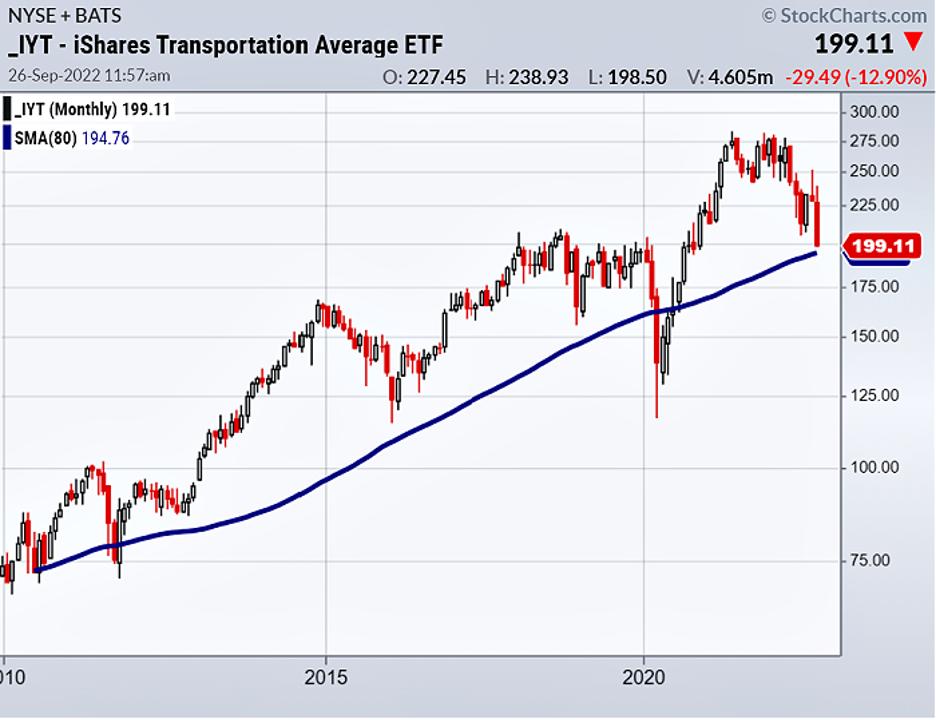

Last Friday, I spoke on Women of Wall Street Twitter Spaces and Fox Business's Making Money with Charles Payne to talk about a key monthly moving average. What makes this moving average so important right now is that three of the Economic Modern Family members are testing it... Read More

Mish's Market Minute September 23, 2022 at 07:37 PM

The market has turned for the worst in recent weeks and continues to fall in a bear market fashion. Most of our portfolio strategies are holding more than 50% cash, some are utilizing inverse ETFs, and in my discretionary trading service, we are largely in cash... Read More

Mish's Market Minute September 21, 2022 at 07:17 PM

The FedEx news has caused many analysts to worry about the transportation sector and the potential ripple effects this could have on the rest of the market. As we have written before, transportation sector is seen as a barometer of economic activity... Read More

Mish's Market Minute September 20, 2022 at 07:50 PM

With the Fed about to announce its next interest rate change, it's a good time to check out the condition of gold (GLD)... Read More

Mish's Market Minute September 19, 2022 at 07:35 PM

On Wednesday, the Federal Reserve is anticipated to raise interest rates by 75 basis points. How will the rate increase affect your portfolio? Depending on your investment holdings, the interest rate increase could have a significant impact... Read More

Mish's Market Minute September 18, 2022 at 11:17 PM

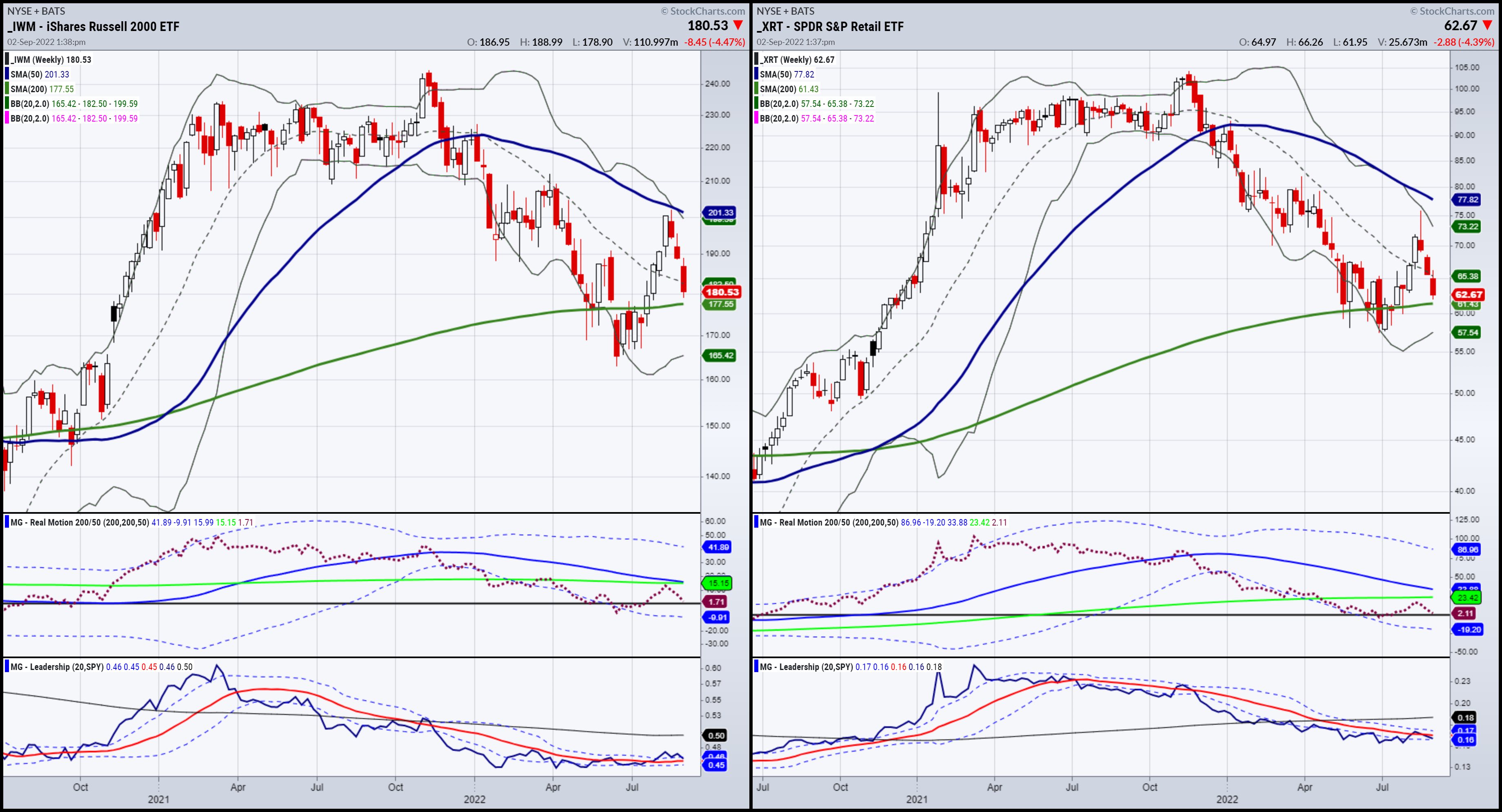

The market took another turn for the worse this past week, with four weeks in a row in the red and the DOW futures dropping, testing significant support from the summer. With the upcoming Fed meeting and higher rates coming to control inflation, we are watching a few themes... Read More

Mish's Market Minute September 14, 2022 at 05:35 PM

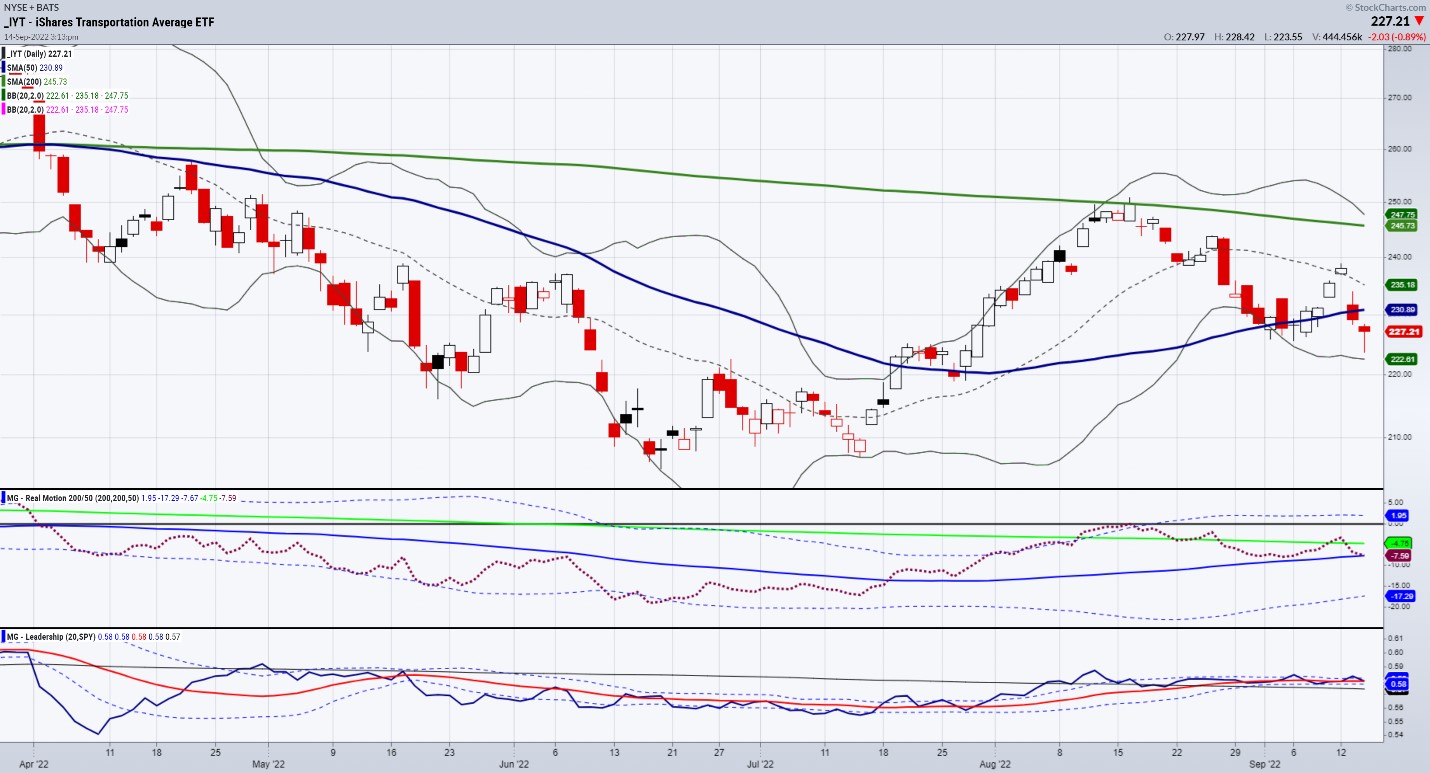

After Tuesday's stock market rout, the outperforming sector transportation (IYT) struggled on Wednesday. Although our other indicator we have been writing about, junk bonds (JNK), led the rally in the indices, IYT did not follow... Read More

Mish's Market Minute September 13, 2022 at 05:55 PM

After a higher-than-anticipated CPI report, the major market averages traded much lower. August's CPI came in increased by 20 basis points. Fed Futures are now pricing in a 20% chance of a 100-basis point hike and an 80% chance of a 75-basis point hike... Read More

Mish's Market Minute September 12, 2022 at 05:25 PM

The S&P 500 was sharply oversold last week according to Our Big View weekly analysis. Hence, the market bounced and cleared the 50-day moving average in all indices. The macro backdrop for the financial system remains the same... Read More

Mish's Market Minute September 09, 2022 at 07:11 PM

Reserve Chairman Jerome Powell's speech this past week cautioned against prematurely loosening monetary policy. Powell's speech reminds us that the Fed is focused on keeping inflation under control. Nonetheless, what we also learned this week is that technical matter... Read More

Mish's Market Minute September 07, 2022 at 07:22 PM

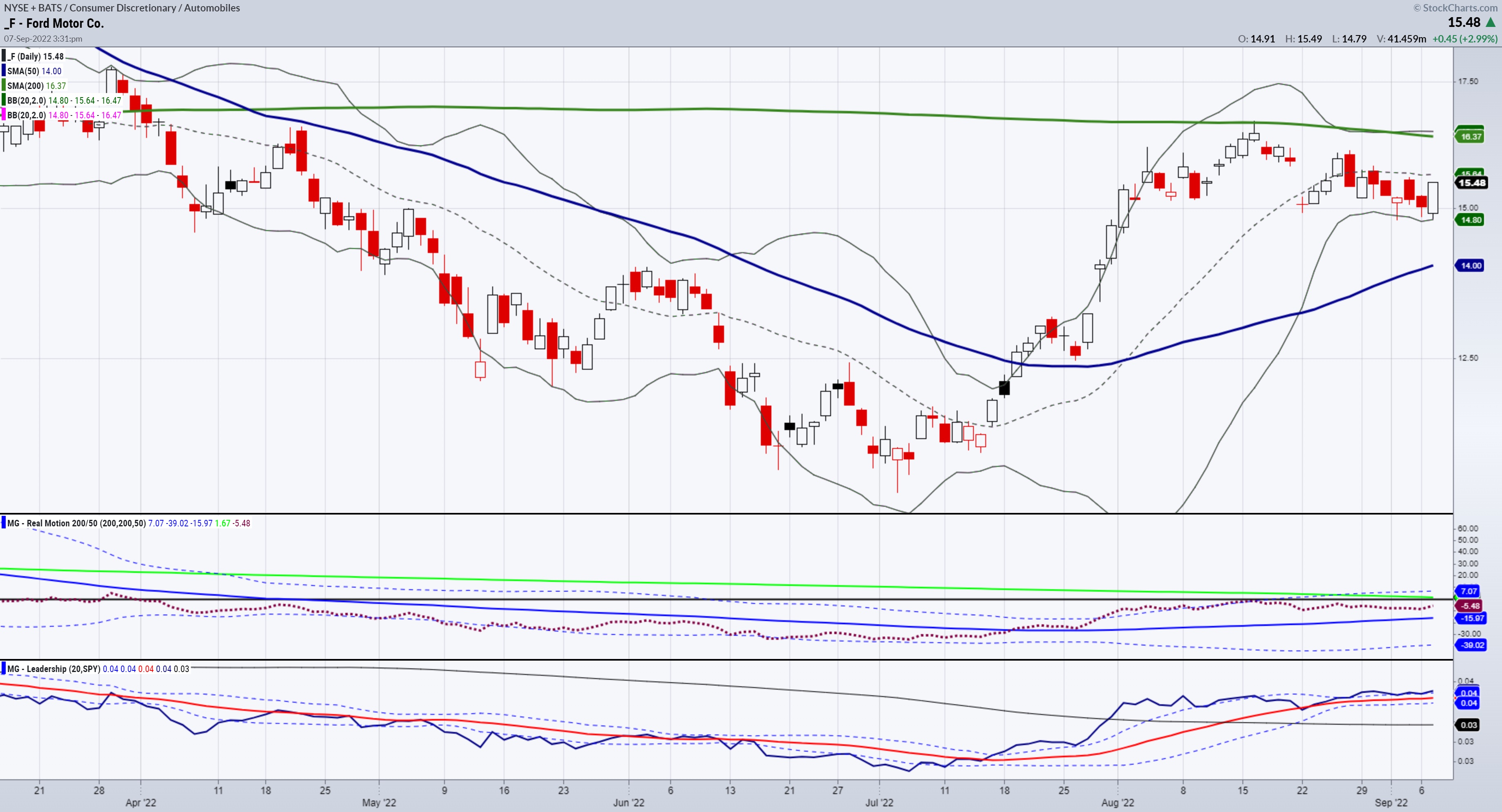

The Biden administration declared an intermediate target in August 2021 that 50% of all new automobiles would be electrified by 2030... Read More

Mish's Market Minute September 06, 2022 at 05:02 PM

Semiconductors have been a significant drag on Wall Street. Sister Semiconductors (SMH) needs to regain her -50week moving average to really see a major technical shift in the market. She is a good barometer of the overall direction of the stock market... Read More

Mish's Market Minute September 02, 2022 at 07:18 PM

Hello friends, Labor Day is approaching, and the market is closed in observation, so it's time for some fantastic fun, entertainment for everyone, and relaxation... Read More