Mish's Market Minute September 29, 2023 at 05:30 PM

We do not want to walk down the political aisle. Nonetheless, what person can turn their heads away from the Sunday deadline on funding the government? The aftermath of a shutdown will most likely include a credit downgrade for the US... Read More

Mish's Market Minute September 27, 2023 at 06:30 PM

We started this year looking at the monthly charts and the 2 moving averages that depict business cycles... Read More

Mish's Market Minute September 26, 2023 at 08:27 PM

We compiled a list of the 10 biggest uncertainties in the stock market right now... Read More

Mish's Market Minute September 22, 2023 at 06:46 PM

This week I appeared with David Keller on Stockcharts Final Bar. We discussed how the market is at a precipice... Read More

Mish's Market Minute September 20, 2023 at 07:49 PM

We are so excited that StockCharts.com is now offering you our ACP plugins, we had to write about it for today's Daily, especially since you can read anywhere the thousands of differing opinions on what Powell said today and the implications for the market... Read More

Mish's Market Minute September 19, 2023 at 07:46 PM

While the UAW strike continues, and the debate on how much it matters in the scheme of things rages on, other wage trends are emerging. Amazon (AZMN) today announced it will hire about 250,000 logistics personnel for the holiday season at a wage of $20.50 per hour... Read More

Mish's Market Minute September 18, 2023 at 07:52 PM

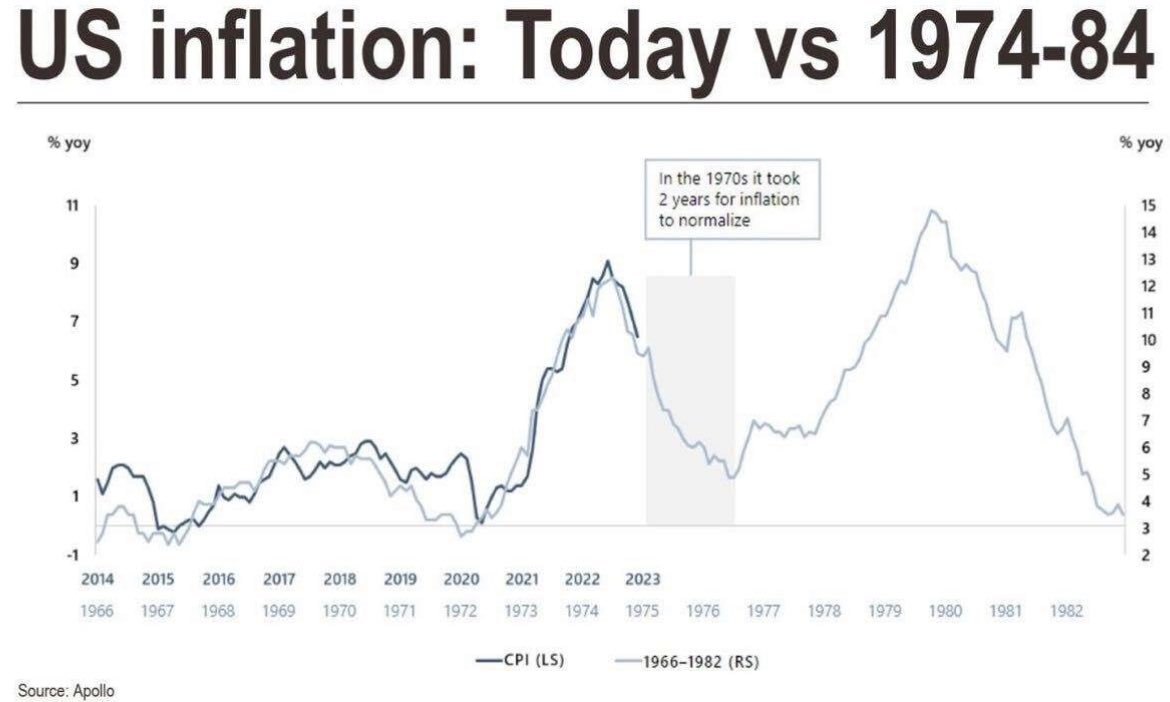

How many of you have heard me say that commodities are inherently volatile? Clearly, from this chart, you can see that after the oil rally in the mid 1970s, the CPI went from nearly 9% in 1974 down to 2% in 1976. Sugar, my favorite barometer of inflation, ran to $... Read More

Mish's Market Minute September 13, 2023 at 07:55 PM

I doubt any of our readers are too surprised by the CPI reading coming in a bit hotter than expected. The bulk of it was in energy costs. Food costs were, mixed with bread and meat, up, while eggs and milk were down... Read More

Mish's Market Minute September 12, 2023 at 07:32 PM

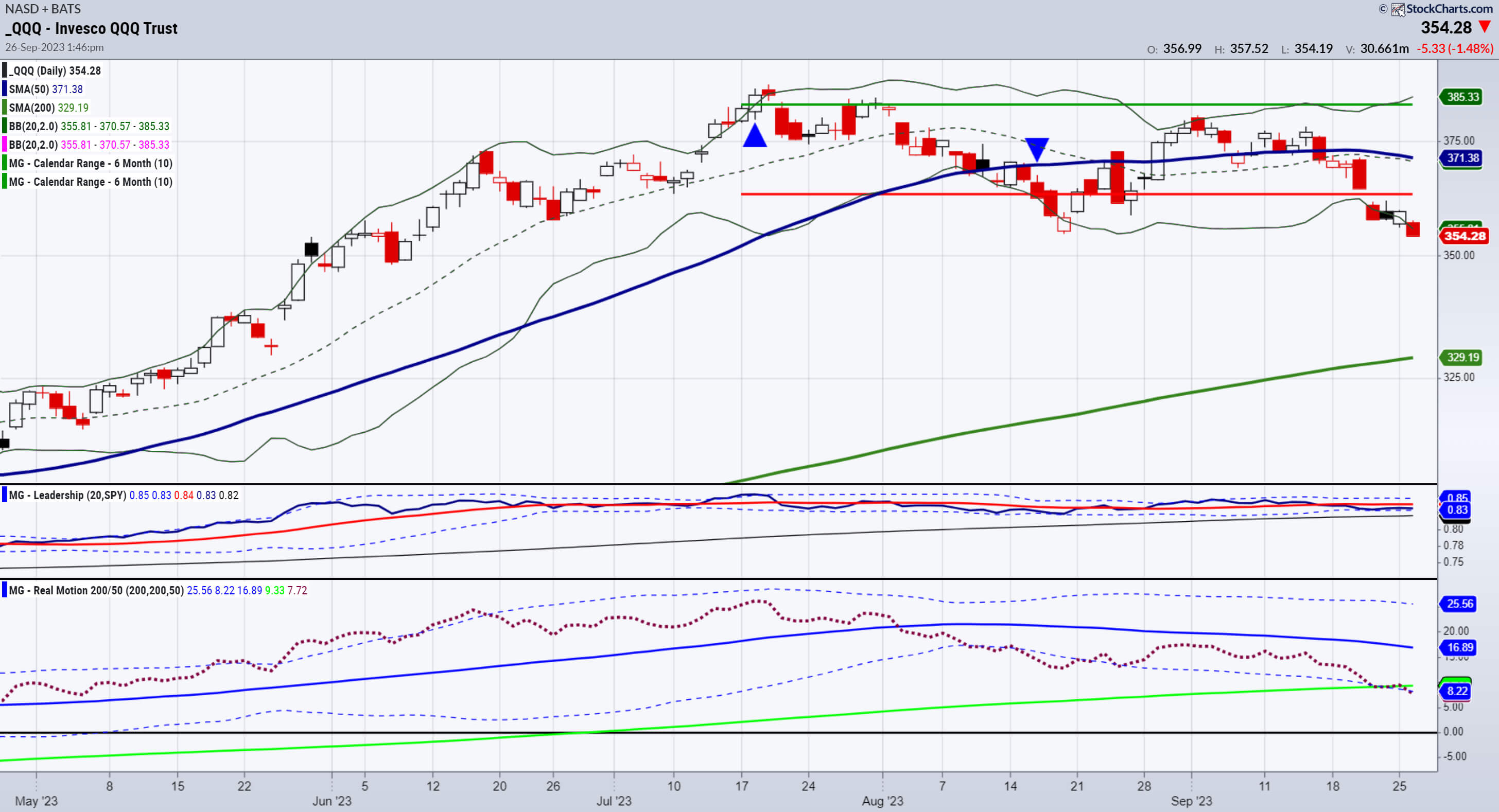

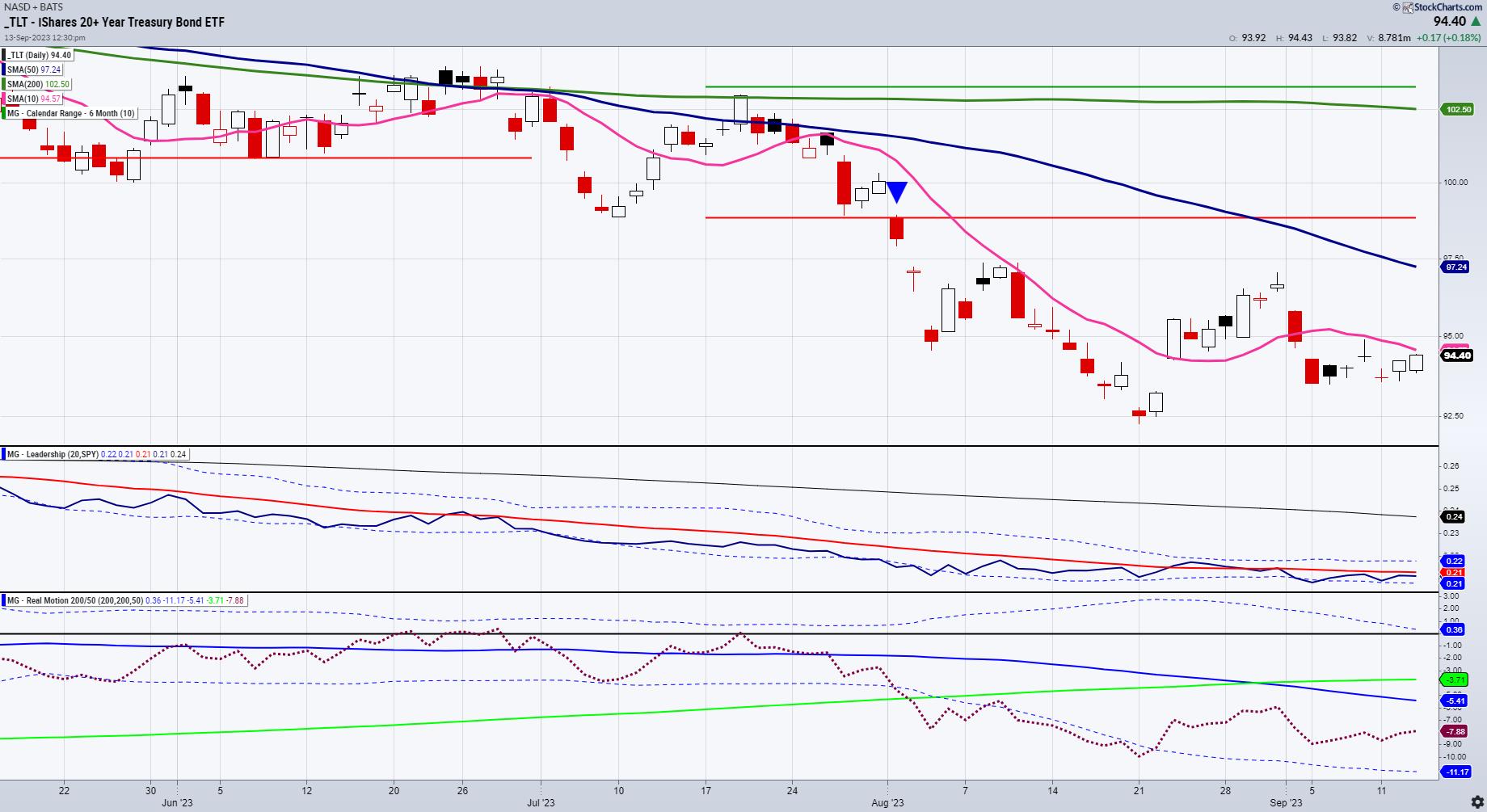

In June, we wrote about the bottom in oil and cannabis through USO and MSOS (ETFs) respectively. In July, we wrote about the potential top in NASDAQ and SPY... Read More

Mish's Market Minute September 11, 2023 at 06:43 PM

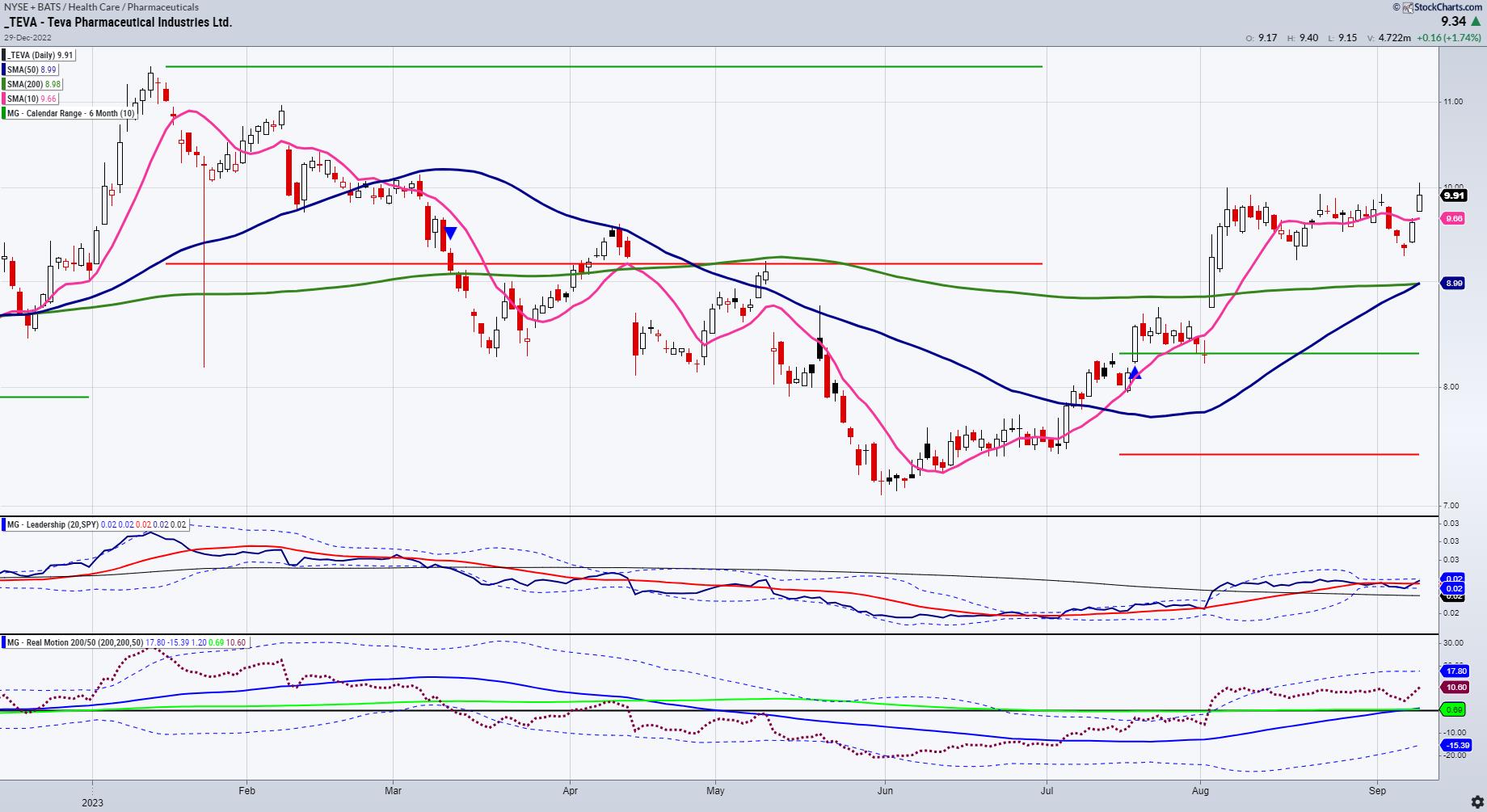

Every week, I am invited on Business First AM with Angela Miles to discuss the market and give a stock pick. This week, I covered TEVA, a stock I have talked about a few times and one, full disclosure, we are positioned in... Read More

Mish's Market Minute September 08, 2023 at 05:44 PM

Probably the worst or at least one of the worst performers in the overall market and in the commodities market, natural gas is choppy and lifeless. So why write about it? For starters, we love an underdog... Read More

Mish's Market Minute September 06, 2023 at 04:19 PM

On July 5th, Mish wrote an article called "Sell in July and Go Away? Calendar Range Reset". In that article, she noted, "should IWM fail to clear the calendar range high and worse, break down under a new 6-month calendar range low[..... Read More

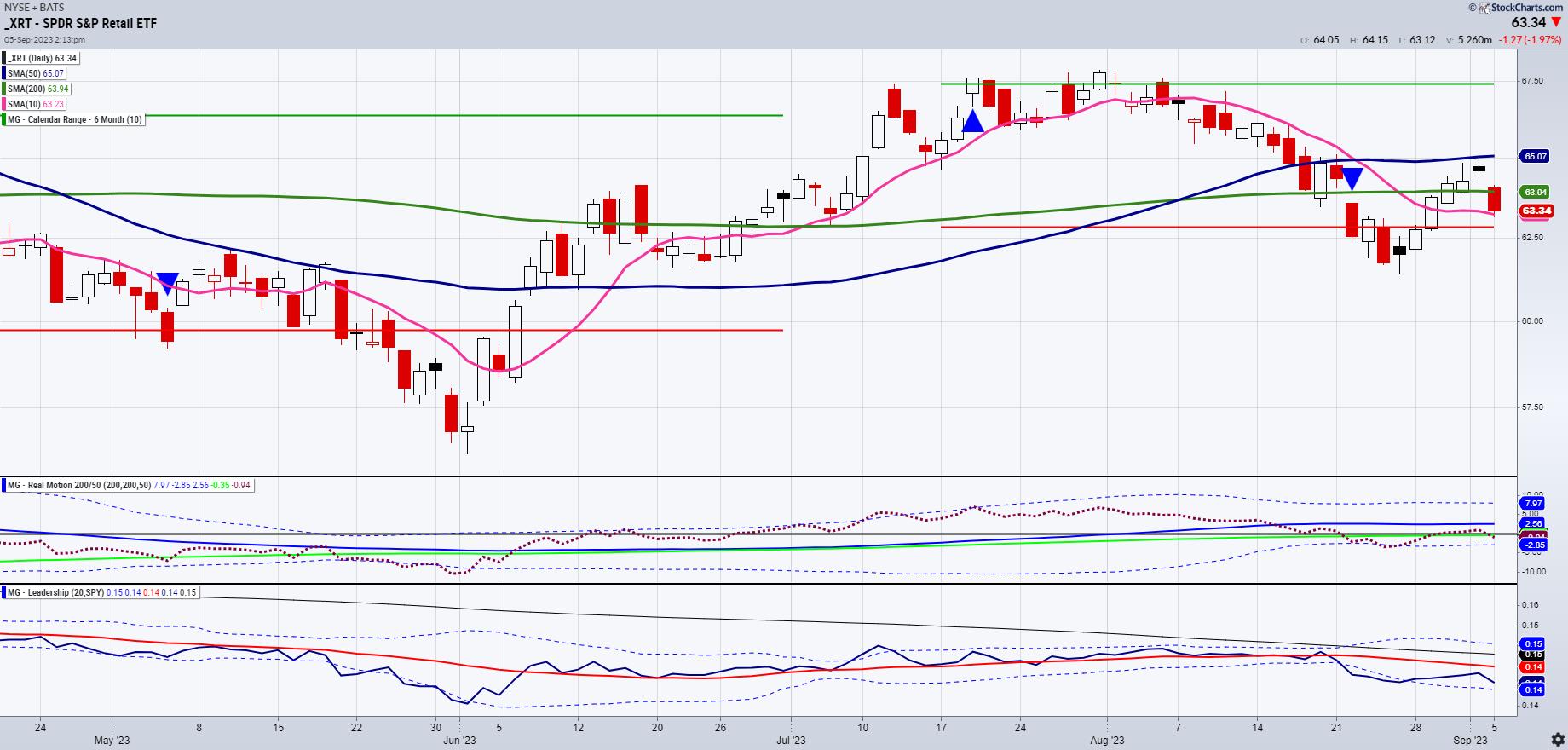

Mish's Market Minute September 05, 2023 at 07:44 PM

This entire year, retail, as measured by the ETF XRT (a.k.a. the Granny of the Economic Modern Family), has underperformed the SPY and QQQs... Read More