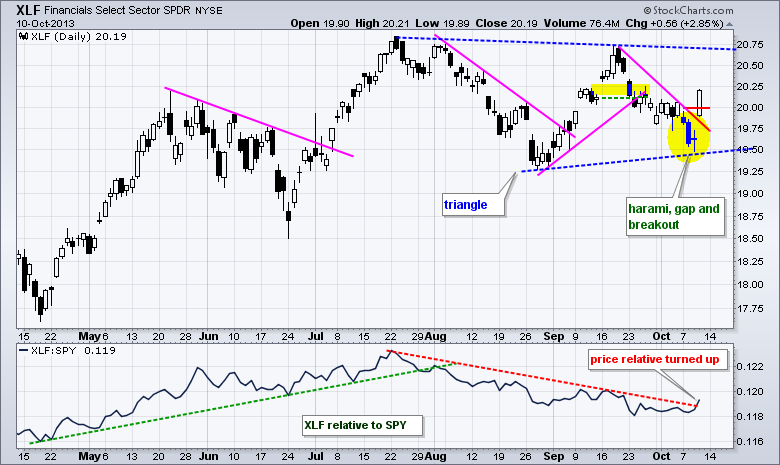

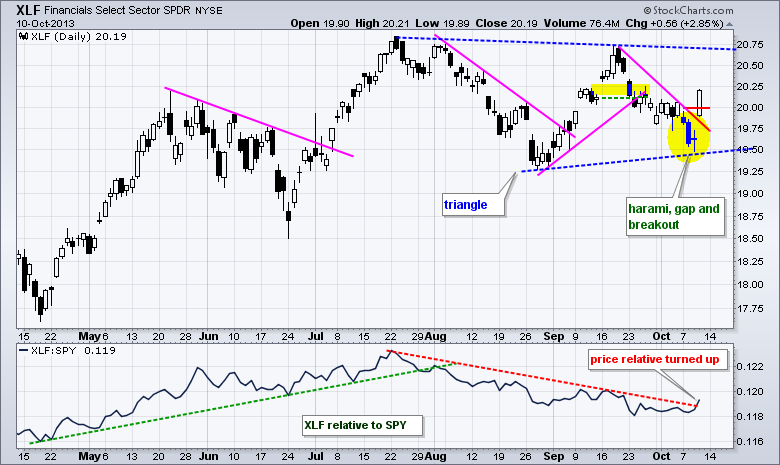

Stocks surged on hopes of a deal in Washington. Is this hope justified or will we be back at a stalemate in a few days? Should traders fade the rally or does this rally have legs? Personally, I think this rally is based on short covering and there is little evidence of a substantial deal that would end the shut down and raise the debt ceiling for more than a few months. I don't think we will default though and the odds still favor some sort of deal by October 17th. If you need to watch some fundamentals, take a look at earnings season, which kicked off this weak. Of note, JP Morgan and Wells Fargo will be reporting today and this will set the tone for the Finance SPDR (XLF), which has been lagging the broader market since July. Short-term, XLF gapped up and surged above resistance at 20 with a big move. This reverses the short-term downtrend and even puts in a higher low because XLF held above the August low. A strong breakout should hold and a move back below 19.75 would negate this move.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

No government reports during the shutdown

Fri - Oct 11 - 08:30 - Retail Sales

Fri - Oct 11 - 08:30 - Producer Price Index (PPI)

Fri - Oct 11 - 09:55 - Michigan Sentiment

Fri - Oct 11 - 10:00 - Business Inventories

Thu - Oct 17 - 23:59 - Debt Ceiling Deadline

Thu - Oct 24 - 09:00 - Government Runs out of Money (estimate)

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More