Mish's Market Minute August 30, 2020 at 04:39 PM

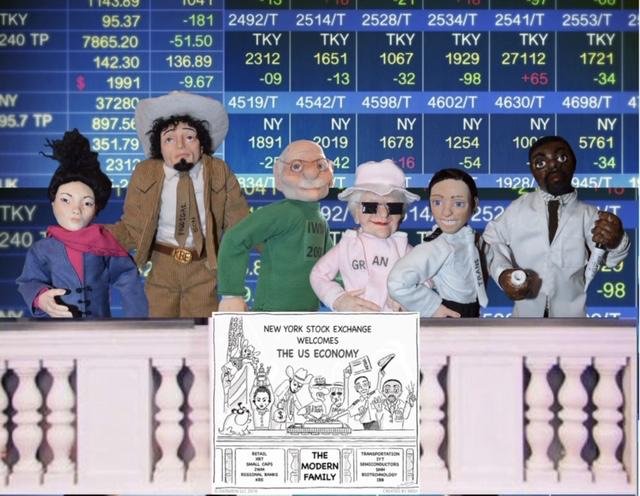

The weekend is the time to step back and look at the Modern Family's weekly trends and inflection points. This week, there are several interesting multi-timeframe patterns developing on the daily and weekly charts; some bullish, others bearish... Read More

Mish's Market Minute August 27, 2020 at 08:04 PM

Today, while the SPY and QQQ were pushing to new highs, the VXX was telling a dramatically different story, which is a warning sign for a potential imminent correction... Read More

Mish's Market Minute August 26, 2020 at 08:18 PM

If you were to look at the Modern Family you'd see a quiet August trading day waiting to hear Fed Chair Powell's speech tomorrow. Grandpa Russell (IWM) fell asleep and closed down for the day firmly stuck in a two-week bullish flag... Read More

Mish's Market Minute August 25, 2020 at 07:10 PM

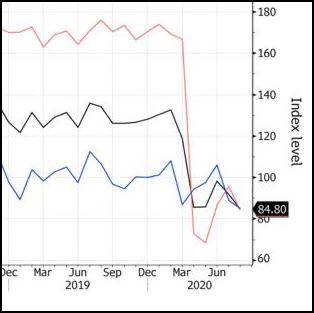

Today's chart (below) is the consumer confidence survey data, which today hit its lowest level since 2014. At the same time, data on new home sales, as well as earnings from home builder Toll Brothers (TOL), are at their best levels in years... Read More

Mish's Market Minute August 20, 2020 at 07:23 PM

Today was the first time that the SPY opened lower than the prior day's low since July 24th. The same is true for the QQQ. Grandpa Russell did it just last week, but not since July 7th prior to that... Read More

Mish's Market Minute August 19, 2020 at 07:07 PM

With so much attention being paid to AAPL reaching a valuation of $2 trillion, I decided to see if AAPL's market cap would make it into the IMF's list of the world's richest countries based on GDP... Read More

Mish's Market Minute August 18, 2020 at 08:38 PM

There were several market messages in today's price action. Starting from the top... The SPY finally closed at an all-time higha nd, after what seems like weeks of anticipating this moment, it closed over the level by fractions of a percent and a doji pattern... Read More

Mish's Market Minute August 17, 2020 at 08:28 PM

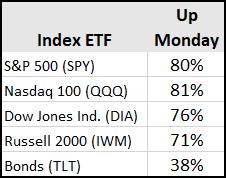

It was a quiet news day, but Mondays don't need news to go up. Today's image above represents the percentage of times that Mondays have closed higher than their Friday close since the March bottom... Read More

Mish's Market Minute August 16, 2020 at 05:10 PM

As the S&P 500 struggles to rise a fraction of a percentage point to be able to achieve the status of reclaiming its February all-time high level... Imagine you could go back to February 19th, 2020... Read More

Mish's Market Minute August 13, 2020 at 08:12 PM

While the media is obsessively focused on cheering for the S&P 500 to close at a new all-time high, the bond market is quietly collapsing. TLT broke its 50-DMA today and has now had its second worst 5-day slide since the March 2020 meltdown... Read More

Mish's Market Minute August 12, 2020 at 07:31 PM

Today's chart is one that every investor should keep an eye on (but most will not), as that double bottom base breakout pattern is in a market that has been declining for almost a decade! However, there's good reason to believe it could wake up like gold has in the last few years... Read More

Mish's Market Minute August 11, 2020 at 07:41 PM

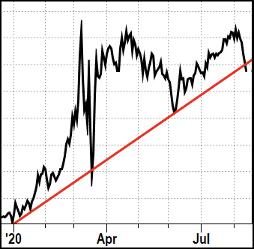

Will today's market tremors shake the QQQ out of its solidly bullish 4-month channel? On April 14th, the QQQ broke above its 50 DMA (blue line) and began the trend that you see above. A steady trend line with 6 points is an impressive feat... Read More

Mish's Market Minute August 06, 2020 at 06:43 PM

As Keith and I are heading on a vacation (with social distancing) starting Monday for 3 weeks, this is the last Daily that I will write until September 1st. Yet, not to worry, Geoff Bysshe will be taking over both my subscription service and the writing of the Daily blog... Read More

Mish's Market Minute August 05, 2020 at 04:59 PM

With the Russell 2000 breaking out over the 50 and 200-week moving averages, the market looks like blue skies, right? Retail (XRT) ran to just over $50.00. Sister Semiconductors (SMH) rocked to another new all-time high... Read More

Mish's Market Minute August 04, 2020 at 05:37 PM

With the Russell 2000 breaking out over the 50- and 200-week moving averages, we should see nothing but blue skies, right? Maybe. We have lots of positives based on hope, of course. Retail (XRT), as featured a while back, is doing well... Read More

Mish's Market Minute August 03, 2020 at 11:14 PM

A few cautious flags were thrown up today in spite of the new all-time highs in NASDAQ. The volume was light. After Friday's spike in volume, Monday QQQs saw below-average daily volume... Read More

Mish's Market Minute August 01, 2020 at 02:14 PM

Last week, Max Wiethe from Real Vision and I sat down for about an hour to discuss a myriad of timely and relevant market topics. (See the link at the end of the commentary). So much happened in this past week. The short list: Blow-out Earnings of Apple (AAPL), Alphabet Inc... Read More