Mish's Market Minute September 30, 2020 at 06:23 PM

It's time to start watching the homebuilding sector. We can look at this using the symbol XHB, which is an ETF based off the SPY... Read More

Mish's Market Minute September 28, 2020 at 07:13 PM

Today's large gap up in the indices can pose some great morning questions. The biggest one being, should I buy the gap, or should I wait to see where things go? You don't want to chase the market, but you don't want to miss out either... Read More

Mish's Market Minute September 25, 2020 at 07:05 PM

Coming into the weekend, we have more time to look over our charts, gather our thoughts and take a step back to grasp the larger picture. So, let's get right to it! From bullish to caution. This is the current phase the major indices have recently switched to... Read More

Mish's Market Minute September 24, 2020 at 06:01 PM

Today the QQQs, SPY, and DIA, closed near the September 21st lows which we noted as possible support. While we rallied intraday, we also sold off, giving back most of the days upward progress... Read More

Mish's Market Minute September 23, 2020 at 06:29 PM

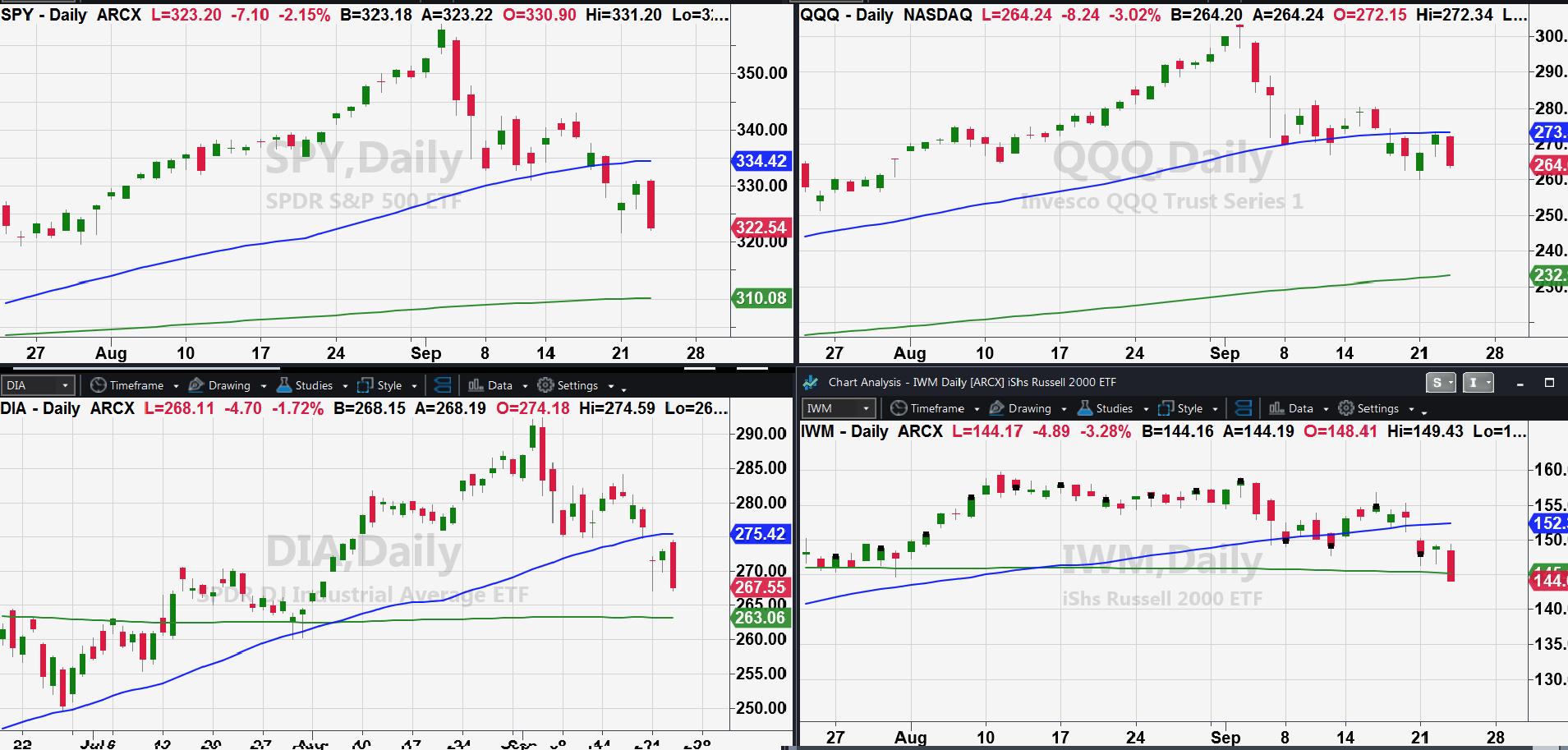

Let's start with the 4 major indices, the SPY, QQQ, DIA and IWM. They all sold off today, breaking yesterday's lows. Besides IWM, they are still not below their recent low from September 21st... Read More

Mish's Market Minute September 22, 2020 at 06:35 PM

Yesterday, Mish talked about watching junk bonds (JNK) to see if the Fed would continue supporting high risk companies. Today, JNK had an inside day. This comes after a large red day where JNK gapped lower, breaking its 104.27-106 range... Read More

Mish's Market Minute September 21, 2020 at 07:16 PM

Coming into Monday, we wrote targets on the S&P 500 and NASDAQ 100. Based on the measured move from the all-time high and the ensuing gap lower (or topping pattern), we shared with you all that the SPY target was 322 and QQQs target was 260... Read More

Mish's Market Minute September 18, 2020 at 07:03 PM

With companies like Pfizer (PFE) giving possible hope for an end-of-year vaccine and a recent gap up in IBB (the Nasdaq Biotechnology ETF), now could be a good time to keep an eye on newer issues in this sector. Large amounts of buying came into IBB on Friday... Read More

Mish's Market Minute September 17, 2020 at 06:44 PM

Yesterday, we were watching the VXX to gauge fear in the market. Today, it gapped higher and then continued to sell off while the indices gapped lower and began to rise... Read More

Mish's Market Minute September 16, 2020 at 04:31 PM

Last night we wondered, is the market correction was over? After all, both SPY and QQQs traded into resistance. For SPY, that number is 342; for the QQQs, it's 282. The DIA had to hold 28,000. Today, SPY tried to clear 342, but wound up closing red and under 340... Read More

Mish's Market Minute September 15, 2020 at 04:56 PM

Is the market correction over? Although a 10-15% correction is normal, the bigger question is whether the bounce we just saw from recent lows is a sell (rather than buy) opportunity. Both SPY and QQQs are trading into resistance... Read More

Mish's Market Minute September 14, 2020 at 07:16 PM

On Friday the 11th, the QQQs (Nasdaq) and IWM (Russell 2000) both closed under the 50-DMA. They were not followed by their friends the DIA (DowJones) and the SPY (S&P 500)... Read More

Mish's Market Minute September 11, 2020 at 06:53 PM

Partly inspired by our recent trip throughout the West, and also partly inspired by our long position in Teck Resources Limit (TECK), which gained over 11% on Friday while the SPY closed basically flat, coal is the topic for the weekend... Read More

Mish's Market Minute September 10, 2020 at 06:34 PM

WIth the SPY, QQQ, DIA, and IWM closing down on the day, now it's a good time to check the health of the Modern Family to give us a bigger picture of the market. Above, you can see the weekly charts for Modern Family (IWM, IYT, XRT, KRE, IBB, SMH), all keys to the larger picture... Read More

Mish's Market Minute September 09, 2020 at 05:35 PM

The 50-DMA did its job! After a perfect touchdown in the NASDAQ QQQs to the 50-DMA at 270, today the NASDAQ gained 2.92%. All the issues for the tech drop -- Softbank, overbought conditions, lack of a stimulus deal, China tensions, vaccine delays, etc... Read More

Mish's Market Minute September 08, 2020 at 07:05 PM

Last Friday, we noted how major symbols (QQQ, IWM, JNK, SMH) bounced off the 50-DMA. Now, with the market still undecided, we can build a plan on what to look for if we break under the 50-DMA. Let's take a look at the QQQs and the SPYs on a daily chart below... Read More

Mish's Market Minute September 04, 2020 at 08:03 PM

After 2 major sell-off days, the market bounced late Friday off the 50-day moving average. Coincidence? First, why do we care about the 50-day moving average? The most common inputs for the Moving Average used by traders and market analysts are the 50-, 100- and the 200-DMAs... Read More

Mish's Market Minute September 02, 2020 at 04:54 PM

As mentioned yesterday, the Big Banks ETF (XLF) and Regional Banks ETF (KRE) are two of the weaker sectors. However, today we saw some money rotate into those sectors, with XLF rising over 1% and KRE rising marginally at .4%. Goldman Sachs (GS) cleared a key moving average... Read More

Mish's Market Minute September 01, 2020 at 04:55 PM

First off, a huge thank you to Geoff Bysshe for covering for me so I could have a vacation for 3 weeks! Before I left, I wrote about 3 major themes to watch continue to emerge - or completely reverse... Read More

Mish's Market Minute September 01, 2020 at 04:55 PM

This article was originally written on August 31st, 2020. Today, the SPY ended its best August performance since 1986 with a market message that is well worth paying attention as soon as tomorrow and well into September... Read More