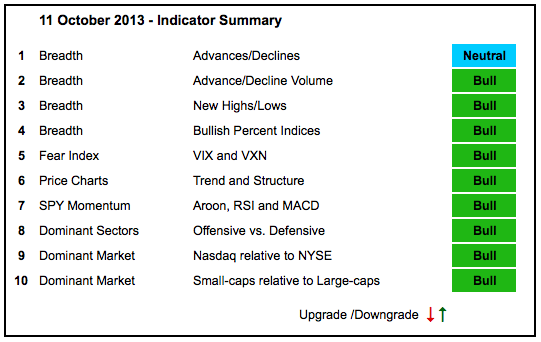

Stocks pulled back in early October, but the long-term uptrends were never in jeopardy and the indicator summary stayed green the entire time. Net New Highs for the Nasdaq and NYSE dipped to the zero line earlier this week, but bounced with Thursday's stock market surge. The trends remain up because the major index ETFs recorded new highs in Sept-Oct and the pullbacks were not deep enough to even challenge long-term support.

- AD Lines: Neutral. The Nasdaq AD Line hit a new high at the beginning of October, but the NYSE AD Line has yet to exceed its May or July highs and has a bearish divergence working.

- AD Volume Lines: Bullish. The Nasdaq and NYSE AD Volume Lines hit new highs in September and then pulled back in October. The long-term trends are clearly up and these pullbacks are corrective for now.

- Net New Highs: Bullish. Net New Highs fell back to the zero lines earlier this week and surged with Thursday's big advance.

- Bullish Percent Indices: Bullish. All nine sector Bullish Percent Indices are above 50%.

- VIX/VXN: Bullish. The S&P 500 Volatility Index ($VIX) surged to the upper end of its 2013 range and fell back on Thursday. The Nasdaq 100 Volatility Index ($VXN) surged to its highest level of the year and then fell back. Overall, fear remains range bound and we have yet to see a breakout.

- Trend-Structure: Bullish. DIA and SPY hit new highs in September. MDY, QQQ and IWM hit new highs this week. All five pulled back in October and then surged on Thursday. Only DIA tested its August low. The other four formed higher lows to keep the long-term uptrends alive.

- SPY Momentum: Bullish. RSI bounced off the 40-50 zone. MACD (5,35,5) turned up near the zero line. The Aroon Oscillator, however, remains below -50.

- Offensive Sector Performance: Bullish. XLI, XLK and XLY recorded new highs in September. XLF is lagging because it has yet to exceed its August high.

- Nasdaq Performance: Bullish. The $COMPQ:$NYA ratio moved to a new high in early October and remains in an uptrend as the Nasdaq outperforms the NY Composite.

- Small-cap Performance: Bullish. The $RUT:$OEX ratio surged to a new high in early October and remains in a strong uptrend as small-caps continue to outperform large-caps.

- Breadth charts (here) and intermarket charts (here) have been updated.

This table is designed to offer an objective look at current market conditions. It does not aim to pick tops or bottoms. Instead, it seeks to identify noticeable shifts in buying and selling pressure.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.