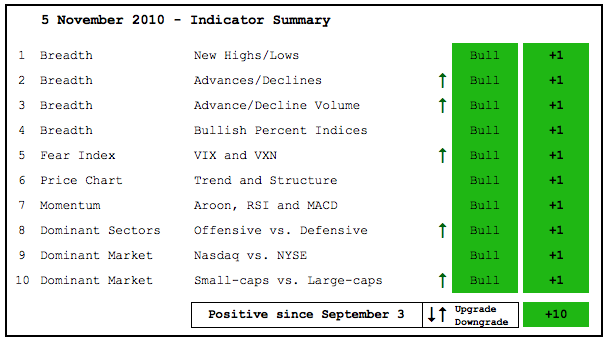

That certainly did not take long. Five indicators were downgraded from bullish to neutral last Friday. These indicators did not break down to warrant a bearish stance, but I downgraded them to neutral because they were not confirming the new highs seen in the major indices. That changed this week. The Nasdaq AD Line and the NYSE AD Volume Line both surged to record new highs for the move. The Volatility Indices turned down and broke to new lows. The finance sector snapped out of its funk and broke above its summer highs. And finally, the $RUT:$OEX ratio held support and broke above its October highs. With these five indicators turning bullish again, the indicator summary is once again at +10. This week marks the two month point for a positive indicator summary. While there are no signs of weakness, stocks have become the most overbought since April 2010. More on that in Friday's Market Message and video.

- AD Lines: Bullish. The Nasdaq AD Line broke above its October highs to record a new high for the move. The NYSE AD Line remains in an uptrend and recorded a new 52-week high.

- AD Volume Lines: Bullish. The Nasdaq and NYSE AD Volume Lines surged to new highs for the move.

- Net New Highs: Bullish. Nasdaq and NYSE Net New Highs surged to their highest levels since April.

- Bullish Percent Indices: Bullish. All Bullish Percent Indices are above 50%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) closed at new closing lows for the move to affirm their downtrends. Even though long-term support is at hand, falling and low volatility is positive for stocks.

- Trend Structure: Bullish. QQQQ, SPY, DIA and IWM all forged new highs for the current move.

- SPY Momentum: Bullish. MACD(5,35,5) and Aroon (20) moved into positive territory the second week of September and RSI surged above 60.

- Offensive Sector Performance: Bullish. The finance sector came to life this week with a break above its summer highs. The consumer discretionary and technology sectors were already leading the market higher.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio turned down as the finance sector lifted the NY Composite this week, but the ratio remains in an uptrend overall.

- Small-cap Performance: Bullish. The $RUT:$OEX ratio held support and broke above its October highs.

- Breadth Charts have been updated (click here)

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure. With 10 indicator groups, the medium-term evidence is unlikely to change drastically overnight. Previous turns include: Positive on 11-Sept. Negative on 5-February. Positive on 5-March. Negative on 11-June. Positive on 18-June. Negative on 24-June. Positive on August 6. Negative on August 13. Positive on September 3.