Mish's Market Minute August 29, 2023 at 07:25 PM

Conference Board Economic Forecast: Looking into 2024, we expect the volatility that dominated the US economy over the pandemic period to diminish... Read More

Mish's Market Minute August 28, 2023 at 07:58 PM

Bonds have had one of the worst years in modern times and one of the fastest rates of interest rate rises. The good news is the market has absorbed the bond's performance. A better risk-on environment is when the SPY outperforms the long bonds... Read More

Mish's Market Minute August 25, 2023 at 05:39 PM

Small caps, as measured by IWM, are key for the fall and heading into 2024. You can also look at the S&P 600 (SML). IWM could be forming an inverted head-and-shoulders bottom, going back from the start of 2023. (See the rectangle area of the IWM chart)... Read More

Mish's Market Minute August 23, 2023 at 05:36 PM

Over the course of our writing the Daily, it has served as a reliable and remarkable guide for investors, traders, and investments. For example, looking most recently on August 22nd, we wrote about watching the dollar decline and TLTs rising. That is happening... Read More

Mish's Market Minute August 22, 2023 at 07:24 PM

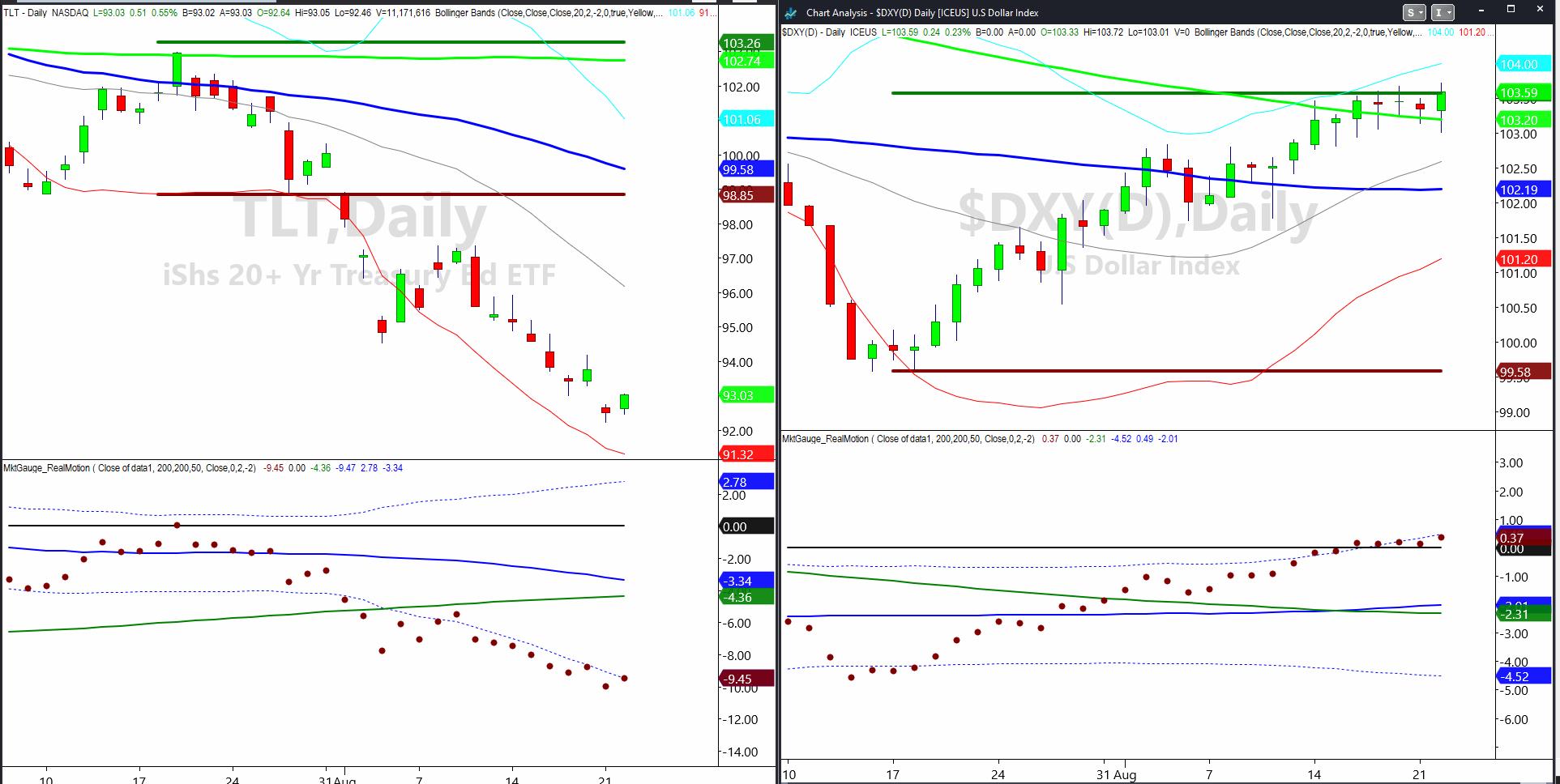

With BRICS happening ahead of Jackson Hole, we thought it would be good to look at the technical charts on both the dollar and the long bonds. The chart below shows that BRICS vs. G7 as a share of purchasing power has increased since 1995... Read More

Mish's Market Minute August 21, 2023 at 08:19 PM

Biotechnology has traded basically sideways since the start of 2023. In the face of higher rates, stronger dollar, inflation, FDA approvals and busts, and an emerging winter season, the ETF IBB has a serenity to it that appears drug-induced, if you will... Read More

Mish's Market Minute August 18, 2023 at 07:04 PM

On Thursday, August 17th, I sat down with Maggie Lake and Real Vision. During the 36-minute interview, the overriding theme continues to be one of "Stagflation". Here are the main points: Rates: We don't really know yet the impact of the rapid rate rise... Read More

Mish's Market Minute August 11, 2023 at 08:38 PM

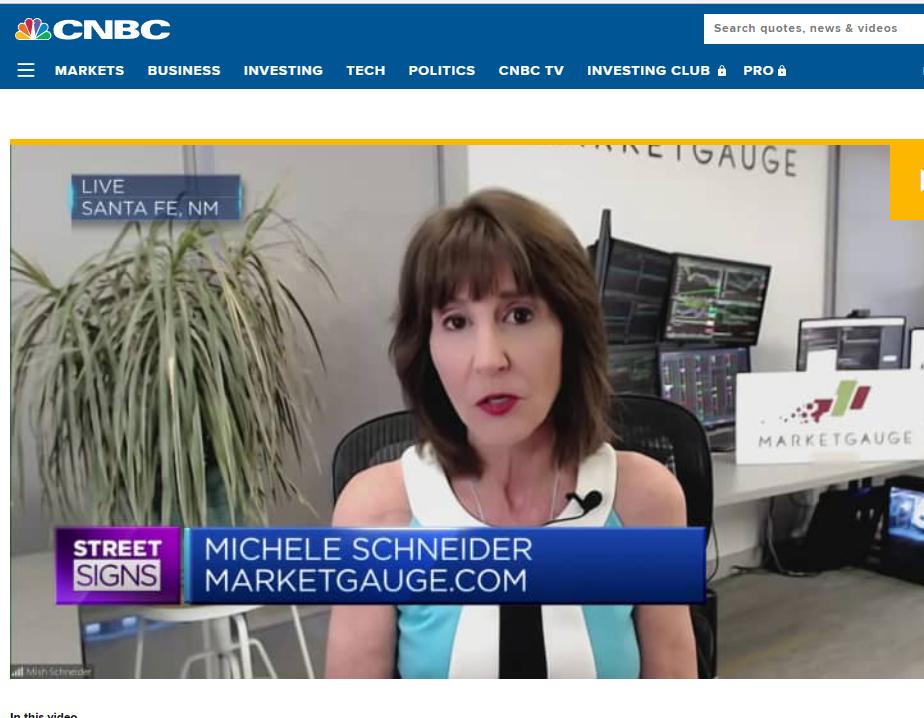

On August 10, I appeared on CNBC Asia to discuss Alibaba (BABA)'s surprise beat on earnings and China's weak economic data. I began the segment reminding investors (and myself) that regardless of the news, opinions of analysts and the talking heads, price pays... Read More

Mish's Market Minute August 09, 2023 at 06:59 PM

Many, in fact most, retail investors that were surveyed believe that the bonds have bottomed. Bill Ackman came out last week extremely bearish. Here's the technical skinny. Last week, TLT had a classic reversal bottom on very oversold conditions... Read More

Mish's Market Minute August 08, 2023 at 06:13 PM

Today, we're continuing to look at the reset of the July 6-month calendar ranges in 4 of the Economic Modern Family Sectors. To remind you, the range is good until the next time it resets in January 2024... Read More

Mish's Market Minute August 07, 2023 at 05:57 PM

It's summertime, and the living should be easy. Folks do tend to go away in August as the market tends to chop around on lower volume. This August proves to be no exception thus far... Read More

Mish's Market Minute August 04, 2023 at 07:14 PM

We finished a very heavy week filled with all kinds of data: Fitch downgrade Earnings -- Amazon up, Apple down Jobs report -- wages rising Treasury Yields higher -- at October 2022 highs Record temperatures around the globe, including winter in S... Read More

Mish's Market Minute August 02, 2023 at 04:24 PM

On August 1st, as many cheered the rise in GDP (partly because consumer spending is 70% of the GDP), another agency did not cheer at all. With Government Debt to the GDP ratio super high, coupled with high interest rates, Fitch was not having it... Read More

Mish's Market Minute August 01, 2023 at 07:56 PM

As the market and economy cheer the rise in GDP, we can thank consumer spending, 70% of GDP; services (what consumer pay for in aid, help or information), 45% of GDP; and government spending, about 19% of GDP. Hence, one sector to watch carefully is retail, or our Granny XRT... Read More