Mish's Market Minute February 27, 2023 at 06:25 PM

The week is starting out exactly how we expect. The SPY and indices stuck in the trading range within a trading range. The latest economic data weak, hence causing buyers to return to the market, figuring bad news is good news... Read More

Mish's Market Minute February 26, 2023 at 07:00 AM

After the CORE PCE numbers came out on Friday, the market had the expected reaction of selling off in anticipation of a more aggressive Fed. We find the reaction less than surprising... Read More

Mish's Market Minute February 23, 2023 at 06:30 PM

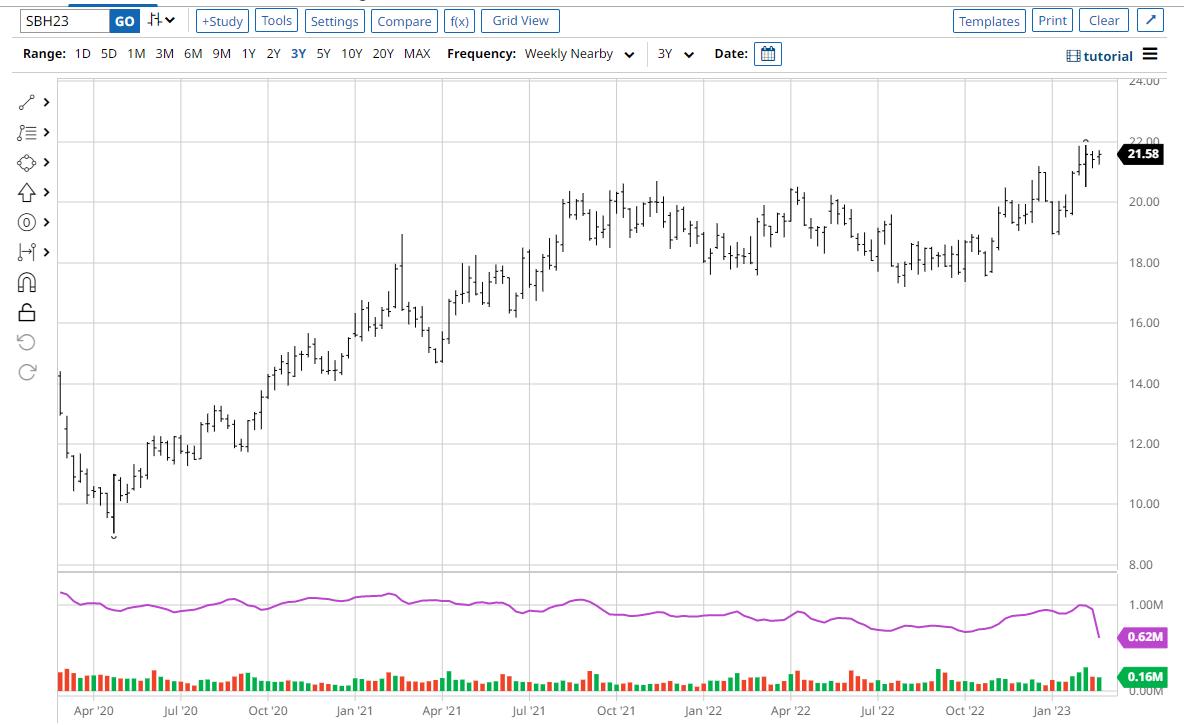

What if sugar futures are really onto something? What if they are relaying food shortages? More social disruption? The Start of Russian hoarding? Which leads to Geopolitical hell? And all the inflation theories that could still develop are staring us right in the face? In the fac... Read More

Mish's Market Minute February 22, 2023 at 06:20 PM

The above chart is from our MarketGauge product called Big View. Risk Sentiment Coming into the FOMC, the sentiment for risk is neutral. A week ago sentiment was 100% bullish. A month ago, it was neutral leaning towards bearish... Read More

Mish's Market Minute February 21, 2023 at 07:33 PM

Akamai Technologies (AKAM) is a cloud computing company in the tech sector that deals with online security. Up until mid-2022, the trend was up. Then, with the hawkish Fed, the trend changed, with AKAM eventually breaking the 23-month or two-year business cycle in May 2022... Read More

Mish's Market Minute February 18, 2023 at 08:39 PM

This coming week is a big one. We have FOMC on tap, with some Fed members calling for .50 bps rate hike on the heels of the hot Producer Price Index and inflation... Read More

Mish's Market Minute February 15, 2023 at 07:26 PM

Wednesday morning brought some love to the US economy. The January retail sales rose 3% month/month vs. +2% estimated. The breakdown fascinates. With food inflation where it is, and egg prices the big headline, the leader for today's number is FOOD, particularly eating out... Read More

Mish's Market Minute February 14, 2023 at 07:09 PM

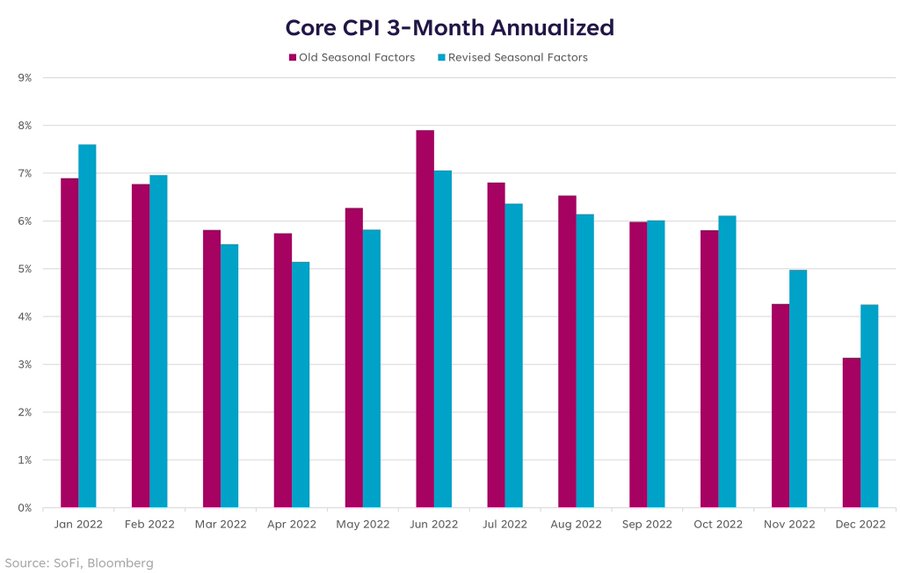

Maybe it's just Valentine's Day, so the food and commodities market sees a push to chocolates, flowers, and fine dining. And maybe not. The consumer price index (CPI) came out with an unexpected rise... but goods remained softer. Services, on the other hand, rose... Read More

Mish's Market Minute February 13, 2023 at 06:19 PM

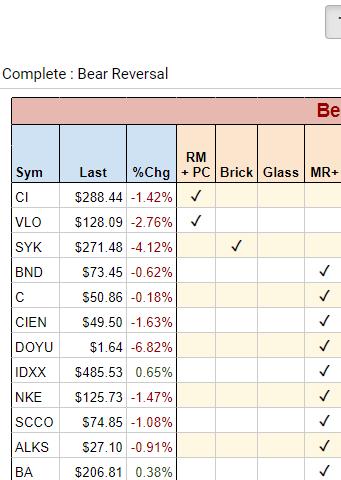

All in all, the key sectors (retail, transportation) have more to prove, especially by clearing the 23-month moving average or 2-year business cycle... Read More

Mish's Market Minute February 10, 2023 at 05:23 PM

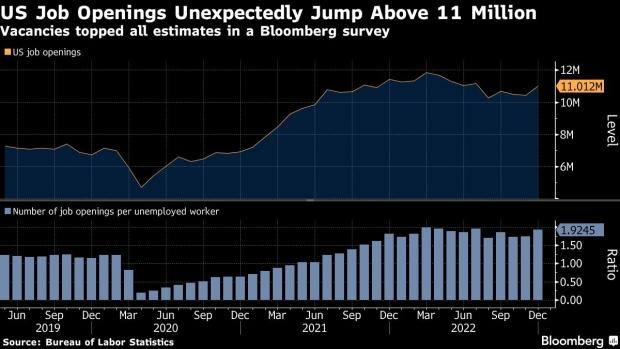

This is not meant to be political. As we have written many times, politics and investing should not be in the same sentence... Read More

Mish's Market Minute February 08, 2023 at 05:55 PM

This week, we have featured the 23-month moving average, or two-year business cycle, and its significance to the indices. In particular, when speaking about the S&P 500 index, we wrote: There was a bullish run in 2021 based on easy money. Inflation ran hotter than most expected... Read More

Mish's Market Minute February 07, 2023 at 11:47 PM

Some of you might have already heard us speak about the monthly moving averages or have read our commentary about their significance. On Monday, we asked, "What if the trading range top at 4200 we have been calling for in the S&P 500 turns out to be..... Read More

Mish's Market Minute February 06, 2023 at 07:10 PM

What if the trading range top at 4200 we have been calling for in the S&P 500 turns out to be..... Read More

Mish's Market Minute February 03, 2023 at 08:33 PM

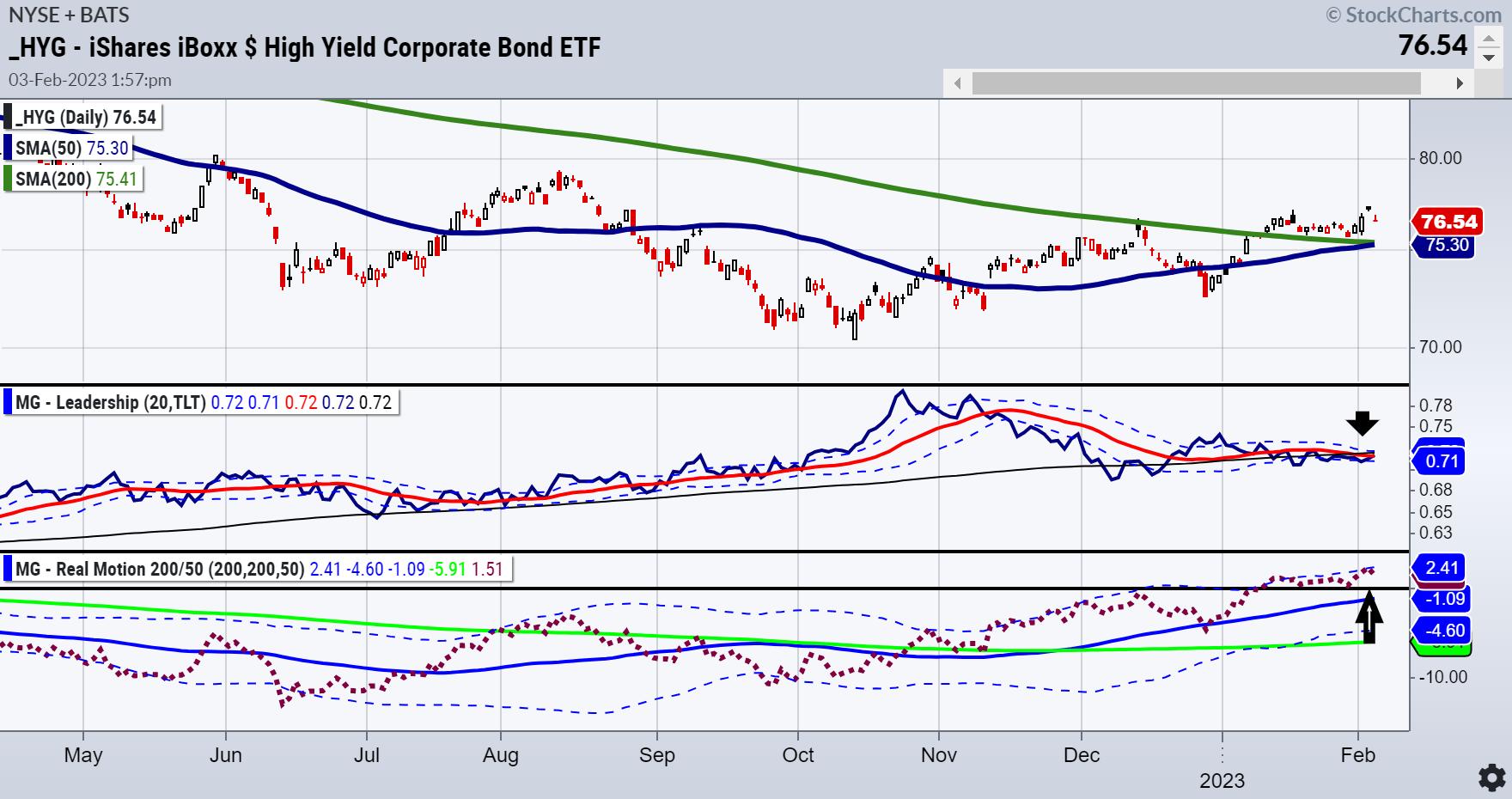

If you are having a hard time figuring out the market's next moves, start by thinking about trading range. The 2023 Outlook spells out reasons for a 1000-point trading range potential in the SPY from 3200-4200... Read More

Mish's Market Minute February 01, 2023 at 05:51 PM

By the time you read this, the buzz of what the Fed did and Powell's presser will be over... at least for the day. We will not repeat the obvious... Read More