Mish's Market Minute October 24, 2023 at 06:31 PM

First off, we are heading out of town to New York where I will be visiting in studio several media channels and hosts. Then, we are off to Orlando for the MoneyShow. On November 1st, Keith and I go on vacation until the middle of the month... Read More

Mish's Market Minute October 23, 2023 at 04:31 PM

Monday, after a lot of spooky headlines, the SPDR S&P 500 ETF (SPY) touched its 23-month moving average (MA) or the two-year biz cycle breakout point right around 417. Plus, the iShares 20+ Year Treasury Bond ETF (TLT) flashed green as did IWM, the small caps... Read More

Mish's Market Minute October 20, 2023 at 06:34 PM

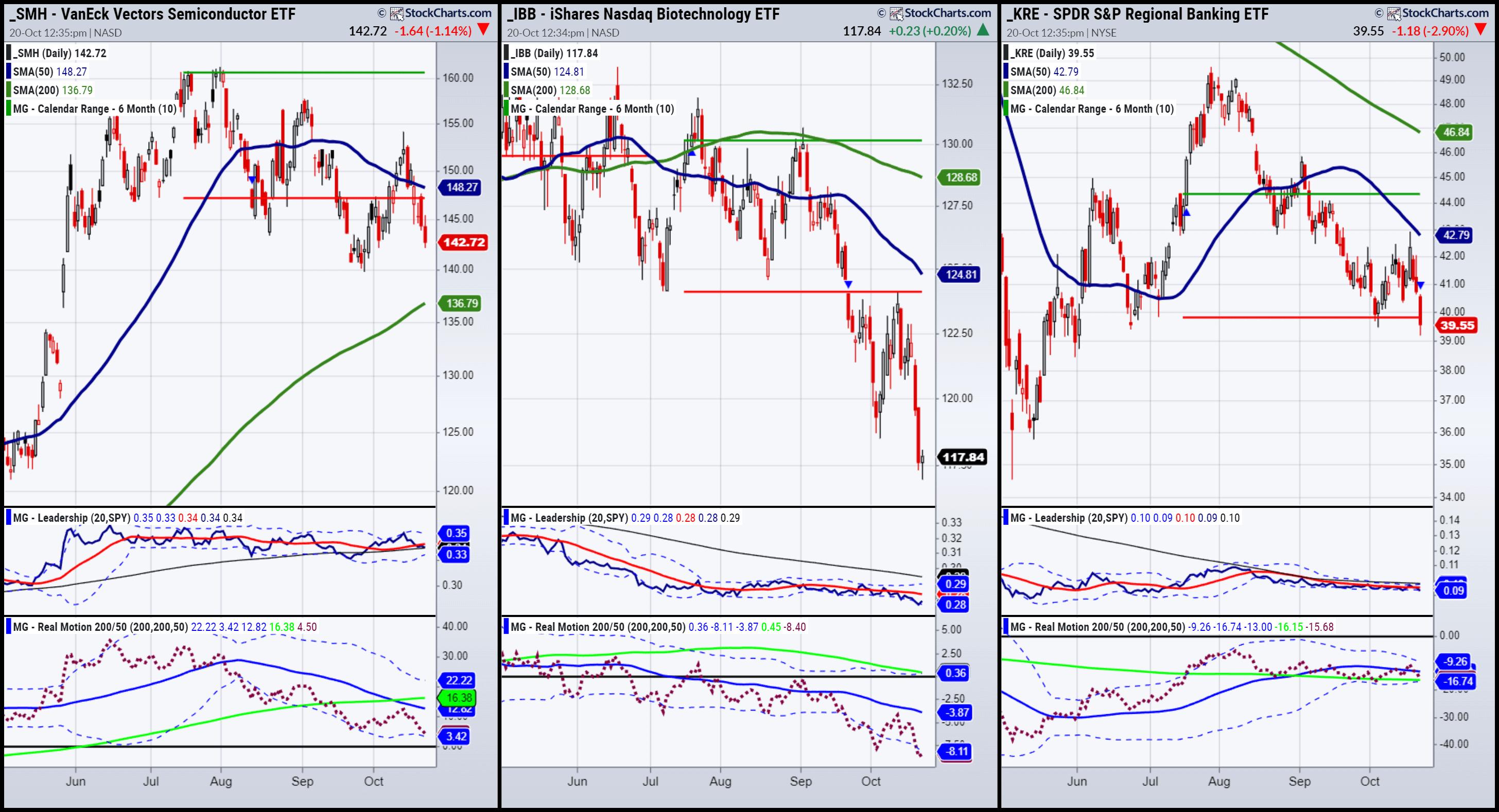

Most of you know our Big View product since I often discuss our risk gauges. I can report to you that our risk gauges show three out of the five with risk off. Most interestingly, the SPY continues to outperform the long bonds, risk-on... Read More

Mish's Market Minute October 18, 2023 at 04:00 PM

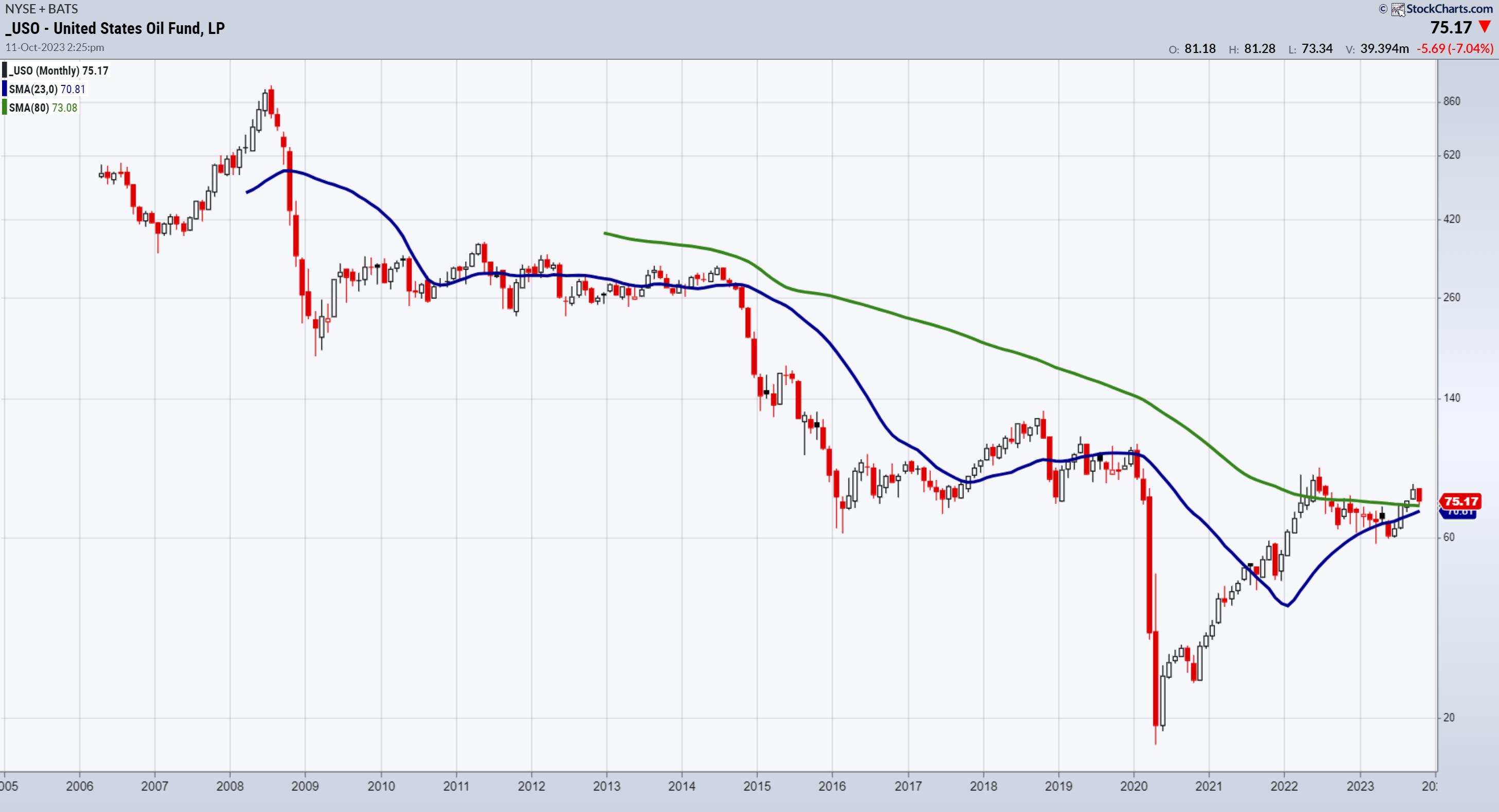

Considering everything: Yields and mortgage rates War Inflation and rising commodity prices Bank stocks falling Risk Gauges: 2 out of 6 now risk-off To name a few, why, then is the S&P 500 so strong? Here are a few reasons: Fed members suggest rate hike pauses... Read More

Mish's Market Minute October 17, 2023 at 04:51 PM

With words like "Schneider's dedication to educating others about stocks is unparalleled," Traders World Fintech Awards honors me in the most amazing way possible... Read More

Mish's Market Minute October 16, 2023 at 05:22 PM

Waking up to a new week of geopolitical stress, fake news (Blackrock spot ETF), higher yields, softer dollar, equities rally, I thought to myself: As far as the market goes, it feels like time is standing still... Read More

Mish's Market Minute October 13, 2023 at 06:02 PM

I went back to my Outlook 2023 written in December 2022, where I begin with: You Can't Run with the Hare and Hunt with the Hounds. This expression will ultimately summarize the upcoming year. As the Year of the Tiger loses its roar, the Year of the Rabbit hops into view... Read More

Mish's Market Minute October 12, 2023 at 06:36 PM

Some notes this week: Growth stocks are acting as a defense move again, especially given that the Fed remains on the fence about interest rate. Small caps and retail though, could still act as an anchor... Read More

Mish's Market Minute October 11, 2023 at 05:54 PM

Before we begin, just a note to mention that TLT took out the fast MA featured in the October 10th daily, while SPY underperformed. If that is a trend, it behooves you to review that daily... Read More

Mish's Market Minute October 10, 2023 at 06:19 PM

The next direction of the long bonds is crucial in determining the macro. First, after a wrecking ball crash and ahead of the FOMC, we could surmise that a bottoming-like action defines the last several trading days. Our Real Motion indicator shows a mean reversion... Read More

Mish's Market Minute October 09, 2023 at 07:49 PM

For consistency, here are the key go-tos during an uncertain time in the market: The next direction of long bonds (TLT). The next direction of the small caps and retail sectors (IWM, XRT)... Read More

Mish's Market Minute October 06, 2023 at 08:07 PM

I spent all of last week, in the media and in print, going over the importance of 2 key indicators. (See the media clips below.) Our risk gauges on Big View, all of which kept flashing risk-on regardless of the doom-and-gloom and initial selloff in bonds and SPY... Read More

Mish's Market Minute October 04, 2023 at 07:11 PM

Yesterday, we covered the 80-month moving average in small caps and retail. Today, I did several interviews -- some already out (BNN Bloomberg), others out soon (Financial Sense with Jim Pupluva), and the one that you'll find on YouTube later today with Real Vision... Read More

Mish's Market Minute October 03, 2023 at 09:06 PM

We began the year examining the 23-month moving averages in all the indices and major market sectors... Read More

Mish's Market Minute October 02, 2023 at 07:35 PM

If you are finding yourself fluctuating between bullishness and bearishness, then congratulations! Hopefully, that also means you are waiting for certain signals to help you commit to one way or another... Read More