Mish's Market Minute April 28, 2021 at 06:25 PM

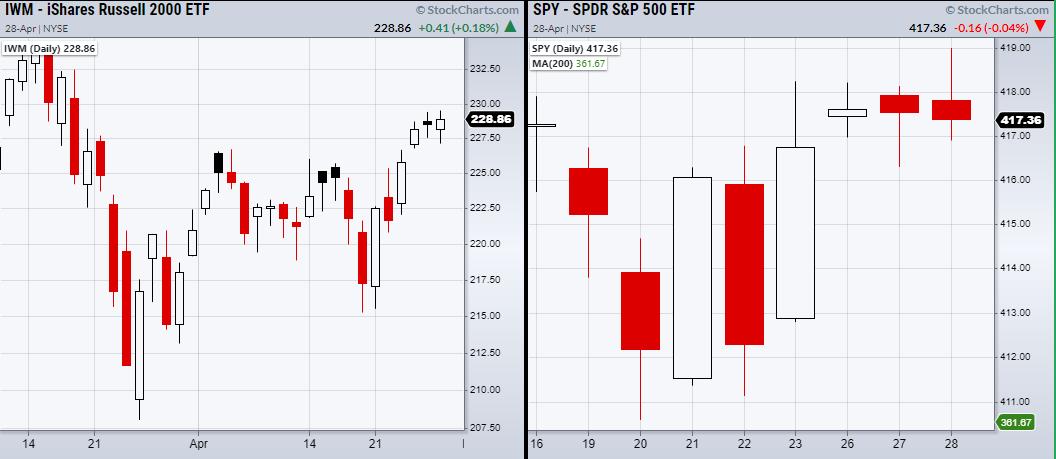

The first half of Wednesday saw minimal movement in the major indices, due in large part to the anticipation for the FOMC minutes that were later released at 2pm ET. However, like the prior FOMC report, it stuck to the same slate of ideas... Read More

Mish's Market Minute April 27, 2021 at 08:30 PM

This week, three of the major indices, including the Nasdaq 100 (QQQ), Dow Jones (DIA) and S&P 500 (SPY), have been lingering near highs without the ability to break out... Read More

Mish's Market Minute April 26, 2021 at 09:15 PM

On Sunday, we concluded that if most of the major indices could clear to new highs, along with the Russell 2000 (IWM) breaking out of resistance from $226.69, the market had the potential to make a powerful move up... Read More

Mish's Market Minute April 23, 2021 at 08:23 PM

The Russell 2000 (IWM), Nasdaq 100 (QQQ), Dow Jones (DIA) and S&P 500 (SPY) all have the potential to make large moves Monday, if they clear their resistance levels together. This month, the SPY, QQQ and DIA were able to make substantial gains... Read More

Mish's Market Minute April 21, 2021 at 09:05 PM

On Wednesday, the major indices along with key sectors held pivotal support areas. In the chart above, we can see that the small-cap index Russell 2000 (IWM) has put in some work to create a head-and-shoulders chart pattern... Read More

Mish's Market Minute April 20, 2021 at 08:04 PM

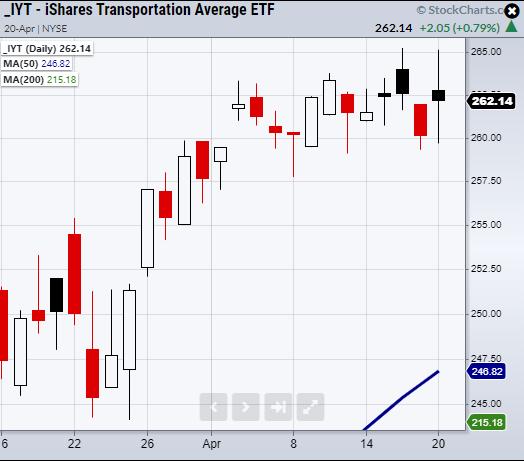

On Tuesday, the transportation sector closed green on the day, while the rest of the Economic Modern Family closed red. The most prominent break of support came from the Russell 2000 (IWM) and the Regional Banking sector (KRE)... Read More

Mish's Market Minute April 19, 2021 at 09:01 PM

Although every member of the Economic Modern Family closed down on Monday, none broke their major support areas. Here is a quick rundown of where each member's closest support level is. First, we have the Russell 2000 (IWM), with support from the low of its current range at $218... Read More

Mish's Market Minute April 16, 2021 at 09:13 PM

Last Wednesday, Mish went live on Fox Business' Making Money with Charles Payne and gave out a very bold pick. Or, at least bold in the eyes of the general populace, as most of the media's coverage has focused on big tech and the Crypto space... Read More

Mish's Market Minute April 14, 2021 at 06:33 PM

On Tuesday, we talked about the Coinbase (COIN) public listing and how waiting for the dust to settle would be a good plan, as there is no prior price action or history to base projections from a technical standpoint... Read More

Mish's Market Minute April 13, 2021 at 07:43 PM

The Nasdaq 100 (QQQ) has made new all-time highs on the heels of Coinbase's direct listing on April 14th... Read More

Mish's Market Minute April 12, 2021 at 08:25 PM

On Monday, the Economic Modern Family, which consists of 1 index and 5 key sectors, showed mixed signals as half of the Family closed down for the day... Read More

Mish's Market Minute April 09, 2021 at 06:26 PM

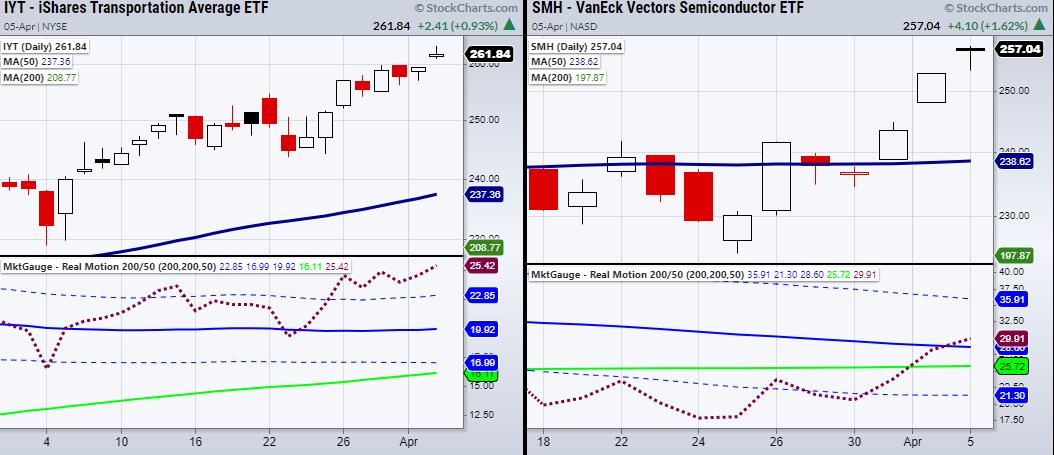

Last week's focus was the Russell 2000 (IWM), Transportation ETF (IYT) and Semiconductors ETF (SMH). IWM has shown us general market direction and sentiment as it contains 2000 small-cap U.S companies. IYT is the backbone or demand side of the economy as the U... Read More

Mish's Market Minute April 07, 2021 at 07:13 PM

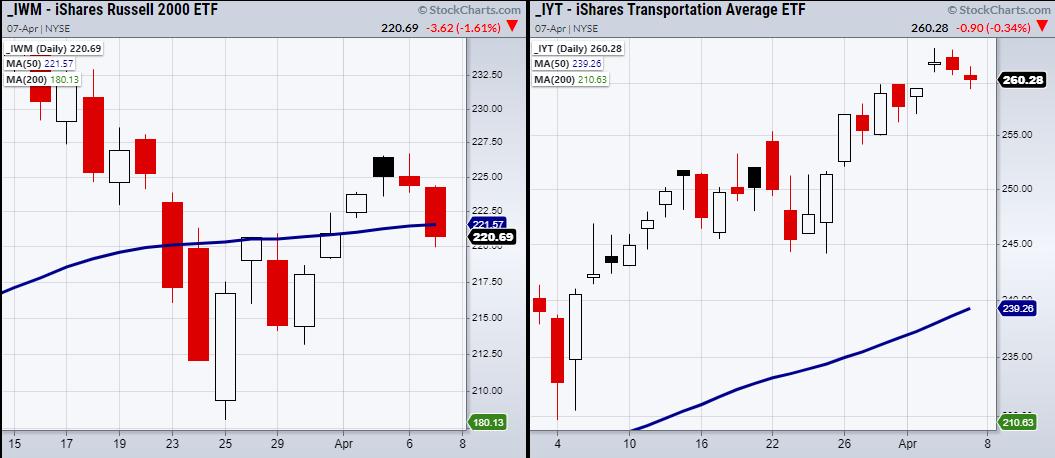

The FOMC Minutes report released Wednesday stated little to no change. Rates will stay low until 2023 and the monthly $120 billion bond-buying program will stay in place. The Fed has been hesitant to change any fiscal policy as it has been very attentive to the economic recovery... Read More

Mish's Market Minute April 06, 2021 at 08:16 PM

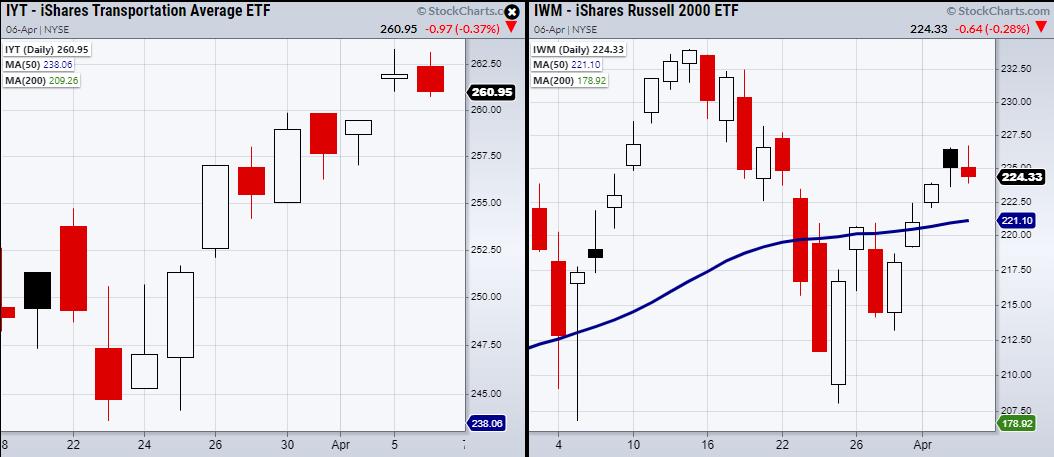

On Monday, we talked about the momentum in the Transportation (IYT) and Semiconductors (SMH) sectors, which showed strength when compared to the Russell 2000 (IWM). On Tuesday, IYT closed near Monday's low, making it a potential bearish engulfing day... Read More

Mish's Market Minute April 05, 2021 at 07:25 PM

SMH and IYT are the strongest members of the Economic Modern Family, as they are both in a bullish phase in price and in momentum. We are measuring momentum based on MarketGauge's proprietary indicator RealMotion... Read More

Mish's Market Minute April 01, 2021 at 08:32 PM

On Thursday, both the Russell 2000 (IWM) and the Nasdaq 100 (QQQ) cleared major resistance levels from the 50-day moving average. In many traders/investors' minds, this has opened the bullish floodgates with new highs in view... Read More