Art's Charts June 30, 2016 at 08:37 AM

S&P 500 Affirms Uptrend with Big Bounce // Short-term Smoothing Improves Returns and Reduces Drawdowns // QQQ leads Recover as IWM Forms Island Reversal // HealthCare SPDR Shows Some Resilience // EW Technology Holds May Low // Five Stocks to Watch: ORCL, CMCSA, ABBV, CERN and ZT... Read More

Art's Charts June 28, 2016 at 08:33 AM

Oversold versus Panic OVERSOLD // IWM Holds the May Low // Housing and Retail Test Benchmark Lows // XSD Becomes Most Oversold // Revisiting the Sovereign Debt Crisis // Brexit View from Belgium //// ....... Read More

Art's Charts June 27, 2016 at 07:10 AM

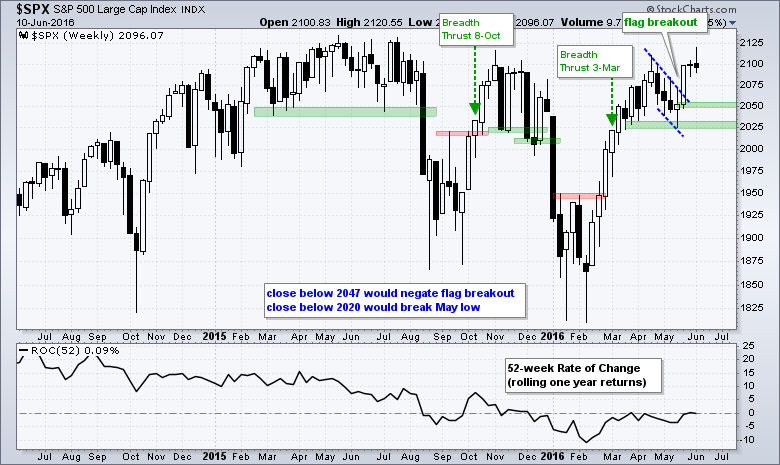

Flag Breakout Fails for S&P 500 // AD Percent Remains on a Bull Signal // New Lows have yet to Expand // %Above 200-day Near Bearish Signal for Nasdaq 100 // Consumer Discretionary Remains the Weakest Sector // Finance Sector Weakens Considerably //// ....... Read More

Art's Charts June 25, 2016 at 03:12 AM

.... Testing the PPO Strategy .... Beware of Survivorship Bias .... Setting the Ground Rules .... Putting Three PPOs to the Test .... Reducing Drawdowns with Trend Filters .... Boosting Returns with a Pullback Rule .... Backtesting the Trend Filters and the Dip ...... Read More

Art's Charts June 24, 2016 at 05:44 AM

Keep Calm and Carry On // S&P 500 Set for Key Support Test // FTSE Gets Turned Inside Out with Volatility // Smoothing out the Volatility // French and German Markets Bear the Brunt //// ....... Read More

Art's Charts June 23, 2016 at 08:44 AM

Keep Your Eye on the Rising Channels // Small-caps and Mid-caps are Leading // Healthcare and Finance Not doing That Bad // 10-yr Yield Springs a Bear Trap // Rising Yields Could Lift Banks // What does a High Volume Spinning Top Suggest? // Five Annotated Stock Charts worth Watc... Read More

Art's Charts June 21, 2016 at 08:01 AM

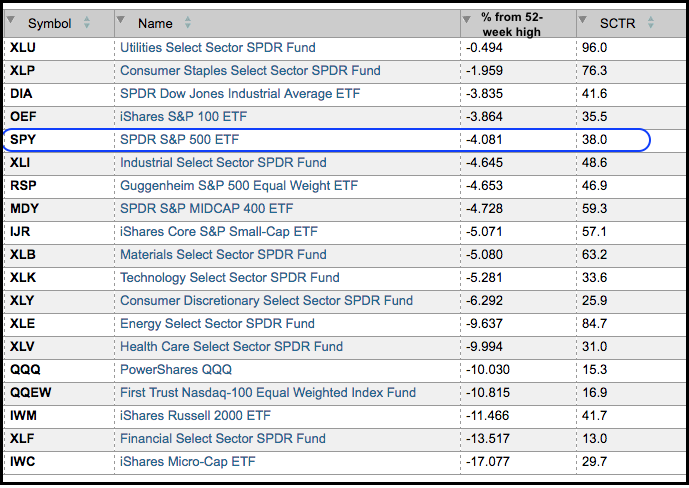

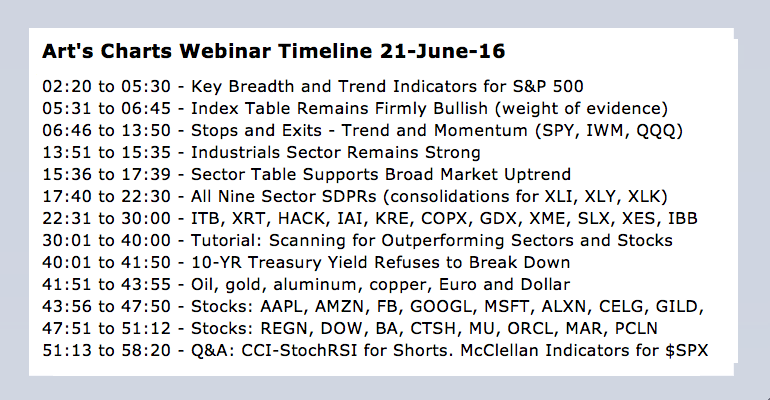

Thinking about Stops and Exits // Surge and Zigzag Advance // Small-caps Continue to Lead // Brexit, the FTSE and the Pound // Industrials Sector Remains Strong // Sector Table Supports Broad Market Uptrend // Index Table Remains Firmly Bullish // Webinar Preview // Scan Code for... Read More

Art's Charts June 17, 2016 at 12:53 PM

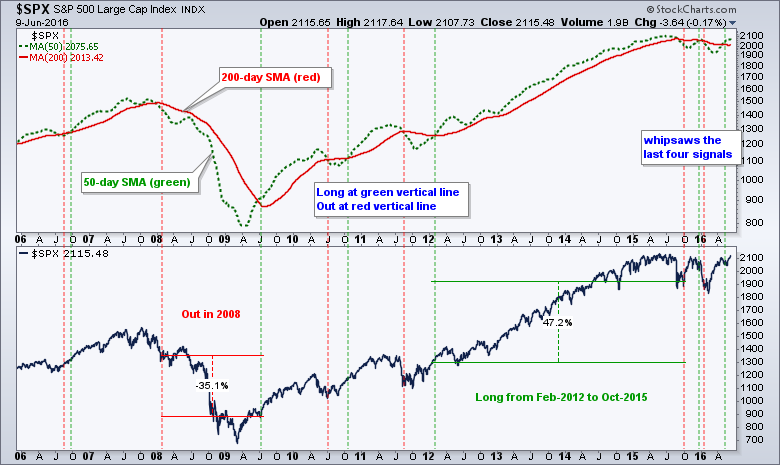

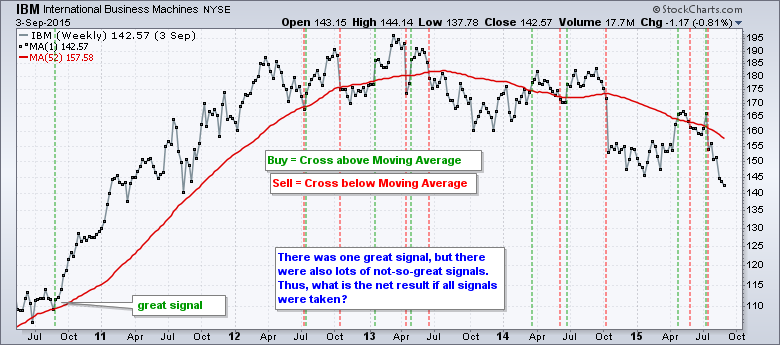

SystemTrader // Review of the Golden Cross Tests // Testing Short-term Moving Averages // A Basic 10-50 SMA Cross // Testing the Classic 13-34 EMA Cross // Does a Trend Filter Improve Results? // Final Thoughts //// .......... Read More

Art's Charts June 16, 2016 at 08:46 AM

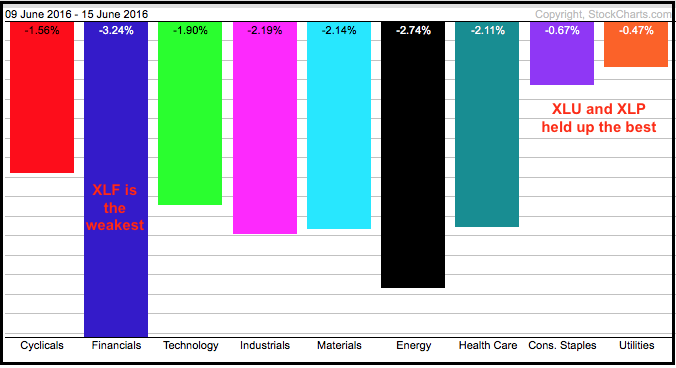

Finance Sector Weighs on Broader Market // Using Vortex Indicators with SPY // QQQ Lags with Lower High // A Choppy Advance for IWM // 5-yr Yield hits 2016 Low // Oil Falls within Rising Channel // New High, New Low and Back Again // Large-cap Techs Weigh on XLK // Aluminum Surge... Read More

Art's Charts June 14, 2016 at 08:04 AM

A Weight of the Evidence Approach // Consumer Discretionary Remains the Weakest Link // Finance Sector Struggles // Technology Does the Splits // Staples and Utilities Lead with New Highs // Ranking the Nine Sectors // Evaluating Price Action with the Stochastic Oscillator // Web... Read More

Art's Charts June 13, 2016 at 06:54 AM

Perspective on Last Week's Failed Rally // Lower High Takes Shape for Nasdaq 100 // Russell 2000 Earned the Right to Correct // Broad Selling hits key Breadth Indicator // New Highs Actually Expanded Last Week // Plunge in Yields Shakes up the Markets // ....... Read More

Art's Charts June 10, 2016 at 01:54 PM

SystemTrader - Tweaking the Golden Cross // Testing Other Indexes // Testing the Golden Cross with Short Positions // Testing with Exponential Moving Averages // The Pitfalls of Optimization // Optimizing the Long-term Moving Average Cross // The Russell 2000 is a Different Beast... Read More

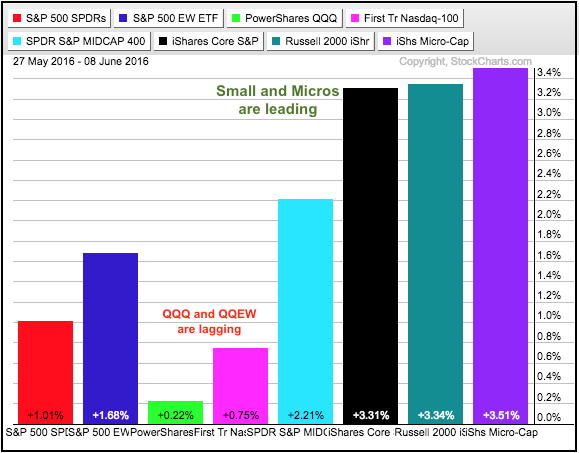

Art's Charts June 09, 2016 at 08:14 AM

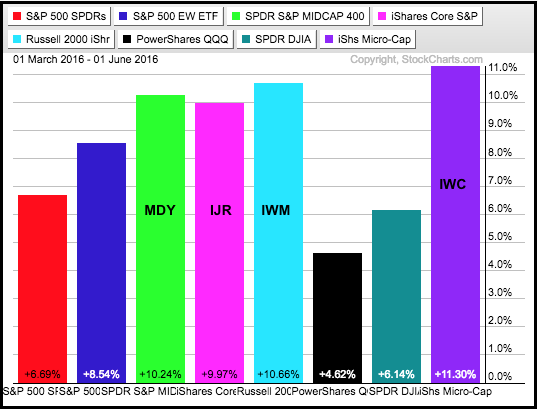

Small and Micros Continue to Lead // Big Techs Weigh on QQQ // QQQ Extends Stall // SPY Hits a New High // IWM Leaves the others in the Dust // 4 of 5 Small-cap Sector ETFs Hit New Highs // Most New Highs since June // Stocks of Interest: TJX, FCX, GS, CVS, DIS, F, ADP, SKX //// ... Read More

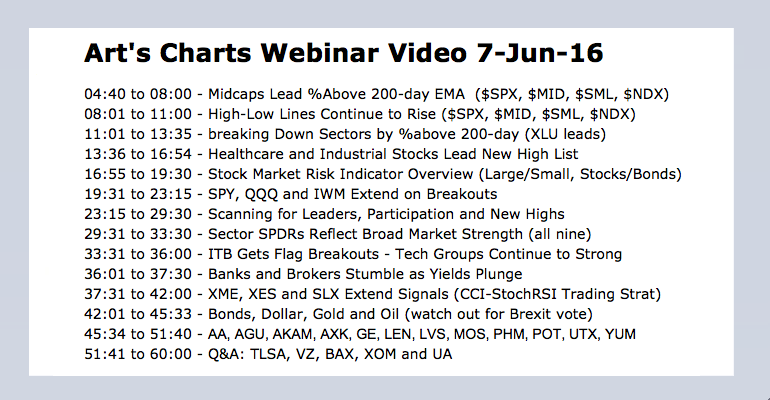

Art's Charts June 07, 2016 at 08:25 AM

Midcaps Lead %Above 200-day EMA // High-Low Lines Continue to Rise // Healthcare and Industrials Lead New High List // Sectors Reflect Broad Market Strength // XLE and XLB Extend Breakouts // Metals & Mining and Oil & Gas Equip & Services SPDRs Extend Signals // Webinar Preview /... Read More

Art's Charts June 06, 2016 at 05:46 AM

Stocks Bounce after Weak Open // SPY Remains In Trend // IWM Continues to Lead // XLE and XLI are in the Spotlight //// .... Stocks Bounce after Weak Open By now we are all aware of the big miss in the employment report... Read More

Art's Charts June 03, 2016 at 11:26 AM

SystemTrader // Crossing Over to the Dark Side! // Key Performance Metrics // Setting the Benchmark // Quantifying the Golden Cross // Risk-adjusted Returns versus Drawdowns // Winners versus Losers // Ratio Metrics // Backtesting Even Further I have scrutinized charts for years,... Read More

Art's Charts June 02, 2016 at 07:38 AM

Small and Mid Caps Lead // SPY and QQQ Remain In Trend // IWM Leads with Higher High // Utes and Staples Lag, but don't Exactly Drag // Technology Leads New High List // HACK Challenges Prior Highs // 10-YR Treasury Yield Winds Tight // A Small Decline on High Volume // 10 Stocks... Read More