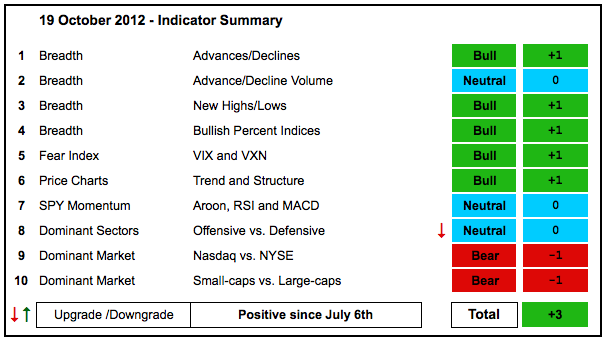

The indicator summary weakened a little big more because I downgraded SPY momentum to neutral. The market is clearly split with relative weakness in the technology weighing on the Nasdaq and relative strength in the finance sector helping the NYSE. In fact, the NYSE AD Line hit a new all time high this week. This is countered by a big bearish divergence in the Nasdaq AD Volume Line and breakdown last week. The consumer discretionary sector probably holds the key. XLY is currently performing in line and holding its uptrend. A breakdown in this key sector would most likely tilt the evidence to the bears.

- AD Lines: Bullish. The Nasdaq AD Line fell back sharply the last four weeks, but remains in an uptrend that started in early June. The NYSE AD Line hit a new high this week and remains in a strong uptrend.

- AD Volume Lines: Neutral. The Nasdaq AD Volume Line formed a large bearish divergence and broke support with a sharp decline the last four weeks. The NYSE AD Volume Line hit resistance from its spring high and pulled back the last four weeks, but remains in an uptrend since early June.

- Net New Highs: Bullish. Nasdaq Net New Highs dipped into negative territory last week, but turned positive again this week and the cumulative line remains above its 10-day EMA. NYSE Net New Highs fell sharply, but remain positive.

- Bullish Percent Indices: Bullish. Eight of the nine sector BPIs remain above 70%. The Technology Bullish% Index ($BPINFO) is the "least strong" with a 63.29% reading.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) and the Nasdaq 100 Volatility Index ($VXN) bounced near the 15% level in mid August and mid September, but did not break resistance and remain in downtrends overall. A break above the 4-Sep high is needed to reverse this downtrend and signal an uptrend in fear, which would stoke selling pressure.

- Trend-Structure: Bullish. DIA, IWM, MDY, QQQ and SPY recorded 52-week highs in September and then moved into corrective mode over the last five weeks. The five week downtrend in IWM/QQQ and consolidation in SPY/DIA is viewed as a correction within a bigger uptrend.

- SPY Momentum: Neutral. RSI and MACD(5,35,5) peaked in mid September, but has yet to break down. Look for RSI to break 40 and MACD(5,35,5) to break 0. Aroon (20), however, did break down with a plunge below -50 late last week.

- Offensive Sector Performance: Neutral. Relative weakness in XLK is offset by relative strength in XLF. XLI and XLY are performing in line.

- Nasdaq Performance: Bearish. The $COMPQ:$NYA ratio broke below the April-July lows and remains in a downtrend as the Nasdaq underperforms the NY Composite. This shows an aversion for high-beta stocks.

- Small-cap Performance: Bearish. The $RUT:$OEX turned down in mid September and remains in a bigger downtrend since February.

- Breadth Charts (here) and Inter-market charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure. With 10 indicator groups, the medium-term evidence is unlikely to change drastically overnight.

Previous turns include:

Positive on 6-July-12

Negative on 18-May-12

Positive on 30-December-11

Negative on 16-December-11

Positive on 3-December-11

Negative on 23-November-11

Positive on 28-October-11

Negative on 5-August-11

Neutral on 29-Jul-11

Positive on 30-Jun-11

Negative on 17-Jun-11

Positive on 25-Mar-11

Negative on 18-Mar-11

Positive on 3-Sep-10

Negative on 13-Aug-10

Positive on 6-Aug-10

Negative on 24-Jun-10

Positive on 18-Jun-10

Negative on 11-Jun-10

Positive on 5-March-10

Negative on 5-Feb-10

Positive on 11-Sept-09