Art's Charts October 31, 2014 at 04:55 AM

The major index ETFs notched another gain with the Dow Diamonds (DIA) leading the way (+1.30%). The gains in the other major index ETFs were, however, modest. Stock futures are pointing sharply higher after the Bank of Japan announced another round of quantitative easing... Read More

Art's Charts October 30, 2014 at 08:41 AM

Stocks turned mixed as the Fed nixed quantitative easing. While I do not think this is the reason for mixed trading, the end of QE provides a good excuse for a rest. Stocks went on a tear the last two weeks and the market is entitled to a breather at this time... Read More

Art's Charts October 29, 2014 at 06:32 AM

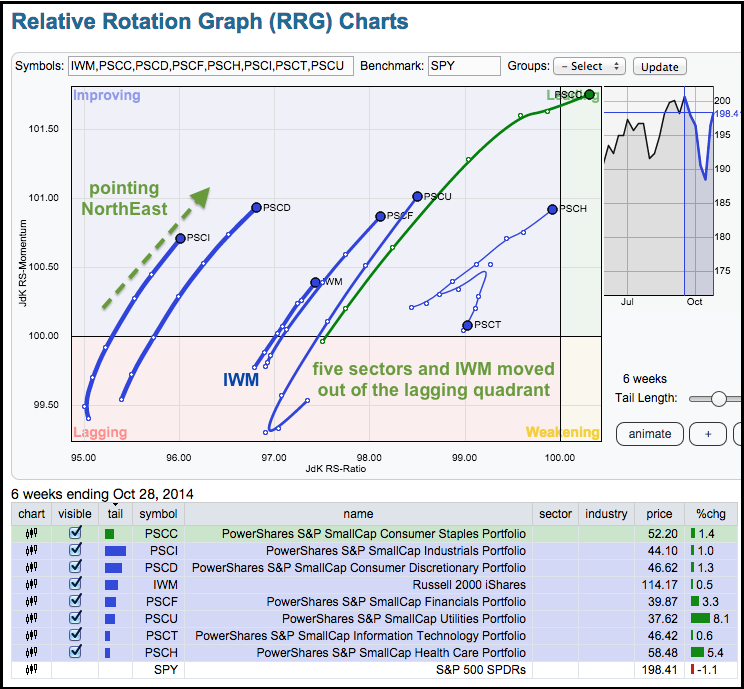

Stocks moved higher again on Tuesday with small-caps and micro-caps leading the charge. The Russell 2000 iShares gained 2.85% and the Russell MicroCap iShares was up over 3%. Keep in mind that it only takes a small rotation to move the needle for small-caps... Read More

Art's Charts October 28, 2014 at 07:14 AM

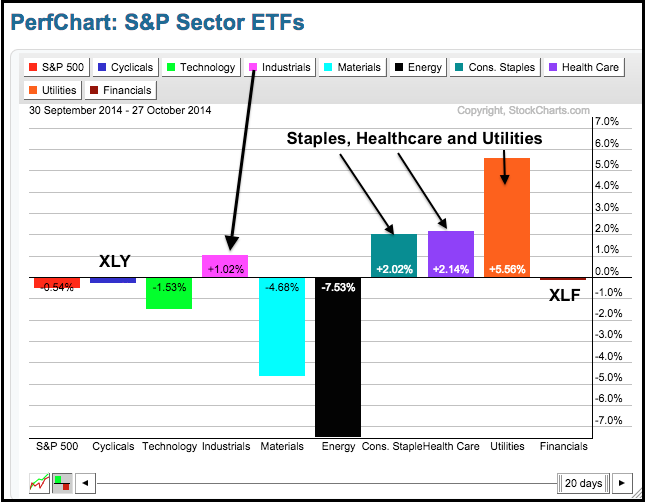

Stocks dipped in early trading as selling pressure hit, but firmed and moved higher in the afternoon. DIA and QQQ closed with fractional gains, while IWM and SPY closed with fractional losses. The sectors were mixed with five up and four days. Energy and materials were slammed... Read More

Art's Charts October 27, 2014 at 06:01 AM

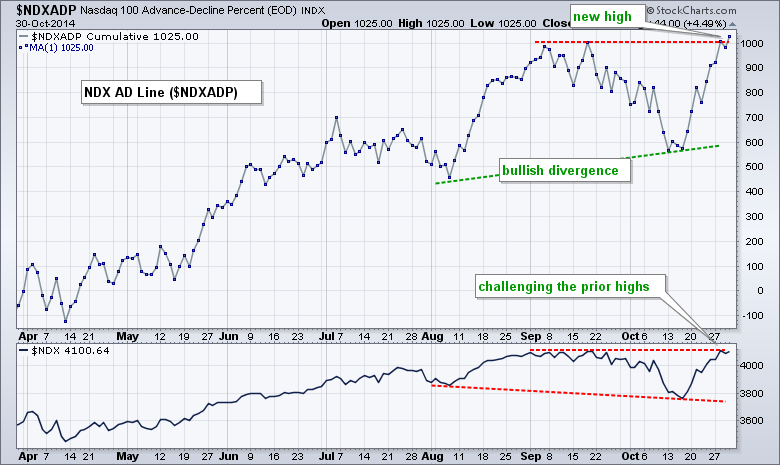

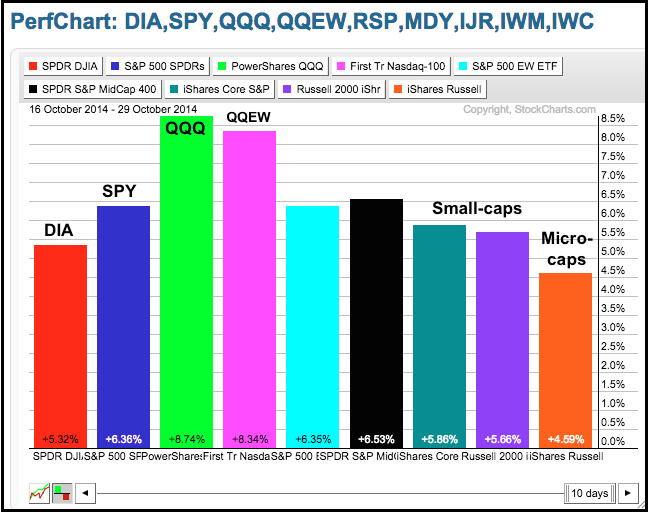

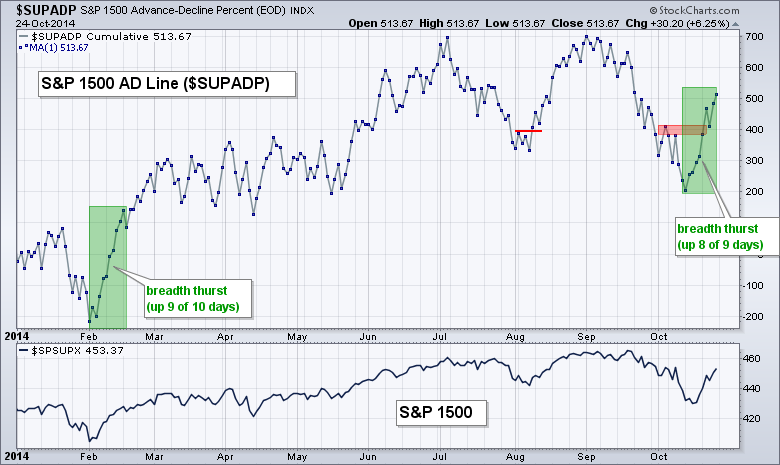

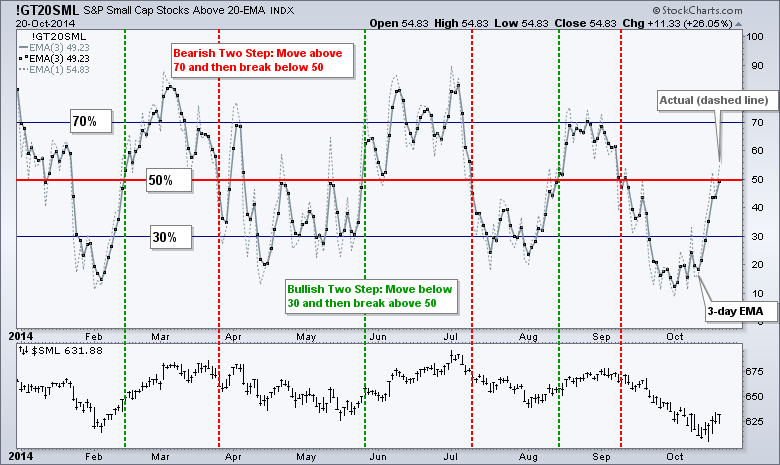

It was another strong week for stocks as the market put in another broad-based rally. Month-to-date, SPY and QQQ are still slightly lower, but IWM is up around 1.5% for October. This suggests that small-caps are showing some upside leadership as we head into November-December... Read More

Art's Charts October 24, 2014 at 05:52 AM

Stocks put in another bullish performance on Thursday with small-caps leading the way. The Russell 2000 Growth iShares (IWO) led the style ETFs with a 2.11% gain. Seven of the nine sectors were up with industrials leading... Read More

Art's Charts October 23, 2014 at 05:38 AM

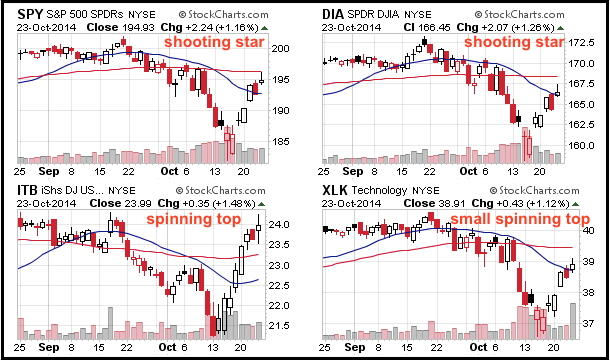

Stocks came under selling pressure on Wednesday with small-caps and micro-caps leading the way lower. These two led the rebound, but this upside leadership faded over the last five days. Seven of the nine sector SPDRs were down with industrials and energy leading the way... Read More

Art's Charts October 22, 2014 at 05:26 AM

Stocks surged with broad strength that lifted all boats (except gold miners). Several of the major index ETFs surged over 2%. All nine sector SPDRs were higher, all nine equal-weight sector ETFs were up on the day and all nine small-cap sector ETFs were up... Read More

Art's Charts October 21, 2014 at 05:50 AM

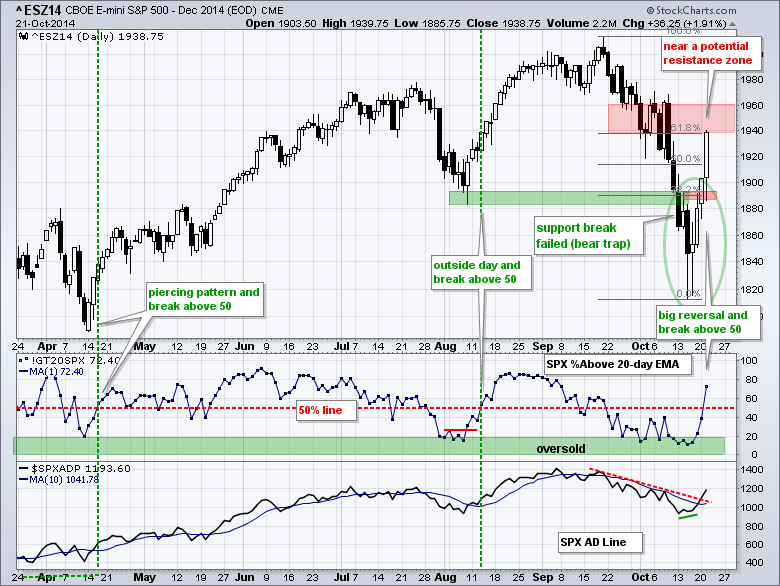

Given the IBM miss, I was pretty impressed with market action on Monday. The Dow Diamonds (DIA) had every reason to fill its gap after a weak open, but immediately firmed and closed near the high of the day (and positive for the day)... Read More

Art's Charts October 20, 2014 at 06:21 AM

Stocks followed up on Thursday's reversal day with a gap up on Friday. Afternoon selling pressure pushed small-caps and micro-caps into negative territory by the close, but the rest of the major index ETFs closed positive... Read More

Art's Charts October 17, 2014 at 04:09 AM

It was another volatile day for stocks and the major index ETFs finished mixed. Once again, the Russell 2000 iShares and Russell MicroCap iShares led the way higher with 1+ percent gains. Energy led the sectors higher and got a nice oversold bounce... Read More

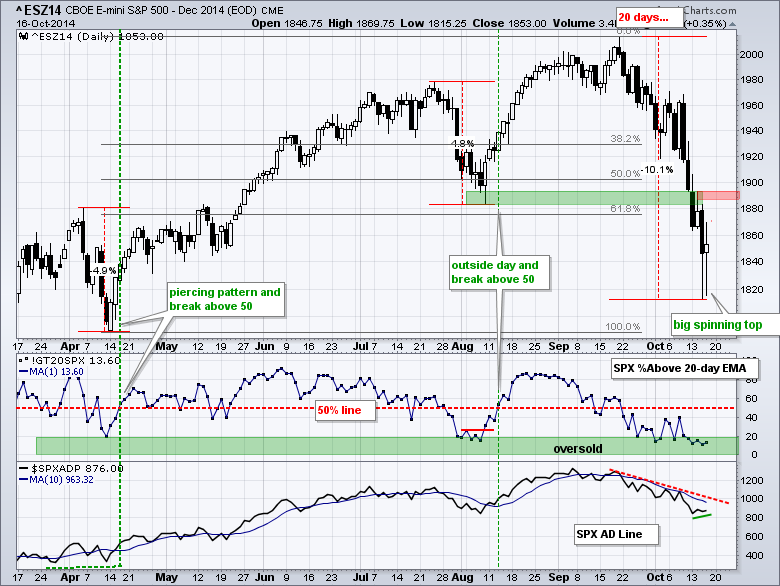

Art's Charts October 16, 2014 at 05:28 AM

Stocks plunged in early trading and then bounced in the afternoon. After a whole lot of volatility, stocks finished mixed overall. The Russell 2000 iShares and the Russell MicroCap iShares gained over 1% and led the rebound... Read More

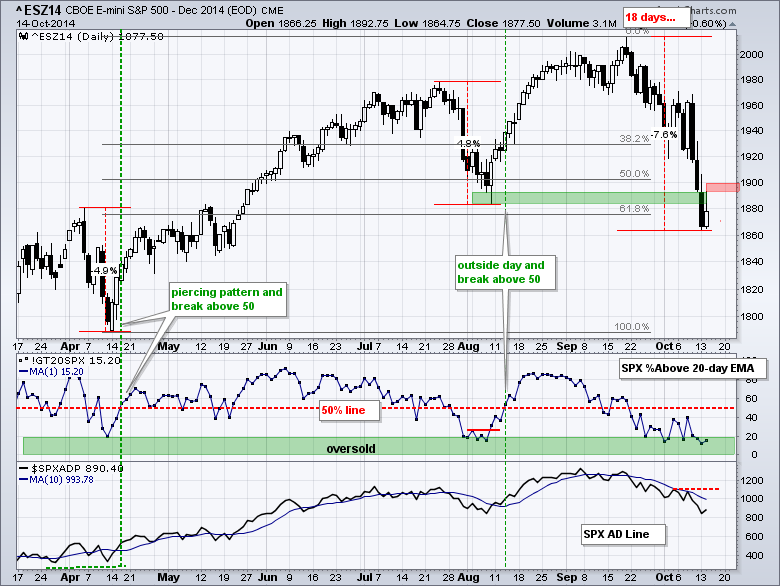

Art's Charts October 15, 2014 at 05:01 AM

Stocks attempted to bounce in early trading, but selling pressure took hold and the major index ETFs fell back in the afternoon. The S&P 500 SPDR (SPY) finished with a small gain (.54%) and the S&P 100 ETF (OEF) ended with a small loss (.09%)... Read More

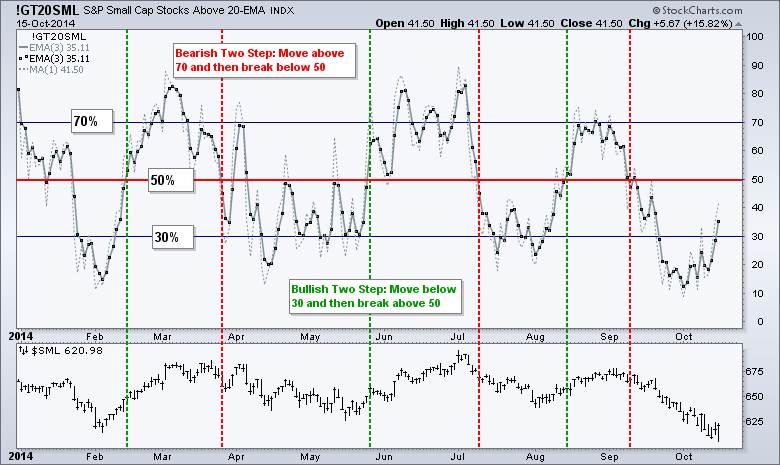

Art's Charts October 14, 2014 at 05:20 AM

Stocks took it on the chin again as broad selling pressure hit most areas. Most of the major index ETFs declined around 1.5% on the day. The Russell 2000 iShares held up relatively well with a .40% decline and the Russell MicroCap iShares finished with a small gain... Read More

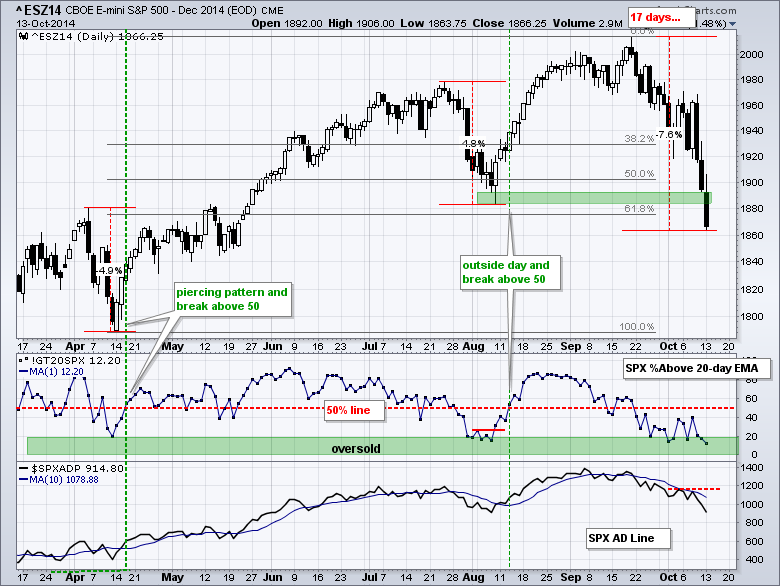

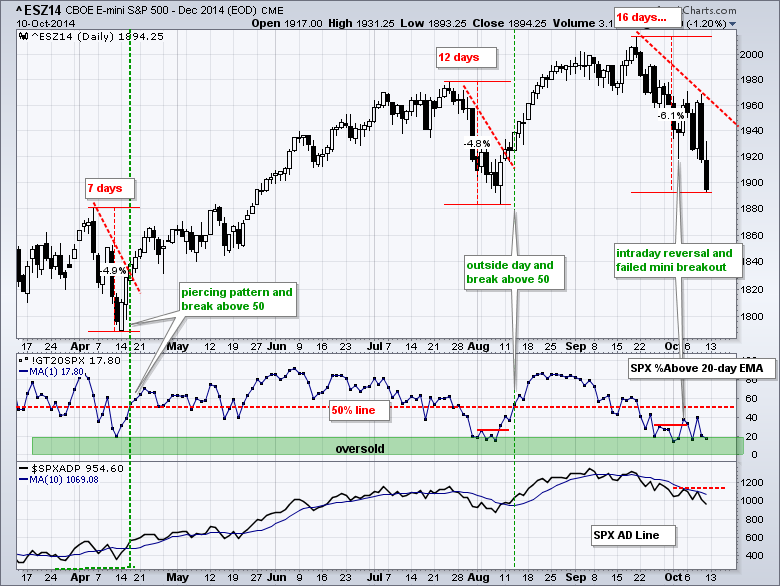

Art's Charts October 13, 2014 at 07:08 AM

Stocks surged on Wednesday, but this surge failed miserably as the major index ETFs plunged to new lows for the month on Friday. The S&P 500 opened at 1961 on Thursday, closed of 1894 on Friday and fell 3.4% in two days. The index is once again oversold with a 6... Read More

Art's Charts October 08, 2014 at 04:26 AM

Stocks were hit with broad-based selling pressure on Tuesday. The major index ETFs lost around 1.5% each. All nine sectors were down with the Industrials SPDR (XLI) leading the way (-2.43%). The consumer staples and utilities sectors held up the best (smallest losses)... Read More

Art's Charts October 07, 2014 at 06:29 AM

Stocks face several headwinds over the next few weeks and this could make for choppy trading, or even further weakness. First, midterm elections are four weeks away and this could create uncertainty... Read More

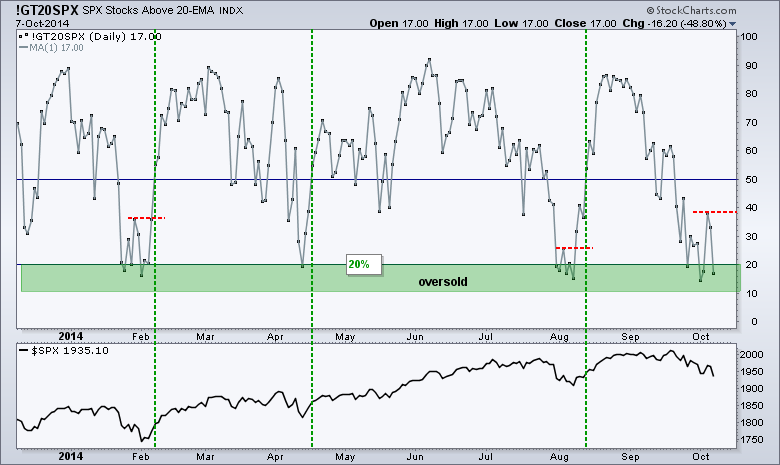

Art's Charts October 06, 2014 at 05:16 AM

Stocks reversed course intraday on Thursday and followed this reversal with a gap-surge on Friday. The gains for the day were modest as the S&P 500 SPDR added 1.10% and the Russell 2000 iShares gained .75% on the day... Read More

Art's Charts October 03, 2014 at 04:26 AM

Stocks were hit with selling pressure in early trading, firmed at midday and then rallied in the afternoon. Small-caps and micro-caps led the way with the Russell 2000 iShares gaining 1% and the Russell MicroCap iShares surging 1.43%... Read More

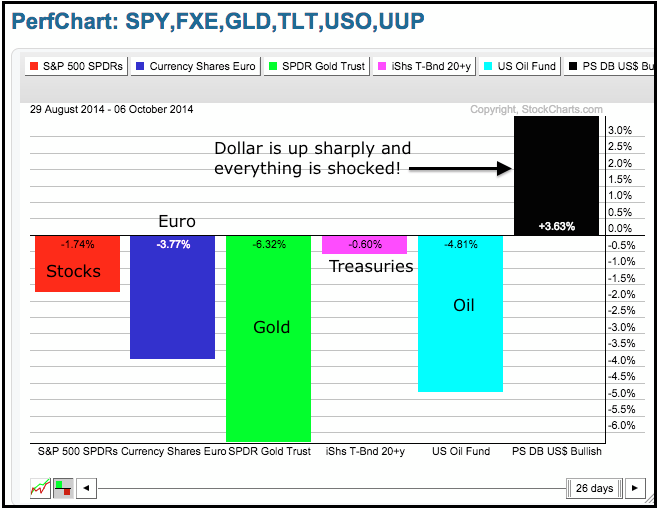

Art's Charts October 02, 2014 at 05:38 AM

Stocks moved sharply lower on Wednesday with the major index ETFs falling over 1%. The Russell MicroCap iShares (IWC) led the way lower with a 1.71% decline. The materials and energy sectors led the way lower. The utilities provided the only gain... Read More

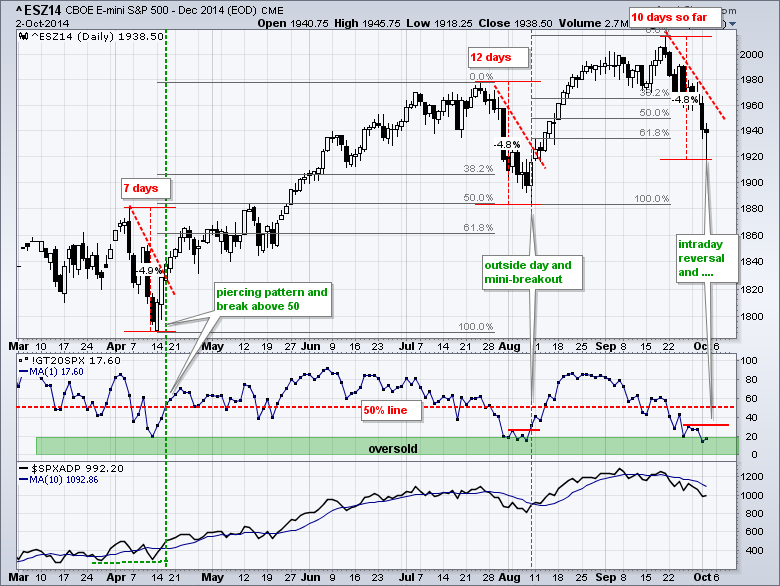

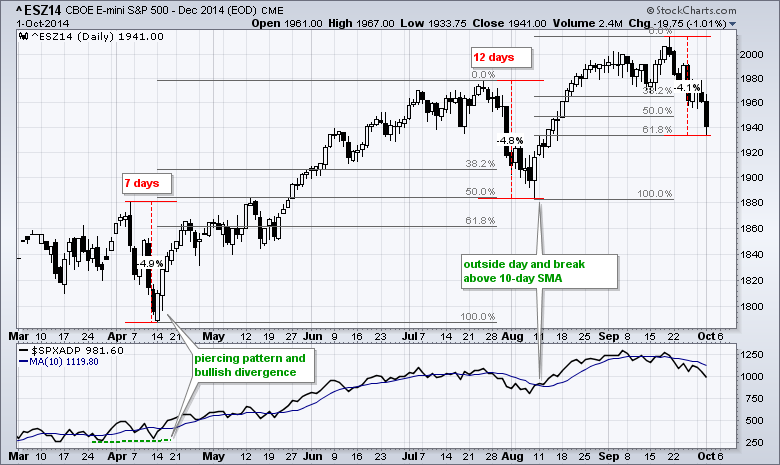

Art's Charts October 01, 2014 at 05:46 AM

The song remains the same. Market performance deteriorated as we moved down in market cap on Tuesday. The S&P 500 SPDR (SPY) declined .26%, the S&P MidCap SPDR (MDY) fell .89% and the Russell 2000 iShares (IWM) lost 1.51%... Read More